ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

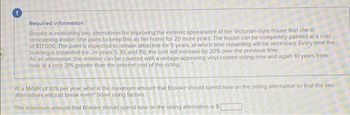

Transcribed Image Text:Required information

Brooke is evaluating two alternatives for improving the exterior appearance of her Victorian-style house that she is

remodeling inside. She plans to keep this as her home for 20 more years. The house can be completely painted at a cost

of $17.500 The paint is expected to remain attractive for 5 years, at which time repainting will be necessary. Every time the

building is repainted (te, in years 5, 10, and 15), the cost will increase by 20% over the previous time.

As an alternative, the exterior can be covered with a vintage-appearing vinyl-coated siding.now and again 10 years from

now at a cost 31% greater than the present cost of the siding.

At a MARR of 10% per year, what is the maximum amount that Brooke should spend now on the siding alternative so that the two

alternatives will just break even? Solve using factors.

The maximum amount that Brooke should spend now on the siding alternative is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Don't use Excel and pen or paperarrow_forwardCalculate the present worth of all costs for a newly acquired machine with an initial cost of $30,000, no trade-in value, a life of 12 years, and an annual operating cost of $16,000 for the first 5 years, increasing by 10% per year thereafter. Use an interest rate of 10% per year. The present worth of all costs for a newly acquired machine is determined to be $ __________ plz answer correct asap help Dont answer by pen pepararrow_forward#38 A firm is considering replacing the existing industrial air conditioning unit. They will pick one of two units. The first, the AC360, costs $26,387.00 to install, $5,018.00 to operate per year for 7 years at which time it will be sold for $7,075.00. The second, RayCool 8, costs $41,041.00 to install, $2,091.00 to operate per year for 5 years at which time it will be sold for $9,042.00. The firm's cost of capital is 6.50%. What is the equivalent annual cost of the RayCool8? Assume that there are no taxes. Submit Answer format: Currency: Round to: 2 decimal places. unanswered not_submitted Attempts Remaining: Infinityarrow_forward

- Annual thermal loss through the pipe lines of a factory is estimated to be $412 in terms of wasted energy. A new anti-heating technology can reduce the energy loss by 93% and costs for $1232. Although this new technology has no salvage value but it helps the factory to save much energy for upcoming 8 Years. Identify the present worth of the entire investment if the market rate is 10%.arrow_forwardCompany ABC is considering investing in a project whose initial cost is $186000. It saves $44000 in the first year, increasing by $5800 each year thereafter. The salvage value of the project is $12500 at the end of year 7. The cost of operating and maintenance in the first year is $3400, increasing by 4% each year thereafter. The company wants to see if the project is worth to be invested in. To help ABC to decide, you should find the present worth (PW) of the project. The company's MARR is 12%. Answer:arrow_forwardCompany ABC is considering investing in a project whose initial cost is $185000. It saves $42000 in the first year, increasing by $5400 each year thereafter. The salvage value of the project is $13600 at the end of year 7. The cost of operating and maintenance in the first year is $3300, increasing by 5% each year thereafter. The company wants to see if the project is worth to be invested in. To help ABC to decide, you should find the present worth (PW) of the project. The company's MARR is 14%.arrow_forward

- 3arrow_forwardPlease no written by hand and no emagearrow_forwardA $2500 computer system can be leased for $79 per month for 3 years. After 3 years, it can be purchased for $750. This is also the salvage value if the system was purchased originally. What is the effective annual rate for leasing the computer? Ans. r = 1.75% and Effective Annual Annual Rate = 23.1% Please shows the formula used dont make a shortcut answer. Provide full detailed solution.arrow_forward

- The management of Brawn Engineering is considering three alternatives to satisfy an OSHA requirement for safety gates in the machine shop. Each gate will completely satisfy the requirement, so no combinations need to be considered. The first costs, operating costs, and salvage values over a 5-year planning horizon are shown below. End of Year Gate 1 Gate 2 Gate 3 0 -$15,000 -$19,000 -$24,000 1 -$6,500 -$5,600 -$4,000 2 -$6,500 -$5,600 -$4,000 3 -$6,500 -$5,600 -$4,000 4 -$6,500 -$5,600 -$4,000 5 -$6,500 + $0 -$5,600 + $2,000 -$4,000 + $5,000 Show the comparisons and internal rates of return used to make your decision:Comparison 1: (Gate 1 versus Gate 3 or Gate 2 versus Gate 3 or Gate 2 versus Gate 1?) IRR 1: %Comparison 2: (Gate 1 versus Gate 2 or Gate 2 versus Gate 3 or Gate 3 versus Gate 1?) IRR 2: Using an internal rate of return…arrow_forwardLittrell's Nursery needs a new irrigation system. System one will cost $145,000, have annual maintenance costs of $10,000, and need an overhaul at the end of year six costing $30,000. System two will have first year maintenance costs of $5,000 with increases of $500 each year thereafter. System two would not require an overhaul. Both systems will have no salvage value after 12 years. If Littrell's cost of capital is 4%, using annual worth analysis determine the maximum Littrell's should be willing to pay for system two.arrow_forwardA transit system is considering buying 6 more buses to provide better service. It will cost $100,000 for buying a new bus and $15,000 per year for maintenance and operation for the following 8 years. If the city’s MARR is 8%, what is the equivalent uniform annual cost of this project? Assume the bus has no value at the end of 8 years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education