FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

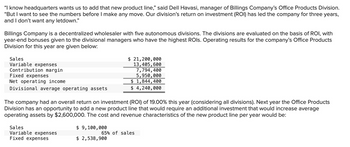

Transcribed Image Text:"I know headquarters wants us to add that new product line," said Dell Havasi, manager of Billings Company's Office Products Division.

"But I want to see the numbers before I make any move. Our division's return on investment (ROI) has led the company for three years,

and I don't want any letdown."

Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated on the basis of ROI, with

year-end bonuses given to the divisional managers who have the highest ROIS. Operating results for the company's Office Products

Division for this year are given below:

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income

Divisional average operating assets

The company had an overall return on investment (ROI) of 19.00% this year (considering all divisions). Next year the Office Products

Division has an opportunity to add a new product line that would require an additional investment that would increase average

operating assets by $2,600,000. The cost and revenue characteristics of the new product line per year would be:

Sales

Variable expenses

Fixed expenses

$ 21,200,000

13,405,600

7,794,400

5,950,000

$ 1,844,400

$ 4,240,000

$ 9,100,000

$ 2,538,900

65% of sales

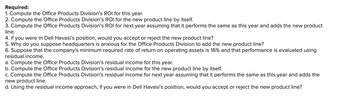

Transcribed Image Text:Required:

1. Compute the Office Products Division's ROI for this year.

2. Compute the Office Products Division's ROI for the new product line by itself.

3. Compute the Office Products Division's ROI for next year assuming that it performs the same as this year and adds the new product

line.

4. If you were in Dell Havasi's position, would you accept or reject the new product line?

5. Why do you suppose headquarters is anxious for the Office Products Division to add the new product line?

6. Suppose that the company's minimum required rate of return on operating assets is 16% and that performance is evaluated using

residual income.

a. Compute the Office Products Division's residual income for this year.

b. Compute the Office Products Division's residual income for the new product line by itself.

c. Compute the Office Products Division's residual income for next year assuming that it performs the same as this year and adds the

new product line.

d. Using the residual income approach, if you were in Dell Havasi's position, would you accept or reject the new product line?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- "I know headquarters wants us to add that new product line," said Dell Havasi, manager of Billings Company's Office Products Division. "But I want to see the numbers before I make any move. Our division's return on investment (ROI) has led the company for three years, and I don't want any letdown." Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to the divisional managers who have the highest ROIS. Operating results for the company's Office Products Division for this year are given below: Sales Variable expenses Contribution margin Fixed expenses Net operating income Divisional average operating assets The company had an overall return on investment (ROI) of 15% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product line that would require an additional investment that would increase average operating assets by…arrow_forwardCapital Investments has two divisions. Each division's required rate of return is 10%. Planned operating results for 2020 are as follows: (Click the icon to view the planned operating results.) Read the requirements. Requirement a. What is the current ROI for each division? Begin by selecting the formula to calculate ROI, then compute the ROI for each division. Division A Division B + + || = || ROI % %arrow_forwardI want the get the solution from requirement a to earrow_forward

- please answer 4a,b,c and 5 only. 4-a. What will be the new breakeven point if the additional $213,280 is spent on advertising? 4-b. Prepare a contribution income statement at the new breakeven point. 4-c. What is the percentage change in both fixed costs and in the breakeven point? 5. If the additional $213,280 is spent for advertising in the next year, what is the sales level (in units) needed to equal the current year’s operating profit at 60,000 unitsarrow_forwardPlease Provide Answer with Full explanation and provide it Step by steparrow_forwardThe new chief executive officer (CEO) of Richard Manufacturing has asked for a variety of information about the operations of the firm from last year. The CEO is given the following information, but with some data missing: (Click the icon to view the variety of operations information.) Read the requirements, Requirement 1. Find (a) total sales revenue, (b) selling price, (c) rate of return on investment, and (d) markup percentage on full cost for this product. (a) The total sales revenue is (Round your answer to the nearest cent.) (b) The selling price per unit is (Round the retum on investment to the nearest whole percent, X%.) (c) The rate of return on investment is (d) Calculate the markup percentage on full cost for this product. (Round your intermediary calculations to the nearest cent and the markup to the nearest hundredth percent XXX%) The markup percentage on full cost for this product is Requirement 2. The new CEO has a plan to reduce fixed costs by $200,000 and variable…arrow_forward

- Tan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Required 1X Required 2 Sales Net operating income. Average operating assets Required: 1. For each division, compute the return on investment (ROI). 2. Compute the residual income for each division assuming the company's minimum required rate of return is 15%. Complete this question by entering your answers in the tabs below. ROI Osaka $ 10,500,000 $630,000 $ 3,500,000 Osaka Division For each division, compute the return on investment (ROI). % Yokohama $ 35,000,000 $ 2,800,000 $ 17,500,000 Yokohama %arrow_forwardProvide correct solution for this questionarrow_forwardCapital Investments has two divisions. Each division's required rate of return is 10%. Planned operating results for 2020 are as follows: (Click the icon to view the planned operating results.) Read the requirements. Requirement a. What is the current ROI for each division? Begin by selecting the formula to calculate ROI, then compute the ROI for each division. Measure of income + Measure of investment 12,350,000 95,000,000 10,640,000 56,000,000 Division A Division B Division A Division B Measure of income 12,350,000 10,640,000 Division A Division B Requirement b. What is the current residual income for each division? Begin by selecting the formula to calculate the residual income (RI), then compute the RI for each division. X Required rate of return Measure of investment 95,000,000 56,000,000 10 % 10 % $ ROI ... % % -( -( $ -($ ROI X 13 % 19 % = ) = ) = Requirement c. Capital is planning an expansion that will require each division to increase its investments by $25,000,000 and its…arrow_forward

- Imagination Corporation uses residual income to evaluate the performance of its divisions. Imagination's minimum required rate of return is 10%. In April, the Commercial Products Division had average operating assets of $105,000 and net operating income of $9,700. What was the Commercial Products Division's residual income in April? Multiple Choice $970. $(970). $800. $(800).arrow_forwardLong Beach Pharmaceutical Company has two divisions, which reported the following results for the most recent year. Income Average invested capital ROI Division I $ 900,000 $6,000,000 Division II $ 200,000 $1,000,000 15% 20% Which was the more successful division during the year? Think carefully about this, and Required: explain your answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education