FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

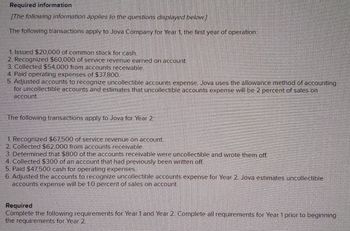

Transcribed Image Text:### Required Information

**The following information applies to the questions displayed below.**

The following transactions apply to Jova Company for Year 1, the first year of operation:

1. Issued $20,000 of common stock for cash.

2. Recognized $60,000 of service revenue earned on account.

3. Collected $54,000 from accounts receivable.

4. Paid operating expenses of $37,800.

5. Adjusted accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account.

The following transactions apply to Jova for Year 2:

1. Recognized $67,500 of service revenue on account.

2. Collected $62,000 from accounts receivable.

3. Determined that $800 of the accounts receivable were uncollectible and wrote them off.

4. Collected $300 of an account that had previously been written off.

5. Paid $47,500 cash for operating expenses.

6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 10 percent of sales on account.

**Required**

Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2.

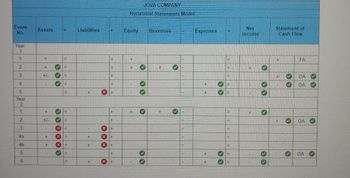

Transcribed Image Text:# Jova Company Horizontal Statements Model

## Overview

This table represents the horizontal statements model for Jova Company, detailing changes across assets, liabilities, equity, revenues, expenses, net income, and cash flows over two years.

### Column Headers

- **Event No.**: Indicates the sequence of transactions or events.

- **Assets**: Changes in assets, denoted by "+" or "–".

- **Liabilities**: Changes in liabilities, including increases or decreases.

- **Equity**: Changes in equity, indicating alterations in ownership value.

- **Revenues**: Revenue changes that affect the income.

- **Expenses**: Changes in expenses, related to operational costs.

- **Net Income**: Effect on net income, indicating profit or loss dynamics.

- **Statement of Cash Flow**: Tracks cash flow activities:

- **FA**: Financing Activities

- **OA**: Operating Activities

- **IA**: Investing Activities (not shown)

### Detailed Explanation by Year

#### Year 1

1. **Event 1**:

- Assets increase.

- No change in liabilities or equity.

- Positive impact on revenues and net income.

- Financing activity (FA).

2. **Event 2**:

- Assets increase.

- No change in liabilities or equity.

- Positive impact on net income.

- Operating activity (OA).

3. **Event 3**:

- Assets fluctuate slightly.

- No change in liabilities or equity.

- Positive impact on net income.

- Operating activity (OA).

4. **Event 4**:

- Assets decrease.

- No change in liabilities.

- Equity increases.

- Positive impact on revenues and net income.

5. **Event 5**:

- Assets decrease.

- Liability increase.

- Negative net income effect.

- Operating activity (OA).

#### Year 2

1. **Event 1**:

- Assets increase.

- No change in liabilities or equity.

- Positive revenue effect.

- Operating activity (OA).

2. **Event 2**:

- Assets fluctuate.

- No change in liabilities.

- Positive net income impact.

- Operating activity (OA).

3. **Event 3**:

- Assets decrease.

- Liability increase.

- Negative cash flow effect

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Explain the three types of Regulations: Proposed, Temporary and Final. At least half pagearrow_forwardHow do you Estimate and report the Fama-French 5-factor estimated equation in the program called e-views?arrow_forwardJournalize the entries to record the transactions, post to the Raw Materials Inventory account, and determine the ending balance in Raw Materials Inventory.arrow_forward

- Requirements Sheet in Workbook Requirement 1—Prepare the Journal Entries in the General Journal Journal Entries Requirement 2—Post Journal Entries to the General Ledger General Ledger Requirement 3—Prepare a Trial Balance Trial Balance Requirement 4—Prepare the Adjusting Entries Adjusting Entries Requirement 5—Post Adjusting Entries to the General Ledger General Ledger Requirement 6—Prepare an Adjusted Trial Balance Adjusted Trial Balance Requirement 7—Prepare the Financial Statements Financial Statements Requirement 8—Prepare the Closing Entries Closing Entries Requirement 9—Post Closing Entries to the General Ledger General Ledger Requirement 10—Prepare the Post Closing Trial Balance Post-Closing Trial Balance During its first month of operation, the Quick Tax Corporation, which specializes in tax preparation, completed the following transactions. July 1 Began business by making a deposit in a company…arrow_forwardPrepare the journal entry for the salaries and wages paid.arrow_forward12. Which of the following shows the first four stages of the writing process in the correct order? A. Prewriting, outlining, revising, drafting B. Prewriting, outlining, drafting, revising C. Outlining, prewriting, revising, drafting D. Proofreading, editing, revising, drafting Mark for review (Will be highlighted on the review page)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education