ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

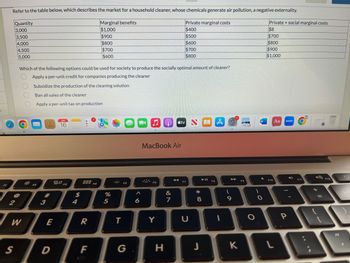

Transcribed Image Text:Refer to the table below, which describes the market for a household cleaner, whose chemicals generate air pollution, a negative externality.

Private marginal costs

Marginal benefits

$1,000

$400

$500

$600

$700

$800

Quantity

3,000

3,500

4,000

4,500

5,000

2

S

1000

W

Which of the following options could be used for society to produce the socially optimal amount of cleaner?

Apply a per-unit credit for companies producing the cleaner

Subsidize the production of the cleaning solution

Ban all sales of the cleaner

Apply a per-unit tax on production

F2

O

#

3

E

D

JAN

16

20

$

4

R

$900

$800

F

$700

$600

%

5

T

F5

A

6

MacBook Air

FO

Y

9 stv

H

&

7

F7

U

*00

8

J

AA

► 11

F8

A

(

9

K

F9

O

Private + social marginal costs

$8

$700

$800

$900

$1,000

F10

Aa

zoom

P

F11

11 +

=

10

#1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A global-positioning anti-theft device installed by one car owner can produce a positive spillover to other citizens in a community. Discuss the impact on the: (1) Private benefit curve (2) Social benefit curve (3) Private cost curvearrow_forwardIdentify whether the following activities are best categorized as a negative externality or a public good. 1) An excavating company pollutes a local stream with acid rock. 2) A family enjoys a Fourth of July firework from their home 3) A late-night road construction reroutes traffic past your house 4) Your roommate plays loud music at 2 amarrow_forwardExternalities: Suppose the daily inverse demand curve for gasoline in Portland is given by P = $100 – Q, the MC = 1.5Q, and the EMC = 1.5Q. Q is measured in thousands of gallons of gasoline per day. a. Graph the demand, marginal cost, and external marginal cost functions. b. How many gallons will be consumed per day if gasoline consumers do not consider the EMC of gasoline? c. How many gallons of gasoline will be consumed per day if gasoline consumers consider the EMC.arrow_forward

- Which of the following is an example of a negative externality (additional social cost)? Multiple Choice ___ an increase in the value of land you own when a nearby development is completed ___ the costs paid by a company to build an automated factory ___ falling property values in a neighborhood where a disreputable nightclub is operating ___ the higher price you pay when you buy a heavily advertised product.arrow_forwardCan you explain this for me? I got this wrong.arrow_forwardIn the market for travel, what is true about the relationship between the market equilibrium (n) and the socially optimal equilibrium (nº) amount of travel when there is zero negative externality? The market equilibrium amount of travel is greater than the socially optimal amount of travel The market equilibrium amount of travel is less than the socially optimal amount of travel The market equilibrium amount of travel is equal to socially optimal amount of travelarrow_forward

- Early settlers in the town of Dry Gulch drilled wells to pump as much water as they wanted from the single aquifer beneath the town. (An aquifer is an underground body of water.) As more people settled in Dry Gulch, the aquifer level fell and new wells had to be drilled deeper at higher cost. The residents of Dry Gulch will overuse water relative to the social optimum because Multiple Choice each resident will fail to adequately consider the external cost of his or her own water use water is a scarce resource each resident will fail to adequately consider the external benefit of his or her own water use the marginal cost of water is increasingarrow_forwardter 5 i A public good Multiple Choice generally results in substantial negative externalities. can never be provided by a nongovernmental organization. costs essentially nothing to produce and is thus provided by the government at a zero price. can't be provided to one person without making it available to others as well.arrow_forwardThe market for some public good consists of only two consumers, Elena and Talia. The marginal cost of providing this good is described by MC = 3 + 5Q. Elena's MWTP = 40 - 3Q and Talia's MWTP = 10 - 2Q. What is the socially-efficient quantity of this good? Round to the nearest whole unitarrow_forward

- There are two people. Each person's demand for a public good is P = 20 - Q. The marginal cost of providing the public good is given by MC2 = $12 (MC is not $24). The above graph summarizes the relevant information. The total demand for the two workers shown above is the vertical sum of the demand curve for each worker.(a) What is the socially efficient quantity of the public good?(b) How much will each person have to pay per unit to provide the socially efficient quantity?(c) What is the consumer surplus for each person based on the quantity determined in (a) and the price determined in (b)?(d) Given that this is a public good, if either one of the two people does not pay the price you have stated in (b), can they be prevented from consuming the good?arrow_forwardGoods with negative externalities are underprovided by the market. True Falsearrow_forwardQUESTION 30 Which of the following is considered a positive externality? OSmoking cigarettes Listening to a new CD with earbuds An indoor classical music concert with tickets that cost $50 Innovation in the semiconductor industryarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education