FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

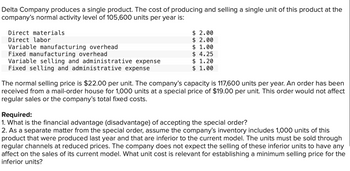

Transcribed Image Text:Delta Company produces a single product. The cost of producing and selling a single unit of this product at the

company's normal activity level of 105,600 units per year is:

$ 2.00

$ 2.00

$ 1.00

$ 4.25

$ 1.20

$ 1.00

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Variable selling and administrative expense

Fixed selling and administrative expense

The normal selling price is $22.00 per unit. The company's capacity is 117,600 units per year. An order has been

received from a mail-order house for 1,000 units at a special price of $19.00 per unit. This order would not affect

regular sales or the company's total fixed costs.

Required:

1. What is the financial advantage (disadvantage) of accepting the special order?

2. As a separate matter from the special order, assume the company's inventory includes 1,000 units of this

product that were produced last year and that are inferior to the current model. The units must be sold through

regular channels at reduced prices. The company does not expect the selling of these inferior units to have any

affect on the sales of its current model. What unit cost is relevant for establishing a minimum selling price for the

inferior units?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Economic All the work on A. is correct. All the chegg answers I found on here were wrong for Part B. The$1,500 is correct, BUT, the numbers underneath it are incorrect. All answers on chegg were wrong so please do not correlate your answer with someone elses. The answers for cost of goods sold are NOT 1400, 1100, 1083, or 1500, 1,300 etc so pick a different number & let's hope it is right. If I give a thumbs down you got it wrong. The answers for Gross Profit are NOT 300, 317, 200.arrow_forwardThe Tall Tale Publishing Company is trying to decide whether or not to accept a special order for its latest blockbuster. In making this decision, which level of costs will most likely be relevant to the decision? A) Unit-level costs B) Facility-level costs C) Product-level costs D) None of the abovearrow_forwardThe Comfy Company manufactures slippers and sells them at $11 a pair. Variable manufacturing cost is a $5 pair, and allocated fixed manufacturing cost is a $3 pair. It has enough idle capacity available to accept a one-time-only special order of 5000 pairs of slippers at $8 a pair. Comfy will not incur any marketing costs as a result of the special order. What would the effect on operating income be if the special order could be accepted without affecting normal sales: (a) $0, (b) $15000 increase, (c) $25000 increase, or (d) $40000 increase? Show your calculations. The HoustonCompany manufactures Part No. 498 for use in its production line. The manufacturing cost per unit for 25,000units of Part No. 498 is as follows: Direct materials $4 Variable direct manufacturing labor 38 Variable manufacturing overhead 15 Fixed manufacturing overhead allocated 18 Total manufacturing cost per unit $75 The Cushion Company has offered to sell…arrow_forward

- If a company has three lots of products for sale, purchase 1 (earliest) for $17, purchase 2 (middle) for $15, purchase 3 (latest) for $12, which of the following statements is true? A.This is a deflationary cost pattern. B.The next purchase will cost less than $12. C.This is an inflationary cost pattern. D.None of these statements can be verified.arrow_forwardSoft selling occurs when a buyer is skeptical of the usefulness of a product and the seller offers to set a price that depends on realized value. For example, suppose a sales representative is trying to sell a company a new accounting system that will, with certainty, reduce costs by 10%. However, the customer has heard this claim before and believes there is only a 40% chance of actually realizing that cost reduction and a 60% chance of realizing no cost reduction. Assume the customer has an initial total cost of $500. According to the customer's beliefs, the expected value of the accounting system, or the expected reduction in cost, is ($ ) Suppose the sales representative initially offers the accounting system to the customer for a price of $35.00. The information asymmetry stems from the fact that the (BUYER OR SALES REP) has less information about the efficacy of the accounting system than does the (BUYER OR SALES REP . At this price, the customer (WILL OR WILL NOT)…arrow_forwardRefer to the information for Smooth Move Company on the previous page. If SmoothMove accepts the order, no fixed manufacturing activities will be affected because there issufficient excess capacity.Required:1. What are the alternatives for Smooth Move?2. CONCEPTUAL CONNECTION Should Smooth Move accept the special order? By howmuch will profit increase or decrease if the order is accepted?3. CONCEPTUAL CONNECTION Briefly explain the significance of the statement in theexercise that “existing sales will not be affected” (by the special sale).arrow_forward

- Vikrambhaiarrow_forwardConsider the case of the Cast Iron Company. On each nondelinquent sale, Cast Iron receives revenues with a present value of $1,390 and incurs costs with a present value of $1,000. Cast Iron’s costs have increased from $1,000 to $1,240. Assuming that there is no possibility of repeat orders and that the probability of successful collection from the customer is p = 0.95, answer the following. a-1. What is the expected profit of granting credit? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) a-2. Should Cast Iron grant or refuse credit? multiple choice Grant Refuse b. What is the break-even probability of collection? (Enter your answer as a percent rounded to 1 decimal place.)arrow_forwardRequired:(a) GEM has an opportunity to sell 10 000 units to an overseas customer. Import duties and other special costs associated with this order would total $42 000. The only selling costs that would be associated with the order would be a shipping cost of $9.00 per unit. What would be the minimum acceptable unit price for GEM to consider this order? (hint: GEM would not accept the order if it would reduce the company’s profit) (b) The company has 200 units of Flicks on hand that were produced two months ago. Due to blemishes on the units, it will be impossible to sell these units at the normal price. If the company wishes to sell them through regular sales channels, what would be the relevant cost for setting the minimum price? Explain. (c) “All future costs are relevant in decision making.” Do you agree? Explain.arrow_forward

- If a company has three lots of products for sale, purchase 1 (earliest) for $17, purchase 2 (middle)for $15, purchase 3 (latest) for $12, which of the following statements is true?A. This is an inflationary cost pattern.B. This is a deflationary cost pattern.C. The next purchase will cost less than $12.D. None of these statements can be verifiedarrow_forwardWhich of the following statements is true? I. Incremental analysis is an analytical approach that focuses only on those revenues and costs that will not change as a result of a decision. II. When expressed on a per unit basis, fixed costs can mislead decision makers into thinking of them as variable costs. II. To estimate what the profit will be at various levels of sales volume, multiply the number of units to be sold above or below the break-even point by the unit contribution margin. Statements I and III are true. Statements II and III are true. All of the statements are true. None of the statements are true.arrow_forwardThe total cost formula for a company can be modeled by TC = 12570+ 50x where x represents the number of items sold. A formula for the company's total income is modeled with TR 80x, where a represents the number of items sold. This company will breakeven when its total costs equal its total income. - How many items must this company sell to breakeven? Answer:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education