ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

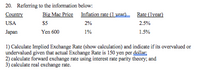

- Referring to the information below:

Country Big Mac Price Inflation rate (1 year) Rate (1year)

USA $5 2% 2.5%

Japan Yen 600 1% 1.5%

1) Calculate Implied Exchange Rate (show calculation) and indicate if its overvalued or undervalued given that actual Exchange Rate is 150 yen per dollar;

2) calculate forward exchange rate using interest rate parity theory; and

3) calculate real exchange rate.

Transcribed Image Text:20. Referring to the information below:

Country

Big Mac Price Inflation rate (1 year) Rate (lyear)

USA

S5

2%

2.5%

Japan

Yen 600

1%

1.5%

1) Calculate Implied Exchange Rate (show calculation) and indicate if its overvalued or

undervalued given that actual Exchange Rate is 150 yen per dollar

2) calculate forward exchange rate using interest rate parity theory; and

3) calculate real exchange rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Explain how monetary considerations, such as currency, exchange rates, and exchange-rate management, would impact the organization’s decision to expand into your selected market, using current exchange rates between China and the United States to support your explanations. Category The U.S. Dollar The Chinese Yuan Exchange Rate 1 USD ≈ 7.24 Yuan 1 Yuan ≈ 0.14 USDarrow_forward36. When a country's goods and services are expensive relative to other countries', we say that its currency is ________ in terms of purchasing power parity. Question 36 options: a) irrational b) rational c) overvalued d) undervaluedarrow_forwardplease answer in text form and in proper format answer with must explanation , calculation for each part and steps clearlyarrow_forward

- Amerika lifts the quota that it applies on the products that it imports from Euro Area and at the same time there is a changing trend in the demand of Americans from EU products to the Japanese products, then how do you thing the following exchange rates will change under the conditions of floating exchange rate system?Sketch graphs a)Dollar/Yen b)Yen/Dollararrow_forwardI need help on this ASAP: The following questions are related to foreign exchange markets.(1) Explain the theory of Purchasing Power Parity (PPP) and give a real-world example(2) An investor in the UK purchased a 60-day T-bill for $875.65. At that time, theexchange rate was $1.5 per pound. At maturity, the exchange rate was $1.83 perpound . What was the investor's holding period return in pounds?arrow_forwardExchange Rate Regime Assume interest parity condition as (see image) Under what circumstances will the domestic interest rate exceed the foreign interest rate?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education