Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

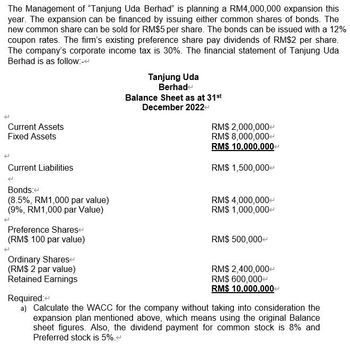

Transcribed Image Text:The Management of "Tanjung Uda Berhad" is planning a RM4,000,000 expansion this

year. The expansion can be financed by issuing either common shares of bonds. The

new common share can be sold for RM$5 per share. The bonds can be issued with a 12%

coupon rates. The firm's existing preference share pay dividends of RM$2 per share.

The company's corporate income tax is 30%. The financial statement of Tanjung Uda

Berhad is as follow:-

Current Assets

Fixed Assets

Current Liabilities

Bonds:

(8.5%, RM1,000 par value)

(9%, RM1,000 par Value)

Preference Shares

(RM$ 100 par value)

Ordinary Shares

(RM$ 2 par value)

Retained Earnings

Tanjung Uda

Berhade

Balance Sheet as at 31st

December 2022

RM$ 2,000,000+

RM$ 8,000,000+

RM$ 10,000,000

RM$ 1,500,000

RM$ 4,000,000

RM$ 1,000,000+

RM$ 500,000+

RM$ 2,400,000+

RM$ 600,000+

RM$ 10,000,000+

Required:

a) Calculate the WACC for the company without taking into consideration the

expansion plan mentioned above, which means using the original Balance

sheet figures. Also, the dividend payment for common stock is 8% and

Preferred stock is 5%.<

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely.arrow_forwardWhat is the equity multiplier if the total assets are $9,878.20 and total shareholder equity is $6,230.20?arrow_forwardIf a firm has retained earnings of $3.4 million, a common shares account of $5.4 million, and additional paid-in capital of $10.8 million, how would these accounts change in response to a 10 percent stock dividend? Assume market value of equity is equal to book value of equity. (Enter your answers in dollars not in millions. Input all amounts as positive values. Indicate the direction of the effect by selecting "increase," "decrease," or "no change" from the drop-down menu.)arrow_forward

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education