FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

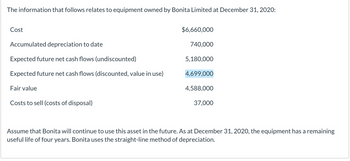

Transcribed Image Text:The information that follows relates to equipment owned by Bonita Limited at December 31, 2020:

Cost

Accumulated depreciation to date

Expected future net cash flows (undiscounted)

Expected future net cash flows (discounted, value in use)

Fair value

Costs to sell (costs of disposal)

$6,660,000

740,000

5,180,000

4,699,000

4,588,000

37,000

Assume that Bonita will continue to use this asset in the future. As at December 31, 2020, the equipment has a remaining

useful life of four years. Bonita uses the straight-line method of depreciation.

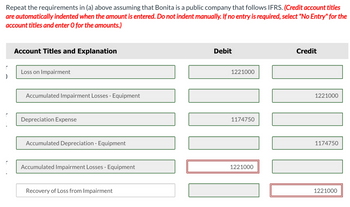

Transcribed Image Text:Repeat the requirements in (a) above assuming that Bonita is a public company that follows IFRS. (Credit account titles

are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the

account titles and enter O for the amounts.)

Account Titles and Explanation

Loss on Impairment

Accumulated Impairment Losses - Equipment

Depreciation Expense

Accumulated Depreciation - Equipment

Accumulated Impairment Losses - Equipment

Recovery of Loss from Impairment

Debit

1221000

1174750

1221000

Credit

1221000

1174750

1221000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Standby equipment held for use in the event of a breakdown of regular equipment is reported as property, plant, and equipment on the balance sheet. True Falsearrow_forwardIn 2-3 paragraphs complete the following: Define gain contingency. Describe the accounting requirements for a gain contingency. Define contingency. What exactly is the company uncertain about—whether a future event will take place and result in a liability or whether a future event will take place that will confirm that a liability exists from an event that has already taken place?arrow_forward(b) Assuming that the exchange of Assets A and B lacks commercial substance, record the exchange for both Tamarisk, Inc. and Vaughn, Inc. in accordance with generally accepted accounting principles. (Do not round intermediate calculations. Round final answer to O decimal places e.g. 58,971. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Tamarisk, Inc.'s Books Debit Credit Vaughn, Inc.'s Books eTextbook and Mediaarrow_forward

- What is the effect on liabilities, stockholder’s equity, revenues and net income if a company does not make an unearned revenue adjusting entry? Explain with suitable examplesarrow_forwardSometimes, for the fixed assets of certain businesses, the balance in Accumulated Depreciation is equal to the cost of the asset. a. Can one record additional depreciation on the assets if the assets are still useful to the business? b. Why? Explain: c. Also, when can such a business make an entry to remove the cost and accumulated depreciation of the fixed assets from the account?arrow_forwardWhich sentence is incorrect? Select one: a. Cash-basis accounting is not in accordance with generally accepted accounting principles. b. In the Accrual-Basis Accounting, expenses are recognized when incurred. c. In the Cash-Basis Accounting, Revenues recognized when cash is received. d. According to the GAAP in Accrual-Basis Accounting, companies recognize revenues when they record cash receipts for their services.arrow_forward

- Please answer the following question Must choose from the following LIST OF ACCOUNTS: Accounts Payable Accounts Receivable Accumulated Amortization - Copvrights Accumulated Amortization - Customer Database Accumulated Amortization - Customer lists Accumulated Amortization - Development Costs Accumulated Amortization - Franchises Accumulated Amortization - Licences Accumulated Amortization - Patents Accumulated Amortization - Software Accumulated Amortization - Trademarks Accumulated Depreciation Accumulated Impairment Losses - Copyrights Accumulated Impairment Losses - Goodwill Accumulated Impairment Losses - Licences Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Trade Names Accumulated Impairment Losses - Trademark Administrative Expenses Advances to Employees Advertising Expense Allowance for Doubtful Accounts Amortization Expense Bad Debt Expense Bank Loans Buildings Cash Common Shares Cost of Goods Sold Depreciation Expense Equipment Gain on Disposal…arrow_forwardPlease help with the following question, need accurate and full answer. What is the effect on liabilities, stockholder’s equity, revenues and net income if a company does not make an unearned revenue adjusting entry? Explain with suitable examplesarrow_forward9. For some of the fixed assets of a business, the balance in Accumulated Depreciation is equal to the cost of the asset. (a) Is it permissible to record additional depreciation on the assets if they are still useful to the business? Explain. (b) When should an entry be made to remove the cost and the accumulated depreciation from the accounts?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education