FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

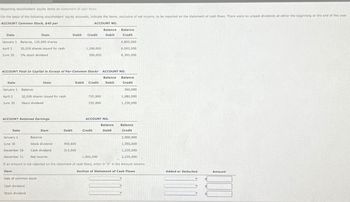

Transcribed Image Text:Reporting stockholders' equity items on statement of cash flows

On the basis of the following stockholders' equity accounts, indicate the items, exclusive of net income, to be reported on the statement of cash flows. There were no unpaid dividends at either the beginning or the end of the year.

ACCOUNT Common Stock, $40 par

ACCOUNT NO.

Date

Item

January 1 Balance, 120,000 shares

April 2

30,000 shares issued for cash

June 30

5% stock dividend

Debit Credit

Balance

Debit

Balance

Credit

4,800,000

1,200,000

300,000

6,000,000

6,300,000

ACCOUNT Paid-In Capital in Excess of Par-Common Stockr ACCOUNT NO.

Date

Item

January 1 Balance

April 2

30,000 shares issued for cash

June 30

Stock dividend

Debit Credit

Balance

Debit

Balance

Credit

360,000

720,000

150,000

1,080,000

1,230,000

ACCOUNT Retained Earnings

ACCOUNT NO.

Date

Item

Debit

Credit

Balance

Debit

Balance

Credit

January 1

June 30

Balance

2,000,000

Stock dividend

December 30

Cash dividend

450,000

315,000

1,550,000

1,235,000

December 31

Net income

1,000,000

2,235,000

If an amount is not reported on the statement of cash flows, enter in "0" in the Amount column.

Item

Section of Statement of Cash Flows

Sale of common stock

Cash dividend

Stock dividend

Added or Deducted

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Reporting Stockholders' Equity Items on Statement of Cash Flows On the basis of the following stockholders' equity accounts, indicate the items, exclusive of net income, to be reported on the statement of cash flows. There were no unpaid dividends at either the beginning or the end of the year. ACCOUNT Common Stock, $10 par ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance, 35,000 shares 350,000 Apr. 2 8, 750 shares issued for cash 87, 500 437,500 June 30 1,000 - share stock dividend 10,000 447, 500 ACCOUNT Paid - In Capital in Excess of Par - Common Stock ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance 140,000 Apr. 2 8, 750 shares issued for cash 183,750 323, 750 June 30 Stock dividend 7,500 331, 250 ACCOUNT Retained Earnings ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Jan. 1 Balance 291, 000 June 30 Stock dividend 17,500 273,500 Dec. 30 Cash dividend 33,500 240,000 Dec. 31 Net income 209,500 449, 500 If an amount is not reported…arrow_forwardCYCLONE, INC. Statement of Stockholders' Equity Year ended Dec. 31, 2021 Common Stock Total Stockholders' Retained Earnings Equity Beginning balance Issuances of stock Add: Net income Less: Dividends 2$ 13,000 $ 6,000 $ 19,000 4,000 4,000 Ending balance 2$ 15,000 $ 7,000 $ 22,000arrow_forwardOn the basis of the following stockholders' equity accounts, indicate the items, exclusive of net income, to be reported on the statement of cash flows. There were no unpaid dividends at either the beginning or the end of the year. Date Item Debit Credit BalanceDebit BalanceCredit January 1 Balance, 60,000 shares 300,000 April 2 15,000 shares issued for cash 75,000 375,000 June 30 2,000-share stock dividend 10,000 385,000 Date Item Debit Credit BalanceDebit BalanceCredit January 1 Balance 180,000 April 2 15,000 shares issued for cash 210,000 390,000 June 30 Stock dividend 7,500 397,500 Date Item Debit Credit BalanceDebit BalanceCredit January 1 Balance 249,000 June 30 Stock dividend 17,500 231,500 December 30 Cash dividend 28,600 202,900 December 31 Net income 179,300 382,200 If an amount is not reported on the statement of cash flows, enter in "0" in the Amount column. Item Section of Statement of…arrow_forward

- Feb 25 Declared a 2.50 per share cash dividend on 20,000 shares of common stock outstanding Mar. 20 Paid the cash dividends declared on Feb. 25, Dec. 31 Closed the 72,000 credit balance in Income Summary that reflects net income to Retained Earnings (a) Prepare the journal entries for these transactions. (b) If Retained Earnings had a 155,000 credit balance on January 1, calculate its year-end balance as of December 31arrow_forwardPlease do not give image formatarrow_forwardDetermining Cash Paid to Stockholders The board of directors declared cash dividends totaling $585,000 during the current year. The comparative balance sheet indicates dívidends payable of $167,625 at the beginning of the year and $146,250 at the end of the year. What was the amount of cash paid to stockholders during the year? %$4 %24arrow_forward

- Identifying and Analyzing Financial Statement Effects of Stock TransactionsMelo Company reports the following transactions relating to its stock accounts in the current year. Use the financial statement effects template to indicate the effects from each of these transactions.(a) Mar. 2 Issued 7,000 shares of $1 par value common stock at $30 cash per share.(b) Apr. 14 Issued 10,500 shares of $100 par value, 8% preferred stock at $250 cash per share.(c) June. 30 Purchased 2,100 shares of its own common stock at $22 cash per share.(d) Sep. 25 Sold 1,050 shares of its treasury stock at $26 cash per share.Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction.Note: Indicate a decrease in an account category by including a negative sign with the amount.arrow_forwardAt September 30, the end of Beijing Company's third quarter, the following stockholders' equity accounts are reported. Common stock, $12 par value Paid-in capital in excess of par value, common stock Retained earnings In the fourth quarter, the following entries related to its equity are recorded. Date October 2 October 25 October 31 November 5 December 1 ecember 31 Retained Earnings Common Dividend Payable General Journal Common Dividend Payable Cash Retained Earnings Common Stock Dividend Distributable Paid-In Capital in Excess of Par Value, Common Stock Common Stock Dividend Distributable Common Stock, $12 Par Value Memo-Change the title of the common stock account to reflect the new par value of $4. Income Summary Retained Earnings Common stock Common stock dividend distributable Paid-in capital in excess of par, common stock Retained earnings Total equity September 30 Beginning Balance 360,000 0 90,000 320,000 770,000 $360,000 90,000 320,000 $ Required: 2. Complete the following…arrow_forwardAt September 30, the end of Beijing Company's third quarter, the following stockholders' equity accounts are reported. Common stock, $10 par value Paid-in capital in excess of par value, common stock Retained earnings In the fourth quarter, the following entries related to its equity are recorded. General Journal Date October 2 October 25 October 31 November 5 December 1 December 31 Retained Earnings Common Dividend Payable Common Dividend Payable Cash Retained Earnings Common Stock Dividend Distributable Paid-In Capital in Excess of Par Value, Common Stock Common Stock Dividend Distributable Common Stock, $10 Par Value Memo-Change the title of the common stock account to reflect the new par value of $4. Income Summary Retained Earnings Common stock Common stock dividend distributable Paid-in capital in excess of par, common stock Retained earnings Total equity September 30 Beginning Balance $ Required: 2. Complete the following table showing the equity account balances at each…arrow_forward

- Entries for Cash Dividends The declaration, record, and payment dates in connection with a cash dividend of $70,100 on a corporation's common stock are July 9, August 31, and October 1. Journalize the entries required on each date. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. July 9 - Select - - Select - - Select - - Select - Aug. 31 - Select - - Select - - Select - - Select - Oct. 1 - Select - - Select - - Select - - Select -arrow_forwardEntries for Cash Dividends The declaration, record, and payment dates in connection with a cash dividend of $57,700 on a corporation's common stock are July 9, August 31, and October 1. Journalize the entries required on each date. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. July 9 Aug. 31 Oct. 1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education