Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:STRAND&SECTIC

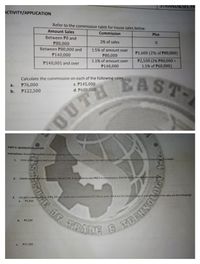

ACTIVITY/APPLICATION

Refer to the commission table for house sales below.

Amount Sales

Commission

Plus

Between P0 and

2% of sales

P80,000

Between P80,000 and

1.5% of amount over

P140,000

P80,000

P1,600 (2% of P80,000)

1.1% of amount over

P2,500 (2% P80,000 +

1.5% of P60,000)

P140,001 and over

P140,000

Calculate the commission on each of the following sales.

c. P145,000

d. P600,000

EA

BAST

a.

P76,000

b.

P122,500

PART 5: QUIZZES/EVALUATION

Instructions: Answer the problem solving involving commissions.

1.

Irene sells furniture and is paid 6% of her total sales as commission. Her sales totaled to P17,945. How much is Irene's commission in a week?

2.

Diwata works with a commission rate of 5.5%. If she wants to earn P825 in commissions, find the total sales that she must make.

Lito gets a weekly salary of P4,235 per week plus a commission of 5.5% on sales. What are his total earnings in a week in which his sales are the following?

a.

P1,000

PRADE B

P4,500

TRANE

b.

C.

P17,384

00

E OF

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Similar questions

- On December 31, 2019, the unadjusted trial balance of Tarzwell Services showed the following balances: Accounts receivable Allowance for doubtful accounts Sales $200,000 1,000 Cr. 700,000 The business has given up trying to collect $5,000 of its accounts receivable but has not yet recorded the write-off entry. The firm uses the allowance method to estimate bad-debt expense. Required a) Provide the entry for the write-off. b) If the firm uses the percent-of-sales allowance method for recording bad-debt expense, and has experienced an average 6% rate of non-collection based on sales, provide the entry to record bad-debt expense for 2019. c) Assume that after the firm recorded the $5,000 of write-offs, it determined that 18% of its remaining accounts receivable will be uncollectible under the aging method. Provide the entry to record bad-debt expense. Don't give answer in image formatarrow_forwardDemonstrate how the product life cycle, competition,distribution and promotion strategies, customers demands,the internet and extranets and perceptions of quality can affect price.arrow_forwardIf the contract annual interest rate on a $2,880,000 fixed rate loan that is fully amortizing over 20 years with equal monthly payments is 6.25%, what is the effective yield to the lender if the lender charges 1.5% as an origination fee, $288 for a credit report and $3,080 for an appraisal fee and the loan is repaid after ten years? a. 6.25% b. 6.51% c. 6.46% d. 6.49%arrow_forward

- As purchasing agent for Eynan Enterprises in Richmond, Virginia, you ask your buyer to provide you with a ranking of "excellent" (worth 4 points), "good" (3 points), "fair" (2 points), or "poor" (1 point) for a variety of characteristics for two potential vendors, Donna Inc. (D) and Kay Corp. (K). You suggest that "Products" total be weighted 0.4, the "Company" total be weighted 0.2, and the "Service" and "Sales" totals each be weighted 0.2. The buyer has returned the following ranking. Which of the two vendors would you select? Click the icon to view the rankings. Part 2 You should choose vendor ▼ Donna Inc. Either Kay Corp. or Donna Inc. Kay Corp. , with a weighted score of ________. (Enter your response rounded to one decimal place.)arrow_forwardA property's annual property taxes equaled $7,560. The seller owes the buyer for 20 days c prorated property taxes. Using the 360-day calendar, how much does the seller owe the buyer? $1,950 $360 $2,100 $420arrow_forwardFind the last date the cash amount is available and the date on which the net amount is due. Invoice date= April 14 Terms 2/10 , n/30 Date goods received= April 16arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.