FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

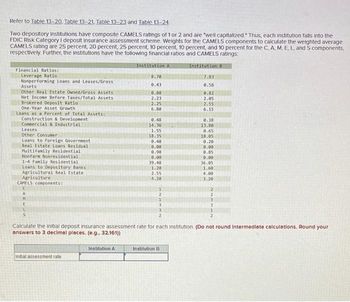

Transcribed Image Text:Refer to Table 13-20, Table 13-21. Table 13-23 and Table 13-24.

Two depository Institutions have composite CAMELS ratings of 1 or 2 and are "well capitalized." Thus, each institution falls into the

FDIC Risk Category I deposit Insurance assessment scheme. Weights for the CAMELS components to calculate the weighted average

CAMELS rating are 25 percent, 20 percent, 25 percent, 10 percent, 10 percent, and 10 percent for the C, A, M, E, L, and S components,

respectively. Further, the institutions have the following financial ratios and CAMELS ratings:

Institution A

Institution 8

Financial Ratios:

Leverage Ratio.

8.70

7.83

Nonperforming Loans and Leases/Gross

0.43

Assets

0.58

Other Real Estate Owned/Gross Assets

0.80

0.82

Net Income Before Taxes/Total Assets

2.23

2.05

Brokered Deposit Ratio

2.25

2.55

One-Year Asset Growth

6.80

6.15

Loans as a Percent of Total Assets:

Construction & Development

Commercial & Industrial

Leases

Other Consumer

Loans to Foreign Government

Real Estate Loans Residual

Multifamily Residential

Nonfarm Nonresidential

0.45

0.38

14.36

13.80

1.55

0.65

18.35

18.05

0.40

0.20

0.00

0.00

0.90

0.85

0.00

0.00

1-4 Family Residential

39.48

36.05

Loans to Depository Banks

1.20

1.60

Agricultural Real Estate

2.55)

4.00

Agriculture

4.20

3.20

CAMELS components:

1

3

3

3

2

2

Calculate the initial deposit insurance assessment rate for each institution (Do not round Intermediate calculations. Round your

answers to 3 decimal places. (e.g., 32.161))

Initial assessment rate

Institution A

Institution B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Categorize each of the nine different sources of risk according to the investment class to which it applies. If the risk applies to both stocks and bonds then categorize it as "both." Question content area bottom Part 1 Interest rate risk applies to: A. stocks only. B. bonds only. C. both stocks and bonds.arrow_forwardThe FTSE 100 Index is an example of a benchmark for measuring the performance of an Equity fund. What is the role of a benchmark in measuring performance of a fund? Give an example of a Bonds Benchmark.arrow_forwardThe lowest rating a bond can receive from Moody's and still be classified as an investment-quality bond is: Group of answer choices BB. Caa. B. Ba. Baa.arrow_forward

- All of the following are purposes of internal risk rating systems except: Group of answer choices D. Pricing and trading of loans. B. Setting of limits and acceptance or rejection of new transactions. C. Inadequacy of loan reserves. A. Monitoring of credit quality.arrow_forwardBonds are like loans the issuers get from investors. Just as your credit worthiness is evaluated when you apply for a loan, the credit worthiness of the bond also needs to be evaluated. To do this, independent agencies have created a rating system. To help investors evaluate bonds, private rating agencies such as Moody’s and Standard & Poor’s assign grades to designate a bond’s quality. Which of the following statements regarding the rating system are correct? Check all that apply. Once a bond receives a rating, it cannot be changed. A bond rated Ba by Moody’s is comparable to a bond rated BB by Standard & Poor’s. Different rating systems are used for corporate versus municipal bonds. The average yields on Aaa bonds are generally lower than the average yields on Baa bonds. The rating C signifies a lower risk of default than a B rating. The following chart shows the distribution of Moody’s ratings for municipal bonds between 1970 and…arrow_forwardCritically discuss five ways in which banks and/or bond holders can manage the credit risk of the loans or bonds they hold as investment assets.arrow_forward

- Consider the relative liquidity of the following assets: Assets 1. A bond issued by a publicly traded company 2. The funds in a money market account 3. A $20 bill 4. Your truck Select the assets in order o Most Liquid Second-Most Liquid Third-Most Liquid Least Liquid Bond 520.00 bill Truck Funds held in a money market account quid.arrow_forwardIn your own words and using various bond websites, locate one of each of the following bond ratings: AAA, BBB, CCC, and D. Describe the differences between the bond ratings. Identify the strengths and weaknesses of each rating.arrow_forward33.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education