ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

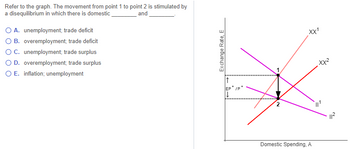

Transcribed Image Text:Refer to the graph. The movement from point 1 to point 2 is stimulated by

a disequilibrium in which there is domestic

and

O A. unemployment; trade deficit

O B. overemployment; trade deficit

OC. unemployment; trade surplus

O D. overemployment; trade surplus

O E. inflation; unemployment

Exchange Rate, E

|↑

EP/P

|↓

XX¹

Domestic Spending, A

Xx²

<=

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Figure 12.4 LRAS2 LRAS, P2 AD AD2 Real GDP (billions of dollars) Refer to Figure 12.4. A movement from equilibrium point B to equilibrium point A would be the result of O an increase in productivity and an increase in government spending. O an increase in consumer confidence and decrease in productivity. an increase in production costs and greater consumer confidence. O technological advances and domestic price decreases. Price Level (dollars) P,arrow_forwardAn increase in the real exchange rate (real depreciation of domestic currency) will result in: A. an increase in imports only. B. an increase in net exports. C. a decline in imports. D. a decline in exports.arrow_forwardA4 Assume Morocco is currently operating with an unemployment rate six percent above its natural rate of unemployment. Draw a correctly labeled graph of the long-run aggregate supply, short-run aggregate supply, and aggregate demand curves. Label the equilibrium price level PL1 and the equilibrium real output Y1. Label the full-employment level of output YF. Where on a production possibilities curve representing full employment in Morocco would current output be—on, outside, or inside the PPC? What can be assumed about inflation based on the information above? Assume that the output gap is estimated to be $156 billion and the government decides to take action. If the marginal propensity to consume is 0.75, by how much would it need to change government spending to close the gap? Show your work. If instead, government chose to use the income tax to close the output gap rather than changes in spending, calculate the change in tax revenue the…arrow_forward

- 2. Assume that the current dollar-Euro exchange rate (Ese) is equal to 1, the real exchange rate (qus/Eur) = 1.33, the price level (P) equals 1.5 in the U.S. and 2 in Europe. Assume that relative PPP holds. a. If inflation is 4% in the U.S. but 2% in Europe, what will be the price levels in the U.S. and Europe a year from now? b. What will the nominal exchange rate (Ese) be a year from now? c. What will the real exchange rate (qus/Eur) be a year from now?arrow_forwardExplain the implication of convergence of relative prices after trade.arrow_forwardWhen we express the value of goods in one country in terms of the same goods in another country, we use: O the real exchange rate. O real GDP. O the nominal exchange rate. O nominal GDP.arrow_forward

- Under a credible system offixed nominal exchangerates...A.The Central Bank can adjustthe interest rate as it deemsappropriate for smoothingdomestic outputfluctuationsB.Domestic inflation will beapproximately equal to theinflation rate of the countryto which the domesticcurrency is peggedC.Public debt can bemonetised, i.e. viagovernment bonds boughtby the Central Bank againstnewly created moneyD.All of these optionsE.None of these optionsarrow_forwardQuestion 15 What is the likely result from a depreciation of a nation's currency when its economy is already operating at its full-employment level of outpul? CA, Net exports would fall and contribute to demand-pull inflation. OB. Net exports would fall, but equilibrium GDP would rise. OC. Net exports would rise and contribute to demand-pull inflation. CD Net exports would rise, but equilibrium GDP would fall.arrow_forwardSub : EconomicsPls answer very faast.I ll upvote. Thank Youarrow_forward

- Analyze the adjustment of the dollar/euro exchange rate following a permanent increase inthe U.S. money supply. In your analysis show both the short-run and the long-run effects ofthis disturbance. Suppose that the economy starts with all variables at their long-run levelsand that output remains constant as the economy adjusts to the money supply change. Alsoassume that the decrease in the money supply affects exchange rate expectations today. Please illiustrate any graph if needed. Thank youarrow_forwardNot use Aiarrow_forwardAn example of a deficit item on the u.s. balance of payments is 1) the sale of a spark plug made by aus. firm in Midigan to a Nissan plant n Tennessee. 2) the payment of a dividend by a British firm to a us, family, O 3) the purchase of Japanese yen by a us, firm, 4) a deposit in a bank in Chicago by the government of Saudi Arabia.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education