FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

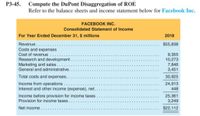

Transcribed Image Text:P3-45.

Compute the DuPont Disaggregation of ROE

Refer to the balance sheets and income statement below for Facebook Inc.

FACEBOOK INC.

Consolidated Statement of Income

For Year Ended December 31, $ millions

2018

Revenue..

$55,838

Costs and expenses

Cost of revenue

Research and development .

Marketing and sales.

General and administrative..

9,355

10,273

7,846

3,451

Total costs and expenses. .

30,925

Income from operations

Interest and other income (expense), net.

24,913

448

Income before provision for income taxes

Provision for income taxes.

25,361

3,249

Net income.

$22,112

Transcribed Image Text:FACEBOOK INC.

Consolidated Balance Sheet

At December 31, $ millions

2018

2017

Current assets

$ 8,079

33,632

Cash and cash equivalents.

$10,019

Marketable securities .

31,095

5,832

Accounts receivable, net.

Prepaid expenses and other current assets

7,587

1,779

1,020

Total current assets

50,480

24,683

48,563

13,721

Property and equipment, net

Intangible assets, net

Goodwill

1,294

18,301

1,884

18,221

2,135

Other assets.

2,576

Total assets

$97,334

$84,524

Current liabilities

$ 380

Accounts payable.

Partners payable.

Accrued expenses and other current liabilities

Deferred revenue and deposits.

$

820

541

390

5,509

2,892

147

98

Total current liabilities..

3,760

7,017

6,190

Other liabilities

6,417

Total liabilities.

13,207

10,177

Stockholders' equity

Common stock and additional paid-in capital.

42,906

40,584

Accumulated other comprehensive loss.

Retained earnings

(760)

41,981

(227)

33,990

Total stockholders' equity...

84,127

74,347

Total liabilities and stockholders' equity.

$97,334

$84,524

Required

a. Compute return on equity (ROE).

b. Apply the DuPont disaggregation into return on assets (ROA) and financial leverage.

c. Calculate the profitability and productivity components of ROA.

d. Confirm the full DuPont disaggregation: ROE = PM × AT × FL.

%3D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2018, Bax had revenues of 008.38M, cost of revenue of $173 50M, R&D expenses of $163 75M, and other expenses of $405 65M What is the net profe margin for the company? Ⓒa. (22.13%) Ob (12 13%) OC 44.35% Od 0122%3arrow_forwardPlease solve the question sub-division b alone.arrow_forwardForecast an Income Statement Following is the income statement for Medtronic PLC. Consolidated Statement of Income ($ millions) For Fiscal Year Ended April 26, 2019 Net sales $27,807 Costs and expenses Cost of products sold 8,331 Research and development expense 2,330 Selling, general, and administrative expense 9,480 Amortization of intangible assets 1,605 Restructuring charges, net 198 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 5,439 Other nonoperating income, net (373) Interest expense 1,314 Income before income taxes 4,498 Income tax provision 547 Net income 3,951 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $3,932 Use the following assumptions to prepare a forecast of the company’s income statement for FY2020. Note: Complete the entire question in Excel using the following template: Excel Template. Format each answer to two decimal…arrow_forward

- Forecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Medtronic PLC Consolidated Statement of Income $ millions, For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 979 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 83 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 7,734 Other nonoperating income, net (157) Interest expense 1,444 Income before income taxes 6,447 Income tax provision 547 Net income 5,900 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $5,881…arrow_forwardklp.2arrow_forwardWhat is the impact on retained earnings each year?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education