FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Required:

• Cash Flow (should follow the given format)

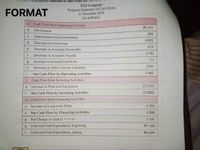

Transcribed Image Text:ion, the projected statement of cash flows can now

XYZ Company

FORMAT

Projected Statement of Cash Flows

31 December 2018

(in millions)

a. Cash Flow from Operating Activities

P3 521

b.

Net Income

800

с.

Depreciation and Amortization

(400)

d. Decrease in Inventories

624

e.

Decrease in Accounts Receivable

(578)

f.

Decrease in Accounts Payable

175

g.

Increase in Accrued Liabilities

h.

Decrease in Other Current Liabilities

(500)

i.

Net Cash Flow by Operating Activities

3 642

p

j. Cash Flow from Investing Activities

k. Increase in Plant and Equipment

(3 593)

odr

1.

Net Cash Flow by Investing Activities

(3 593)

m. Cash Flow from Financing Activities

n. Increase in Long-term Debts

3 500

o. Net Cash Flow by Financing Activities

3 500

p. Net Change in Cash (i+1+o)

3 549

q. Cash and Cash Equivalents, beginning

PI 100

Cash and Cash Equivalents, ending

P4 649

r.

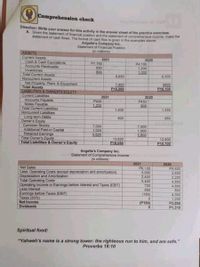

Transcribed Image Text:Comprehension check

Direction: Write your answer for this activity in the answer sheet of the practice exercises.

A. Given the statement of financial position and the staterment of comprehensive income, make the

statement of cash flows. The format of cash flow is given in the examples above.

Angelie's Company Inc.

Statement of Financial Position

(in millions)

ASSETS

Current Assets

Cash & Cash Equivalents

Accounts Receivable

Inventories

Total Current Assets

Noncurrent Assets

Net Property, Plant, & Equipment

Total Assets

LIABILITIES & OWNER'S EQUITY

Current Liabilities

Accounts Payable

Notes Payable

Total Current Liabilities

Noncurrent Liabilities

Long-term Debts

Owner's Equity

Common Stocks

Additional Paid-in Capital

Retained Eamings

Total Owner's Equity

Total Liabilities & Owner's Equity

2021

P7, 160

690

2020

P4,100

1,200

1,000

800

8,650

6,300

7.400

P16.050

9800

P16.100

2021

2020

P430

P450

1200

900

1,630

1,350

800

950

7,000

1,000

5.620

7,000

1,000

5,800

13,620

P16.050

13,800

P16.100

Angelie's Company Inc.

Statement of Comprehensive Income

(in millions)

2021

P6,120

3,000

2,400

5,400

720

900

2020

P9,600

2,600

2,200

4,800

4,800

800

Net Sales

Less: Operating Costs (except depreciation and amortization)

Depreciation and Amortization

Total Operating Costs

Operating Income or Earnings before Interest and Taxes (EBIT)

Less Interest

Eamings before Taxes (EBIT)

Taxes (30%)

Net Income

Dividends

(180)

4,000

1,200

P2,800

P1,310

(P180)

Spiritual food:

"Yahweh's name is a strong tower: the righteous run to him, and are safe."

Proverbs 18:10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- a. which cash flow method presentation is easier to understand: direct or indirect? b. explain the three sections of the indirect method: operating, investing, & financing.arrow_forwardWhat adjustment is made to FCFE when calculating the terminal value in a Discounted Cash Flow (DCF) analysis?arrow_forwardWhich of the following phrases best describes the term " actual cash value"? a. market value b. appraised value c. replacement cost less depreciation d. original cost less depreciationarrow_forward

- Discuss arguments supporting the need for improving the Statement of Cash Flows(SCF). What suggestions do Broom and the authors of the text make regarding improvement?arrow_forwardThe primary formula for calculating operating cash flow is?arrow_forwardCan you give some explanation of why Amortization Expense is included as a source of cash in a cash flow statement?arrow_forward

- How can we show mathematically that the two approaches cash flow from operation and net income are identical?arrow_forwarda. explain the information found on the statement of cash flow. b. how do the direct and indirect methods of preparing the statement of cash flow different?arrow_forwardThe two approaches to reporting cash flows provided by operating activities are the a. the liquidity and profitability methods. b. the basic and standard methods. c. direct and indirect methods. d. the gross margin and contribution margin methods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education