FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

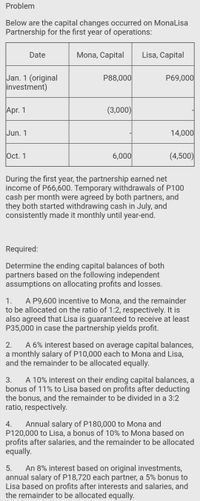

Transcribed Image Text:Problem

Below are the capital changes occurred on MonaLisa

Partnership for the first year of operations:

Date

Mona, Capital

Lisa, Capital

Jan. 1 (original

investment)

P88,000

P69,000

Apr. 1

(3,000)

Jun. 1

14,000

Oct. 1

6,000

(4,500)

During the first year, the partnership earned net

income of P66,600. Temporary withdrawals of P100

cash per month were agreed by both partners, and

they both started withdrawing cash in July, and

consistently made it monthly until year-end.

Required:

Determine the ending capital balances of both

partners based on the following independent

assumptions on allocating profits and losses.

A P9,600 incentive to Mona, and the remainder

to be allocated on the ratio of 1:2, respectively. It is

also agreed that Lisa is guaranteed to receive at least

P35,000 in case the partnership yields profit.

1.

A 6% interest based on average capital balances,

a monthly salary of P10,000 each to Mona and Lisa,

and the remainder to be allocated equally.

2.

A 10% interest on their ending capital balances, a

bonus of 11% to Lisa based on profits after deducting

the bonus, and the remainder to be divided in a 3:2

ratio, respectively.

3.

Annual salary of P180,000 to Mona and

P120,000 to Lisa, a bonus of 10% to Mona based on

profits after salaries, and the remainder to be allocated

equally.

4.

An 8% interest based on original investments,

annual salary of P18,720 each partner, a 5% bonus to

Lisa based on profits after interests and salaries, and

the remainder to be allocated equally.

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fiona and Gary are partners' with capital balances of P200,000 and P800,000 respectively. They agreed to accept Romy who will contribute cash P500,0000.00 Romy will be given a 25% interetst in the partnership. Use Bonus method, compute the following Fiona, Capital a b Gary, Capital Romy, Capital Romy will be given a 40% interetst in the partnership. Asset is to be revalued, compute the following Fiona, Capital Gary, Capital Romy, Capitalarrow_forwardXavier and Yolanda have original investment of $50,000 and $100,000 respectively in a partnership. The articles of partnership include the following provisions regarding income; interest on original investment at 10%, salary allowances of $27,000 at $18,000 I have the remaining income how much of the net loss of $6000 alligator to Yolanda?arrow_forwardallowance of $6,000 per month to partner C. The articles of partnership provide for a salary If C withdrew only $4,000 per month, would a partner's cash withdrawal in lieu of edited to interest from another Dartner and (b) by contribu- tion of assets to the partnership. accoi what 9. Why is it important to state all partnership assets in terms of current prices at the time of the admission of a new partner? 10. Why might a partnership pay a bonus to a newly admitted partner? pactice Exercises PE 12-1A Journalizing partner's original investment Catrina Santana contributed a patent, accounts receivable, and $23,000 cash to a parthersinpa The patent had a book value of $8,000. However, the technology covered by the patent ap peared to have significant market potential. Thus, the patent was appraised at $85,000. The accounts receivable control account was $38.000, with an allowance for doubtful accounts of $2,000. The partnership also assumed a $10,000 account payable owed to a Santana…arrow_forward

- = Homnes is admitted to the partnership of Rose & Novak. Prior to Hornes' admission, the partnership books show Rose's capital balance at $170,000 and Novak's at $85,000. Assume Rose and Novak share profits and losses equally. Read the requirements. Requirement 1. Compute each partner's equity on the books of the new partnership under the following plans: a. Hornes pays $100,000 for Novak's equity. Hornes pays Novak directly. Begin by computing the partner's equity base for plan a. Homes pays $100,000 for Novak's equity. Hornes pays Novak directly. (Enter a share for each partner. Complete all input fields. For accounts with a $0 balance, make sure to enter "0" in the a field. Enter negative amounts with a parentheses or minus sign.) Plan A Plan A: Partnership capital before admission of Hornes Plan A: Effect on capital balance as a result of admission of Hornes Plan A: Partnership capital after admission of Hornes b. Hornes contributes $85,000 to acquire a 1/4 interest in the…arrow_forwardes Watts and Lyon are forming a partnership. Watts invests $27,000 and Lyon invests $63,000. The partners agree that Watts will work one-fourth of the total time devoted to the partnership and Lyon will work three-fourths. They have discussed the following alternative plans for sharing income and loss: (a) in the ratio of their initial capital investments; (b) in proportion to the time devoted to the business; (c) a salary allowance of $18,000 per year to Lyon and the remaining balance in accordance with the ratio of their initial capital investments; or (d) a salary allowance of $18,000 per year to Lyon, 8% interest on their initial capital investments, and the remaining balance shared equally. The partners expect the business to perform as follows: Year 1, $18,000 net loss; Year 2, $45,000 net income; and Year 3, $75,000 net income. Required: Complete the tables, one for each of the first three years, by showing how to allocate partnership income or loss to the partners under each of…arrow_forwardi need the answer quicklyarrow_forward

- Do not give answer in imagearrow_forward1. Aristorenas, Soriano and Filamor have the following profit and loss agreement: Partners Aristorenas and Soriano will receive salaries of P40,000 each. Partner Filamor will get a bonus of 10% of profit after salaries and bonus. Remaining profits are shared by Aristorenas, Soriano and Filamor in the ratio of 3:4:3, respectively. * The partnership had a profit of P91,000. How much should be allocated to Filamor? P 4,000 b. Р 4,070 а. C. P 9,100 d. P27,300 2. A partnership showed the following account balances: sales, P70,000; cost of sales, P40,000; operating expenses, P10,000; partners' salaries, P13,000; interest paid to banks, P2,000 and partners' drawings, P8,000. The partnership profit is P20,000. с. Р 5,000. d. P(3,000). а. b. P18,000. 3. Villena, a partner in the Dulay, Villena & Co., has a 30% participation in partnership profits and losses. Villena's capital account has a net decrease of P120,000 during the calendar year 2019. During 2019, Villena withdrew P260,000 (charged…arrow_forward3arrow_forward

- Ahmed contributes cash of $12, 000 and Fatima contributes Office equipment that cost $10,000but valued at $8,000, during the first-year partners earn a profit of $5, 000. Assume the partners agreed to share the profit and loss equally.1. Prepare a journal entry to form the partnership? 2. How much profit should each partner earned?arrow_forwardi need the answer quicklyarrow_forwardThe partnership of Arun, Margot, and Tammy has been doing well. Arun wants to retire and move to another state for a once-in-a-lifetime opportunity. The partners' capital banaces prior to Arun's retirement are $60,000 each. Prepare a schedule showing how Arun's withdrawal should be divided assuming his buyout is: A. $70,000 B. $45,000 C. $60,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education