FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

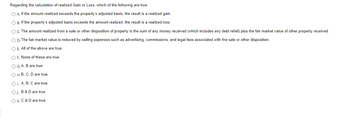

Transcribed Image Text:**Regarding the calculation of realized Gain or Loss, which of the following are true:**

- **A.** If the amount realized exceeds the property’s adjusted basis, the result is a realized gain.

- **B.** If the property’s adjusted basis exceeds the amount realized, the result is a realized loss.

- **C.** The amount realized from a sale or other disposition of property is the sum of any money received (which includes any debt relief) plus the fair market value of other property received.

- **D.** The fair market value is reduced by selling expenses such as advertising, commissions, and legal fees associated with the sale or other disposition.

**Options:**

- **E.** All of the above are true

- **F.** None of these are true

- **G.** A, B are true

- **H.** B, C, D are true

- **I.** A, B, C are true

- **J.** B & D are true

- **K.** C & D are true

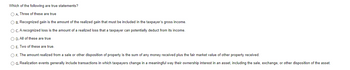

Transcribed Image Text:**Which of the following are true statements?**

- **A.** Three of these are true.

- **B.** Recognized gain is the amount of the realized gain that must be included in the taxpayer’s gross income.

- **C.** A recognized loss is the amount of a realized loss that a taxpayer can potentially deduct from its income.

- **D.** All of these are true

- **E.** Two of these are true.

- **F.** The amount realized from a sale or other disposition of property is the sum of any money received plus the fair market value of other property received.

- **G.** Realization events generally include transactions in which taxpayers change in a meaningful way their ownership interest in an asset, including the sale, exchange, or other disposition of the asset.

Expert Solution

arrow_forward

Step 1 Explanation

Gain or Loss on Property Exchanged or Sold

In most cases, a taxpayer is required to report any profit or loss from the sale or exchange of property. If the sum realised exceeds the seller's adjusted basis in the property, the seller has gained. When the property's adjusted basis exceeds the amount realised, the seller suffers a loss.

The amount realized from sale generally equals to fair market value, the debt element is not considered on part of seller.

The fair market value of property is not netted by sale expenses for valuation purposes.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- vi.2arrow_forwardAdjusted Basis of property is the property's: a. riginal basis adjusted to the date of the disposition. b. cost or other basis of the property on the date the taxpayer acquires it. c. cost plus all of the expenses associated to put it in place. d. deprecated value.arrow_forwardWhich of the following would be an example of a "transactional" adjustment made to a comparable sale? An adjustment for below-rate financing An adjustment for the property's use An adjustment for the property's location An adjustment for the property's operating expensesarrow_forward

- Gains and Losses results from realization events such as: a. sales, purchases, exchanges, or other disposition of property. b. sales, exchanges, or other disposition of property. c. Disposition , sales and donations. d. all of the above.arrow_forwardStatement 1: Measurement period is relevant if Fair Value of Net Assets of acquiree includes the recognition of the contingent asset, contingent liability, and assets/liabilities with provisional amounts. Statement 2: Measurement period is relevant for the remeasurement fo all contingent considerations. A. Both Statetements are Correct B. Both Statements are Incorrect C. Only Statement 1 is Correct D. Only Statement 2 is Correctarrow_forwardIf an asset is sold at a gain, why is the gain deducted from net income when computing the netcash provided by operating activities under the indirect method?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education