FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

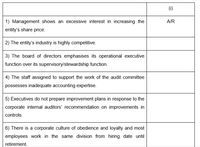

The following table shows a number of factors recognised by the auditor as having an effect on the risk of fraud.

Note: Number 1 risk factor is completed for you as an example in the table below. Using the table below, write your answers for Number 2 to 6 in the table.

Required:

For each of the foregoing risk factors listed in the left-hand column of the Table above, write in the right-hand column (i) the risk component that is most directly related to the following three option:

Incentives/Pressures (I/P)

Opportunity (O)

Attitude/Rationalisation (A/R)

Transcribed Image Text:(1)

1) Management shows an excessive interest in increasing the

A/R

entity's share price.

2) The entity's industry is highly competitive.

3) The board of directors emphasises its operational executive

function over its supervisory/stewardship function.

| 4) The staff assigned to support the work of the audit committee

possesses inadequate accounting expertise.

5) Executives do not prepare improvement plans in response to the

corporate internal auditors' recommendation on improvements in

controls.

6) There is a corporate culture of obedience and loyalty and most

employees work in the same division from hiring date until

retirement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Listed in the table below are some common audit procedures. For each procedure below: Identify whether it is a test of control (TOC), substantive test of transaction (STOT), analytical procedure (AP) or a test of details of balances (TODOB). Write your answer in the 2nd column of the table below. State one audit objective that is being satisfied. Write your answer in the 3rd column of the table below. Procedure (a) Type of Test (b) Audit Objective Example: Compare the quantity and description of items on duplicate sales invoices with related shipping documents. STOT Accuracy 1.Foot the list of accounts payable and trace the balance to the general ledger. 2. Account for the sequence of purchase orders 3. Select a sample of purchase transactions from purchase journal and trace them to vendors’ invoices and statements 4. Exam cash payments subsequent to the balance date to see if they are related to unrecorded…arrow_forwardd) Name the four types of tests auditors normally perform in an audit after risk assessment is done.arrow_forward13. When the auditors obtain an understanding of internal control for the financing cycle documentation will frequently include a written description as well as a(n): Group of answer choices Decision table List of audit objectives Internal control questionnaire Summary of tests of controlsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education