Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

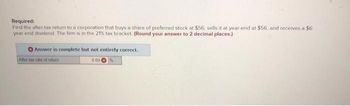

Transcribed Image Text:Required:

Find the after-tax return to a corporation that buys a share of preferred stock at $56, sells it at year-end at $56, and receives a $6

year-end dividend. The firm is in the 21% tax bracket. (Round your answer to 2 decimal places.)

Answer is complete but not entirely correct.

6.69

After tax rate of retam

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- d. Suppose the only owners of stock are corporations. Recall that corporations get at least a 50 percent exemption from taxation on the dividend income they receive, but they do not get such an exemption on capital gains. If the corporation's income and capital gains tax rates are both 33 percent, what does this model predict the ex- dividend share price will be? (Do not round intermediate calculations and round. your answer to 4 decimal places, e.g., 32.1616.)arrow_forwardNeed Help with this Questionarrow_forward4arrow_forward

- Given the tax rates as shown, what is the marginal and average tax rates for a firm with taxable income of $102,000? Taxable Income Tax Rate $0-50,000 15% $50,001-75,000 25% $75,001-100,000 34% $100,001-335,000 39%arrow_forwardPlease help me with the question correct all parts or pls skiparrow_forwardAdjusted WACC. Lewis runs an outdoor adventure company and wants to know what effect a tax change will have on his company's WACC. Currently, Lewis has the following financing pattern: Equity: 36% and cost of 18.17% Preferred stock: 15% and cost of 11.88% Debt: 49% and cost of 10.8% before taxes What is the adjusted WACC for Lewis if the tax rate is a. 40%? b. 25%? с. 20%? d. 10%? е. 0%? ..... a. What is the adjusted WACC for Lewis if the tax rate is 40%? |% (Round to two decimal places.)arrow_forward

- Vijay shiyalarrow_forwardd. Determine what rate of return must be earned on the net proceeds to the corporation so there will not be a dilution in earnings per share during the year of going public. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. > Answer is complete but not entirely correct. Rate of return 27.74 % e. Determine what rate of return must be earned on the proceeds to the corporation so there will be a 5 percent increase in earnings per share during the year of going public. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. > Answer is complete but not entirely correct. Rate of return 11.42%arrow_forwardThe price earnings ratios for 4 public companies are: 5.2, 4.6, 3.4, 4.86. The after-tax capitalization rate is: a. 16.00% b. 18.08% c. 20.19% d. 22.15%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education