FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

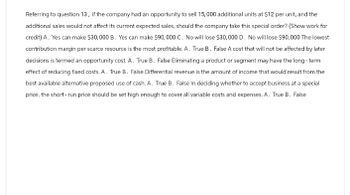

Transcribed Image Text:Referring to question 13, if the company had an opportunity to sell 15,000 additional units at $12 per unit, and the

additional sales would not affect its current expected sales, should the company take this special order? (Show work for

credit) A. Yes can make $30,000 B. Yes can make $90,000 C. No will lose $30,000 D. No will lose $90,000 The lowest

contribution margin per scarce resource is the most profitable. A. True B. False A cost that will not be affected by later

decisions is termed an opportunity cost. A. True B. False Eliminating a product or segment may have the long-term

effect of reducing fixed costs. A. True B. False Differential revenue is the amount of income that would result from the

best available alternative proposed use of cash. A. True B. False In deciding whether to accept business at a special

price, the short-run price should be set high enough to cover all variable costs and expenses. A. True B. False

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Do problem 4, a through h.arrow_forwardBates Company plans to add a new item to its line of consumer product offerings. Two possible products are under consideration. Each unit of Product A costs $18 to produce and has a contribution margin of $9, while each unit of Product B costs $30 and has a contribution margin of $10. What is the differential revenue for this decision? Multiple Choice O O $21 $1 $13 $12arrow_forward3) If demand for 2022 is instead 2,500 units should the company pay to increase their capacity? Why? Please explain your calculations and reference to the chart in Figure 1. Assume units are sold at the normal price. Please mention the concept of incremental profits. Hint: If you expand capacity, you will have to pay additional fixed costs of $25,000. Remember that fixed costs are fixed within the relevant range. If you expand capacity then you are outside this range. If you expand capacity then you can make revenue on 500 additional units at the normal price and would pay variable costs on 500 additional units. Please consider the incremental profit or loss of expanding capacity. The incremental profit is the increase in revenues minus the increase in costs of adding 500 more units. If the incremental profit of expanding capacity is positive then you should do so.arrow_forward

- Solve 2, the first answer is the wrong. Find the lowest acceptable transfer price.arrow_forwardQ1.Determine the production plan that will maximise the weekly profit of MJD Ltd and prepare a profit statement showing the profit your plan will yield. Q2.The marketing director of MJD Ltd is concerned about the company’s ability to meet the quantity demanded by its customers. Two alternative strategies are being considered to overcome this: To increase the number of hours worked using the existing machinery by working overtime. Such overtime would be paid at a premium of 50% above normal labour rates, and variable overheads costs would be expected to increase in proportion to labour costs. To buy product B from an overseas supplier at a cost of £19 per unit; which includes the cost of delivery. This purchased product would need to be repackaged at a cost of £1 per unit before it can be sold Evaluate each of the two alternative strategies and write a report to the marketing director discussing which strategy should be adopted.arrow_forwardHelp!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education