FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

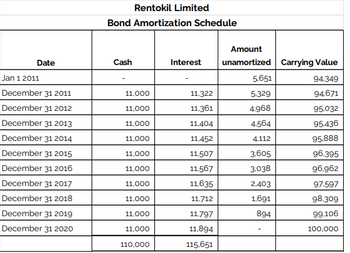

Rentokil Limited issued a 10-year bond on January 1 2011. It pays interest on January

1. The below amortization schedule and interest schedule reflects this. Its year end is

December 31.

a) Indicate whether the bonds were issued at a premium or a discount and explain

how you came to your decision and Compute the stated interest rate and the effective interest rate

c) Prepare the journal entries for the following years:

I. 2011, 2012 & 2018

Transcribed Image Text:Rentokil Limited

Bond Amortization Schedule

Amount

Jan 1 2011

Date

Cash

Interest

unamortized Carrying Value

-

-

5.651

94.349

December 31 2011

11,000

11,322

5.329

94.671

December 31 2012

11,000

11,361

4.968

95.032

December 31 2013

11,000

11.404

4.564

95.436

December 31 2014

11,000

11.452

4.112

95.888

December 31 2015

11,000

11.507

3.605

96.395

December 31 2016

11,000

11.567

3.038

96.962

December 31 2017

11,000

11,635

2.403

97.597

December 31 2018

11,000

11,712

1,691

98,309

December 31 2019

11,000

11.797

894

99.106

December 31 2020

11,000

11,894

100,000

110,000

115.651

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ces Exercise 5-1 (Algo) Future value; single amount [LO5-2] Determine the future value of the following single amounts (FV of $1, PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) (Round your final answers to nearest whole dollar amount.). Invested Amount i= 15,500 23,000 35,000 56,000 1. $ 2. 3. 4. M $ $ $ 5% 5% 11% 6% n= 12 6 18 14 Future Valuearrow_forwardMore Into st and annuity table for discrete con project is S (Round to the neare the project V acceptable. 1.0000 2.1800 3.5724 5.2154 71542 1800 1800 1.3924 1.6430 1.9388 2.2873 2.6996 3.1855 C 8475 1.5656 0000 0.4587 0.2799 0.1917 0.1398 0.1059 0.0824 0.0652 0.0524 0.8475 0.7182 0.6086 0.6387 0.4599 R1743 26901 0.5158 0.4371 03704 о3139 0 2660 0.2255 0.1911 0.3717 0.3198 0.2859 0.2624 4 9.4420 12.1415 15 3270 19 0859 23 5213 3.1272 34976 38115 4 0776 4.3030 4.4941 8 3.7589 0.2452 4.4355 0.2324 10 5.2338 0,0425 0.2225 Print Donearrow_forwardCurrent Attempt in Progress Michael is planning for his retirement this year. One option that has been presented to him is the purchase of an annuity that would provide a $38,000 payment each year for the next years. Click here to view the factor table. Calculate how much Michael should be willing to pay for the annuity if he can invest his funds at 7%. (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to O decimal place, e.g. 58,971.) Payment $ eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answerarrow_forward

- 10 ts 02:45:14 eBook Hint Print Ferences Bruin, Incorporated, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) -$ 28,200 -$ 28,200 3,900 13,600 11,500 9,400 8,800 14,400 4,700 16,000 0123 + 4 a-1.What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a- 2. Project A Project B % % Using the IRR decision rule, which project should the company accept? O Project A O Projectarrow_forward5 Exercises i ces Exercise 5-3 (Algo) Present value; single amounts [LO5-3] Determine the present value of the following single amounts (FV of $1, PV of $FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answers to earest whole dollar amount.): 1. 2. 3. 4. Future Amount $ 33,000 $ 27,000 $ $ 38,000 53,000 i= 4% 5% 12% 12% n = 10 18 20 12 Saved Present Valuearrow_forwardWhich mutually exclusive project below would you recommend?arrow_forward

- Cash Flow Asset End of year Amount Appropriate Required Return D 1 through 5 $1,500 12% 6 $8,500 By using cell references to the given datea and the function PV, Calculate the value of asset D.arrow_forwardPresent and future value tables of $1 at 3% are presented below: N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 10.95400 0.68095 15.6178 10.63496 16.0863 11.29607 17.5989 11.63496 14 1.51259 0.66112 17.0863 15 1.55797 0.64186 18.5989 11.93794 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 4 8 00 1.30477 0.76642 10.1591 Shelley wants to cash in her winning lottery ticket. She can either receive fourteen, $200,000…arrow_forwardPresent and future value tables of $1 at 3% are presented below: N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.91347 4 1.12551 0.88849 4.1836 3.71710 4.3091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 7 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11.4639 8.53020 11.8078 8.78611 11 1.38423 0.72242 12.8078 9.25262 13.1920 9.53020 12 1.42576 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 0.68095 15.6178 10.63496 16.0863 10.95400 14 1.51259 0.66112 17.0863 11.29607 17.5989 11.63496 15 1.55797 0.64186 18.5989 11.93794 19.1569 12.29607 16 1.60471 0.62317 20.1569 12.56110 20.7616 12.93794 Today, Thomas deposited $100,000 in a three-year,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education