FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Required

c. Calculate the ROI for Bowman.

d. Franklin has a desired ROI of 13 percent. Headquarters has $90,000 of funds to assign to its investment centers. The manager of

the Bowman Division has an opportunity to invest the funds at an ROI of 15 percent. The other two divisions have investment

opportunities that yield only 14 percent. Calculate the new ROI for Bowman division, if the investment opportunity is adopted by

Bowman.

e. Based on the original data, calculate the original residual income. Also, calculate the new residual income based on information

provided in Requirement d.

Complete this question by entering your answers in the tabs below.

Required C

Required D

Required E

Calculate the ROI for Bowman. (Round your answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).)

ROI

%

< Required C

Required D >

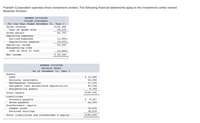

Transcribed Image Text:Franklin Corporation operates three investment centers. The following financial statements apply to the investment center named

Bowman Division.

BOWMAN DIVISION

Income Statement

For the Year Ended December 31, Year 2

$106,280

59,575

46,705

Sales revenue

Cost of goods sold

Gross margin

Operating expenses

Selling expenses

Depreciation expense

(2,650)

(4,015)

40,040

Operating income

Nonoperating item

( 4,900)

$ 35,140

Loss on sale of land

Net income

BOWMAN DIVISION

Balance Sheet

As of December 31, Year 2

Assets

Cash

$ 12,592

Accounts receivable

Merchandise inventory

Equipment less accumulated depreciation

Nonoperating assets

40,456

37,100

90,358

9,700

Total assets

$190,206

Liabilities

$ 9,567

Accounts payable

Notes payable

Stockholders' equity

64,000

78,000

38,639

Common stock

Retained earnings

Total liabilities and stockholder's equity

$190,206

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Bechtelar Company is decentralized and has a required opportunity cost of capital of 14%. The North division, whose current return on investment (ROI) is 26% is considering an investment which will earn a return of 26%. The South division whose current ROI is 25%, is considering an investment which will earn a return of 27%. If the managers objective is to maximize ROI, each division will make the following choice. Please answer with full ROI formulas and include all numbers. Not just North or South.arrow_forwardUse the following information for the Problems below: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return on invested capital is 8 percent. Division A Division B Division C $ Sales revenue ? ? 12,000,000 $ $ Income Average investment ? 450,000 2,190,000 $ ? ? 2,700,000 Sales margin 40% ? 45% Capital turnover 2 ? ? ROI ? ? 20% $ Residual income ? ? 133,000 PR 13-37 (Algo) ROI and Residual Income; Missing Data (LO 13-2) Required: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return on invested capital is 6 percent. Note: Round "Capital turnover" answers to 2 decimal places. Division A Division B Division C Sales revenue $ 40,800,000 Income $ 1,710,000 $ 8,160,000 Average investment 10,200,000 Sales margin 18 % 1.00 % 20% Capital turnover ROI Residual income % % 18 % $ 501,000arrow_forwardThe South Division of Wiig Company reported the following data for the current year. Sales Variable costs Controllable fixed costs Average operating assets 1. 2. 3. Top management is unhappy with the investment center's return on investment (ROI). It asks the manager of the South Division to submit plans to improve ROI in the next year. The manager believes it is feasible to consider the following independent courses of action. Return on Investment $2,950,000 1,947,000 Increase sales by $300,000 with no change in the contribution margin percentage. Reduce variable costs by $155,000. Reduce average operating assets by 4%. Action 1 595,000 (a) Compute the return on investment (ROI) for the current year. (Round ROI to 2 decimal places, e.g. 1.57%.) Action 2 5,000,000 Action 3 (b) Using the ROI formula, compute the ROI under each of the proposed courses of action. (Round ROI to 2 decimal places, e.g. 1.57%.) Return on investment do % % % %arrow_forward

- Please help with 1-3 thank you!!!arrow_forwardTan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Required 1X Required 2 Sales Net operating income. Average operating assets Required: 1. For each division, compute the return on investment (ROI). 2. Compute the residual income for each division assuming the company's minimum required rate of return is 15%. Complete this question by entering your answers in the tabs below. ROI Osaka $ 10,500,000 $630,000 $ 3,500,000 Osaka Division For each division, compute the return on investment (ROI). % Yokohama $ 35,000,000 $ 2,800,000 $ 17,500,000 Yokohama %arrow_forwardH1.arrow_forward

- Kelfour Enterprises has divided its operations into two divisions. Relevant accounting data for each division is as follows: Divisions Sales Operating Assets Operating Income Western Division $ 330,000 $ 280,000 $ 33,000 Eastern Division $ 480,000 $ 330,000 $ 34,500 Kelfour has an additional $68,000 of funds to invest. The manager of the Western Division believes that she can invest the funds at a rate of return (ROI) of 23.00% while the manager of the Eastern Division has found a new investment opportunity that is expected to yield a 21.00% ROI. Kelfour uses residual income (RI) to evaluate managerial performance. The company wide desired ROI is 19.00%. Based on this information Multiple Choice The manager of the Western Division would accept the $68,000 additional investment opportunity because it would increase the Division's RI by $2,720. The manager of the Eastern Division would accept the $68,000 additional investment…arrow_forwardDd3. For the most recent year, Petunia Company had the following data for its Clarkston Division, an investment center: total contribution margin—$671,110 budget, $695,741 actual; controllable fixed costs—$298,900 budget, $295,702 actual. Average operating assets for the year were $1,959,045. Determine the actual return on investment.arrow_forwardEvaluating Investment Centers Terry Enterprises, Inc. has two divisions-the Foods division and the Clothes division. Historically, Terry has used the division's ROI as the performance measure for the bonus determinations. Terry Foods division has gross total assets of $1,000,000, accumulated depreciation of $350,000, current liabilities of $250,000, and sales of $2,000,000. Foods' operating income is $320,000. Terry Clothes division has gross total assets of $5,000,000, accumulated depreciation of $2,100,000, current liabilities of $1,500,000, and sales of $8,000,000. Clothes' operating income is $870,000. Use the DuPont formula to compute ROI for each division and for Terry Enterprises as a whole. Use operating income and gross total assets as the measures of income and investment. Round answers to the nearest whole percentage. ROI Foods Clothes Terry Enterprises % % %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education