ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

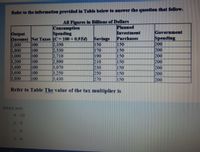

Transcribed Image Text:Refer to the information provided in Table below to answer the question that follow.

All Figures in Billions of Dollars

Consumption

Spending

Output

Income) Net Taxes (C= 100 + 0.9Yd)

2,600

2,800

3,000

3,200

3,400

3,600

3,800

100

100

100

100

100

100

2,350

2,530

2,710

2,890

3,070

3,250

3.430

|Savings

150

170

190

210

230

250

270

Planned

Investment

Purchases

150

150

150

150

150

150

Government

Spending

200

200

200

200

200

200

100

150

200

Refer to Table The value of the tax multiplier is

Select one:

a. -10

b. -5

C. -9

d. -4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 6 of 9 Due to a restricted budget, a company can only undertake one of the following projects: Project X: This project has an initial investment of $800,000 and annual profits of $400,000 in year 1, $375,000 in year 2 and $300,000 in year 3. Project Y: This project has an initial investment of $800,000 and a profit of $1,150,000 in year 3. a. Calculate the IRR for Project X. % Round to two decimal places b. Calculate the IRR for Project Y. % Round to two decimal places c. Which project should the company undertake? (click to select)Project XProject Yarrow_forwardTable 24.8 All Figures in Billions of Dollars Consumption Spending Income) Net Taxes (C=100 +0.9Yd) 2,350 2,530 2,710 2,890 3,070 3,250 3,430 Planned Investment Purchases 150 150 150 150 150 150 150 Output 2,600 2,800 3,000 3,200 3,400 3,600 3,800 100 100 100 100 100 100 100 Savings 150 170 190 210 230 250 270 Government Spending 200 200 200 200 200 200 200 le Refer to Table 24.8. The value of the tax multiplier is Lütfen birini seçin: O A. -5 O B. 10 OC -10 O D.-4 OE-9arrow_forwardPublic Budget Cycle Develop a four- to five-page paper in which you analyze the Public Budget Cycle in a government agency of your choice. (Defense and National Security) Be sure to include each of the phases of the budget cycle (preparation and submission, approval, execution and audit, and evaluation) and address how each relates to the overall organizational mission of the government agency. Your paper must be four to five pages (not including title and reference pages) and must be formatted according to APA style as outlined in the approved APA style guide. You must cite at least three scholarly sources in addition to the textbook. Textbook Lee, R. D. & Johnson, R. W. (2008). Public budgeting systems (8th Ed.). Sudbury, MA: Jones and Bartlett.arrow_forward

- Consider the following supply and demand function, QD = 65 − 2P and QS = 1.5P − 5, and assume a $17.50 excise tax is collected from consumers. (a) Calculate price and quantity in this market before (P1 and Q1) and after the tax (P2 and Q2). (b) What is the amount of tax revenue that is collected from con- sumers, producers and in total? (c) What is the relative tax burden of consumers and producers? (d) Show how the elasticity of supply and demand determine the shar- ing of the tax burden. (e) What is the relative tax burden of producers and consumers if the tax is collected from producers, instead?arrow_forwardThe necessary condition for a budget to be considered fiscally sustainable is that:(a) it is balanced annually.(b) it does not cause the crowding out effect.(c) the current generation of voters accepts the burden of their current level of taxation.(d) the present value of expected future government revenue is equal to the present value of expected government spending.arrow_forwardThe homestead exemption is a legal regime that protects the equity that homeowners have in their principal residences from general liens and property taxes. The protection varies by state. What is the maximum equity that a general lienholder could attach for a property valued at $200,000 and a mortgage balance of $145,397 in a state with a $25,000 homestead exemption? (Input your answer rounded to the nearest whole dollar and without the $ sign, e.g., 1000)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education