ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Refer to the article below:

FRONT PAGE

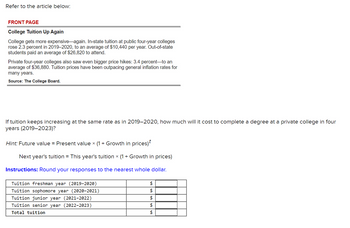

College Tuition Up Again

College gets more expensive again. In-state tuition at public four-year colleges

rose 2.3 percent in 2019-2020, to an average of $10,440 per year. Out-of-state

students paid an average of $26,820 to attend.

Private four-year colleges also saw even bigger price hikes: 3.4 percent-to an

average of $36,880. Tuition prices have been outpacing general inflation rates for

many years.

Source: The College Board.

If tuition keeps increasing at the same rate as in 2019-2020, how much will it cost to complete a degree at a private college in four

years (2019-2023)?

Hint: Future value = Present value x (1 + Growth in prices)

Next year's tuition = This year's tuition x (1 + Growth in prices)

Instructions: Round your responses to the nearest whole dollar.

Tuition freshman year (2019-2020)

Tuition sophomore year (2020-2021)

Tuition junior year (2021-2022)

Tuition senior year (2022-2023)

Total tuition

$

$

$

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A study of the effects of the minimum wage on employment of low-skilled workers estimated the price elasticity of demand for low-skilled workers is -0.75. Suppose that the government is considering raising the minimum wage from $7.25 per hour to $7.75 per hour. Based on this information, calculate the percentage change in the employment of low skilled workers. Use the midpoint formula?arrow_forwardThe bar graph below shows the percentages of income spent on food (i.e., the portion of a consumer's budget devoted to food spending) and the elasticities of demand (in absolute value) for several countries' residents. [Click on the bar graph to open a PDF viewable version in another tab.] Malawians Haitians Bangladeshis Indians Brazilians Koreans. Greeks Italians Australians French Canadians Americans Percentage of Income spent on Food 17% 15% 14% 12% W 31% 28% 35% 40% X 56% Elasticity of Demad 66% 81% 75% According to the bar graph, which of the answer choices is correct? Malawians spend less money on food than Australians. French spend less money on food than Brazilians. Bangladeshis spend a larger percentage of their income on food than Americans. O Canadians spend a larger percentage of their income on food than Koreansarrow_forwardPablo bought a sofa on sale for $147.20. This price was 68% less than the original price. What was the original price?arrow_forward

- You can drag and drop files here to add them. Consider the public policy aimed at smoking: (a) Suppose studies indicate that the price elasticity of demand for cigarettes is about 2. If the government is able to increase the price of a pack of cigarette from $2 to $3 (through may be, higher taxes), by what percentage will the consumption (demand) of cigarettes decrease? Please show all calculations. (b) Studies also find that the price elasticity of demand for cigarettes for higher income earners is more inelastic compared to that of those earning less income. Why might this be true? Please explain your answer I of U X2 x2 画 tv MacBook Proarrow_forwardFor Question 16, consider the linear Demand curve illustrated below. price 16. 8.00 A. B. C. D. 0 Demand quantity 84,000 0 If an increase in supply led to a decrease in price from $5.36 to $4.87, total consumer expenditures on this good would increase. decrease. remain constant (i.e., not change). None of the above answers are necessarily correct, since the graph does not convey enough information to determine how total consumer expenditures would change for this decrease in price.arrow_forwardPlease answer the following. A diagram and one paragraph should help to support your answer. Question: With consideration for elasticity (especially PED), what would be one industry in which the government instituting a subsidy would make sense and why?arrow_forward

- = D(x) = 23 Espacio en Blanco 1: Espacio en Blanco 2: Espacio en Blanco 3: P = 1 X 20 and the price-supply equation = S(x) P = Given the price-demand equation (A) Find the equilibrium price. Answer: The equilibrium price is $ (use 2 decimal places) (B) The total gain to producers who are willing to supply units at a lower price is $ (C) The total savings to consumers who are willing to pay a higher price for the product is $ = 8+ 1 8000 (round to 2 decimal places) (use 2 decimal places)arrow_forwardSuppose that the demand curve for a product is given by = 100 – 2 Px+a Py, = £20 is the price of another product, and where a Py %3D where Px = £20, where = 8. a) Calculate the demand for good X in this market at the current price level. How much revenue would the firm make? b) If the firm wishes to increase total revenue, would it need to increase or decrease the current price of good X? c) Calculate the cross-price point elasticity between goods X and Y at the current price level. Are the goods complements or substitutes? Note: The writing is clear and abbreviations are not allowed.arrow_forwardFrom California to New York, legislative bodies across the United States are considering eliminating or reducing the surcharges that banks impose on noncustomers, who make $14 million in withdrawals from other banks’ ATM machines. On average, noncustomers earn a wage of $20 per hour and pay ATM fees of $2.75 per transaction. It is estimated that banks would be willing to maintain services for 5 million transactions at $1.00 per transaction, while noncustomers would attempt to conduct 19 million transactions at that price. Estimates suggest that, for every 1 million gap between the desired and available transactions, a typical consumer will have to spend an extra minute traveling to another machine to withdraw cash.a. Based on this information, what would be the nonpecuniary cost of legislation that would place a $1.00 cap on the fees banks can charge for noncustomer transactions?b. What would be the full economic price of this legislation?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education