FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

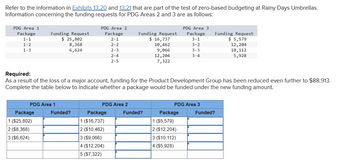

Transcribed Image Text:Refer to the information in Exhibits 13.20 and 13.21 that are part of the test of zero-based budgeting at Rainy Days Umbrellas.

Information concerning the funding requests for PDG Areas 2 and 3 are as follows:

PDG Area 1

Package

PDG Area 2

PDG Area 3

Funding Request

Package

1-1

$ 25,802

2-1

Funding Request

$ 16,737

Package

Funding Request

3-1

$ 5,579

1-2

1-3

8,368

2-2

10,462

3-2

12,204

6,624

2-3

9,066

3-3

2-4

12,204

3-4

10,112

5,928

2-5

7,322

Required:

As a result of the loss of a major account, funding for the Product Development Group has been reduced even further to $88,913.

Complete the table below to indicate whether a package would be funded under the new funding amount.

PDG Area 1

PDG Area 2

PDG Area 3

Package

Funded?

Package

Funded?

Package

Funded?

1 ($25,802)

1 ($16,737)

1 ($5,579)

2 ($8,368)

2 ($12,204)

3 ($6,624)

2 ($10,462)

3 ($9,066)

4 ($12,204)

5 ($7,322)

3 ($10,112)

4 ($5,928)

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Please help me solve the white squares on the Budgeted balance sheet!arrow_forwardWhich one of the following statements is true about a balanced budget? Group of answer choices Revenues should be less than expenses Revenues and expenses should be equal Expenses should not be greater than revenues Zero-based method should be used every other yeararrow_forwardNonearrow_forward

- For Req #4, Can you please highlight what items I should enter into the budgeted income statement for May? Your spreadsheet has far more lines than what the question does and I am confused. Item2 3.33points ItemSkipped Print Item 2 Problem 8-19 (Algo) Cash Budget; Income Statement; Balance Sheet [LO8-2, LO8-4, LO8-8, LO8-9, LO8-10] Minden Company is a wholesale distributor of premium European chocolates. The company’s balance sheet as of April 30 is given below: Minden CompanyBalance SheetApril 30 Assets Cash $ 9,200 Accounts receivable 76,250 Inventory 49,750 Buildings and equipment, net of depreciation 228,000 Total assets $ 363,200 Liabilities and Stockholders’ Equity Accounts payable $ 63,750 Note payable 23,900 Common stock 180,000 Retained earnings 95,550 Total liabilities and stockholders’ equity $ 363,200 The company is in the process of preparing a budget for May and has assembled the following data: Sales are budgeted at…arrow_forwardanswer in text form please (without image)arrow_forwardFont Paragraph Styles 6. Assume you are the chief administrator of a small healthcare facility and are comparing the actual cost to the budgeted cost. Prepare a Comparative Analysis of Actual to Budget and write a brief paragraph on how you believe this unit performed during the year. 2021 Actual Difference 2020 Budget Dollars Dollars Dollars Maintenance Expense $300,000.00 $450,000.00 Dietary Expense $615,000.00 $645,000.00 General Services $21,500,000.00 ? $21,200,000.00 ? Supply Expense Total $5,500,000.00 $6,150,000.00arrow_forward

- Which of the following statements is true? 1. Budgets are used for the distinct purposes of planning and profit. II. Control Involves developing goals and preparing various budgets to achieve those goals. III. A continuous or perpetual budget is a 12-month budget that rolls forward one month (or quarter) as the current month (or quarter) is completed. Multiple Choice None of the statements are true. Only statement Ill is true. ○ Only statement I is true. All of the statements are true. Barrow_forwardquestion 19 A county general fund budget includes budgeted revenues of $600 and budgeted expenditures of $595. Actual revenues for the year were $610. To close the Estimated Revenues account at the end of the year a. Debit Estimated Revenues $10 b. Credit Estimated Revenue $10 c. Debit Estimated Revenues $600 d. Credit Estimated Revenues $600 Question 20 Hill City uses encumbrance accounting to control expenditures. However, it charges the cost of outstanding purchase commitments to expenditures in the year they are received, not in the year they are ordered. If Hill City had $5,000 of purchase commitments outstanding at the end of Year 1 and received those goods during Year 2 at a cost of $4,900, what would be the impact on total Fund Balance for Year 2? a. Total Fund Balance at the end of Year 2 would be $4,900 less than at the end of Year 1. b. Total Fund Balance at the end of Year 2 would be $100 less than at the end of Year 1. c. Total Fund Balance at the end of Year 2 would be…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education