ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

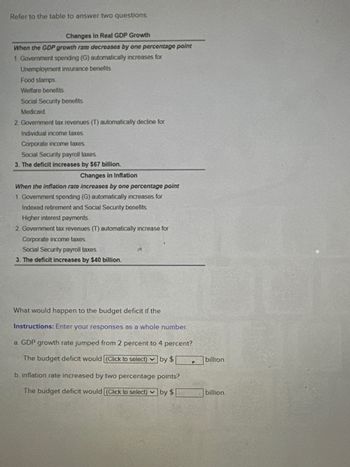

Transcribed Image Text:Refer to the table to answer two questions.

Changes in Real GDP Growth

When the GDP growth rate decreases by one percentage point

1. Government spending (G) automatically increases for

Unemployment insurance benefits

Food stamps,

Welfare benefits.

Social Security benefits.

Medicaid

2. Government tax revenues (T) automatically decline for

Individual income taxes.

Corporate income taxes.

Social Security payroll taxes.

3. The deficit increases by $67 billion.

Changes in Inflation

When the inflation rate increases by one percentage point

1. Government spending (G) automatically increases for

Indexed retirement and Social Security benefits.

Higher interest payments

2. Government tax revenues (T) automatically increase for

Corporate income taxes.

Social Security payroll taxes.

3. The deficit increases by $40 billion.

19

What would happen to the budget deficit if the

Instructions: Enter your responses as a whole number.

a. GDP growth rate jumped from 2 percent to 4 percent?

The budget deficit would [(Click to select) by $

b. inflation rate Increased by two percentage points?

The budget deficit would (Click to select) by $

billion.

billion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that nominal GDP was $9250000.00 in 2005 in Orange County California. In 2015, nominal GDP was $12000000.00 in Orange County California. The price level rose 2.00% between 2005 and 2015, and population growth was 3.25%. Calculate the following figures for Orange County California between 2005 and 2015. Give all answers to two decimals. a. Nominal GDP growth was b. Economic growth was %. c. Inflation was d. Real GDP growth was e. Per capita GDP growth was f. Real per capita GDP growth wasarrow_forwardThe housing market has weakened during every recession except which of the following? a. The Recession of 1974 b. The Recession of 1991 c. The Recession of 2001 d. The Recession of 2008arrow_forwardIn Panel A that nominal GDP is larger than real GDP. Explain why nominal GDP is larger than real GDP in 2022.arrow_forward

- For each item shown below, identify whether it increases or decreased during a recession. a. GDP b. consumer spending c. retail sales d. home sales e. employmentarrow_forwardGDP in the U.S. in 2000 was $10.1 trillion dollars and GDP in 2008 was $14.3 trillion. The CPI in 2000 was 172.2 and the CPI in 2008 was 215.3 (The CPI in 2009 was 214.5) What was Real GDP in 2008 (in 2009 $)? $14.25 trillion $11.48 trillion $17.81 trillion $14.35 trillion Question 30 (S What was the economic growth rate between 2000 and 2008? Growth rate= RGDP (2)-RGDP (1) 100 RGDP (1) Aarrow_forwardQuestion 2 Based on the information in the table, the 2021 growth rate is Year Real GDP 2020 $2,545 billion 2021 $2,675 billion 4.8% 4.0% 24.8% 5.1% Price Index 120.00 124.80arrow_forward

- suppose a small economy produces only smart TVs. in year one, 10,000 TVs are produced and sold at a price of $1,000 each. in year two, 10,000 TVs are produced and sold at a price of $1,500 each. As a result, ____ real GDP increased. ____ real GDP decreased. ____ real GDP stayed the same. ____ nominal GDP stayed the same.arrow_forwardScenario 1: An increase in the unemployment rate to 7.4% has occurred. Inflation has increased causing a decline in consumer spending. Exports have declined by more than $4 billion. This has caused a decrease in GDP by 3.7%.arrow_forwardWrite brief notes on the economic ideas of the following:1. James Tobin2. Andre Gunder Frank3. Supply-siders4. New classicalarrow_forward

- Which of the following is a sign of a strong economy A. An increase in GDP B. A shrinking economy C. An increase in unemployment D. A decrease in spending powerarrow_forward21 Macroeconomic Information for Mexico: 2020 Q2 GDP (in 2020 Q2 pesos) 4.97 trillion pesos 2020 Q1 GDP (in 2020 Q1 pesos) 6.09 trillion pesos 2020 Q2 GDP (in 2015 pesos) 3.76 trillion pesos 2020 Q1 GDP (in 2015 pesos) 4.54 trillion pesos Calculate Mexico's inflation, using the GDP deflator method, between the first and second quarters of 2020. (Enter your answer in percent form, rounded to one decimal place, without the percent sign. For example, if your answer is 0.12345, enter 12.3.)arrow_forwardDiscuss how policymakers use national income data to make decisions about taxes, spending, and other economic policies.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education