FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

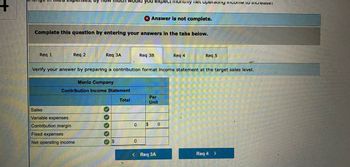

Verify your answer by preparing a contribution format income statement at the target sales level.

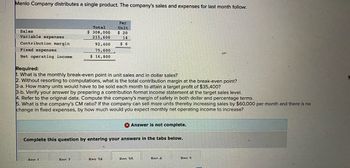

Transcribed Image Text:Menlo Company distributes a single product. The company's sales and expenses for last month follow:

Sales.

Variable expenses

Contribution margin

Fixed expenses

Net operating income.

Total

$ 308,000

215,600

92,400

75,600

$ 16,800

Required:

1. What is the monthly break-even point in unit sales and in dollar sales?

2. Without resorting to computations, what is the total contribution margin at the break-even point?

3-a. How many units would have to be sold each month to attain a target profit of $35,400?

3-b. Verify your answer by preparing a contribution format income statement at the target sales level.

4. Refer to the original data. Compute the company's margin of safety in both dollar and percentage terms.

5. What is the company's CM ratio? If the company can sell more units thereby increasing sales by $60,000 per month and there is no

change in fixed expenses, by how much would you expect monthly net operating income to increase?

Ren 1

Per

Unit

$ 20

14

$6

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Ren 2

Rea 3A

Ren 3R

Ren 4

Ren 5

Transcribed Image Text:Req 1

Complete this question by entering your answers in the tabs below.

Req 2

Sales

Variable expenses

Contribution margin

uch would you expect monumy net operating income to increase:

Req 3A

Menlo Company

Contribution Income Statement

Fixed expenses

Net operating income

00000

Verify your answer by preparing a contribution format income statement at the target sales level.

$

Total

0

Answer is not complete.

0

Req 3B

$

Per

Unit

< Req 3A

Req 4

0

Req 5

Req 4 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- explain the impact on financial statement using FIFO, weighted avverage and LIFO. When would the three methods give similar profit figures? when would they give indentical profit figure?arrow_forwardThe “plus” in cost-plus pricing is often referred to as Markup. Extra profit. Gross profit. Margin of Safety.arrow_forwardDescribe the earned value management terms.arrow_forward

- Conceptually, how would you evaluate a quantity discount offerfrom a supplier?arrow_forwardDetermine the alternative that Thermo Blast should select to achieve its Net profit goal.arrow_forwardManagement uses Cost Volume Profit (CPV) analysis as a planning process to predict the future volume of activity, costs incurred, sales made and profit received. Required: i. List and explain FIVE assumptions in C-V-P analysis.arrow_forward

- Discuss the following profitability ratios: Profit Margin, ROA-Return on Assets, ROI-Return on Investment, and the Gross Margin.arrow_forwardWhich of the following equations is correct for determining the required sales in units to generate a targeted amount of pre-tax income (πB) under the equation method (where Q = sales in units, F = total fixed costs, πB = pre-tax profit, v = variable cost per unit, and p = selling price per unit)?arrow_forwardProfitability changes may be simply calculated by using what kind of tool: sales price/volume/variable costs/fixed costs.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education