FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

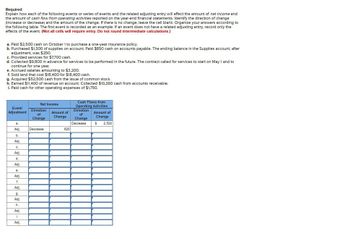

Transcribed Image Text:Required

Explain how each of the following events or series of events and the related adjusting entry will affect the amount of net income and

the amount of cash flow from operating activities reported on the year-end financial statements. Identify the direction of change

(Increase or decrease) and the amount of the change. If there is no change, leave the cell blank. Organize your answers according to

the following table. The first event is recorded as an example. If an event does not have a related adjusting entry, record only the

effects of the event. (Not all cells will require entry. Do not round intermediate calculations.)

a. Paid $2,500 cash on October 1 to purchase a one-year Insurance policy.

b. Purchased $1,300 of supplies on account. Pald $850 cash on accounts payable. The ending balance In the Supplies account, after

adjustment, was $250.

c. Provided services for $7,700 cash.

d. Collected $9,800 in advance for services to be performed in the future. The contract called for services to start on May 1 and to

continue for one year.

e. Accrued salaries amounting to $3,200.

f. Sold land that cost $18,400 for $18,400 cash.

g. Acquired $52,500 cash from the Issue of common stock.

h. Earned $11,400 of revenue on account. Collected $10,260 cash from accounts receivable.

1. Pald cash for other operating expenses of $1,750.

Net Income

Cash Flows from

Operating Activities

Event/

Adjustment

Direction

of

Direction

Amount of

Change

Amount of

of

Change

Change

Change

a.

Adj.

Decrease

b.

Adj.

Decrease

$ 2,500

825

C.

Adj.

d.

Adj.

e.

Adj.

f.

Adj.

g.

Adj.

h.

Adj.

i.

Adj.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education