FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

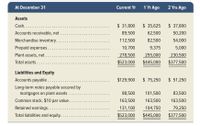

Refer to Simon Company’s

Transcribed Image Text:At December 31

Current Yr

1 Yr Ago

2 Yrs Ago

Assets

Cash. ....

$ 31,800

$ 35,625

$ 37,800

Accounts receivable, net .

89,500

62,500

50,200

Merchandise inventory. .

112,500

82,500

54,000

Prepaid expenses....

10,700

9,375

5,000

Plant assets, net.....

278,500

255,000

230,500

Total assets...

$523,000

$445,000

$377,500

Liabilities and Equity

Accounts payable . . .

$129,900

$ 75,250

$ 51,250

Long-term notes payable secured by

mortgages on plant assets

98,500

101,500

83,500

Common stock, $10 par value.

163,500

163,500

163,500

Retained earnings. . .

131,100

104,750

79,250

Total liabilities and equity. . .

$523,000

$445,000

$377,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The financial statements for Castile Products, Incorporated, are given below: Castile Products, Incorporated Balance Sheet December 31 Assets Current assets: Cash Accounts receivable, net Merchandise inventory Prepaid expenses Total current assets Property and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 10% Total liabilities. Stockholders equity Connon stock, $5 per value. Retained earnings Total stockholders equity Total liabilities and stockholders' equity Castile Products, Incorporated Income Statement For the Year Ended December 31 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Net incone before taxes Income taxes (30%) Net income $24,000 230,000 370,000 9,000 633,000 860,000 $1,493,000 $ 290,000 320,000 610,000 $150,000. 733,000 883,000 $1,493,000 $ 2,290,000 1,220,000 1,070,000 580,000 490,000 32,000 458,000 137,400 $ 320,600arrow_forward! Required information [The following information applies to the questions displayed below.] You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company's financial statements, including comparing Lydex's performance to its major competitors. The company's financial statements for the last two years are as follows: Assets Current assets: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Note payable, 10% Total liabilities Lydex Company Comparative Balance Sheet Stockholders' equity: Common stock, $70 par value. Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Sales (all on account) Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest…arrow_forwardBased on the information in financial statements for Emerson Corporation, the operating margin is Note: Round your intermediate and final answer to two decimal places. Emerson Corporationarrow_forward

- Vdarrow_forwardPlease select THREE of the ratios listed below and perform them for years 2012 and 2011. Please interpret the data by including the following: (1) Write out the formula for each ratio you selected and show your calculations. (2) Discuss whether each ratio you selected measures liquidity or profitability and what those terms mean. (3) What factor(s) contributed to the increase or decrease from last year? Discuss whether those changes were favorable or unfavorable to the company and why? (4) What does each of your calculated ratios potentially mean for the company’s overall financial condition? Please assume the market price of the common stock on 12/31/11 was $113.40. Also, if you need any numbers from 2010 for averages, please use the following: Cash 300,000 Marketable securities 1,000,000 A/R 345,000 Inventory 647,000 Prepaids 220,000…arrow_forwardThe following financial data (in thousands) were taken from recent financial statements of Staples, Inc.: Please see the attachment for details: 1. Determine the times interest earned ratio for Staples in Year 3, Year 2, and Year 1? Round your answers to one decimal place.2. Evaluate this ratio for Staples.arrow_forward

- Hello, I need formulas explaining the answers, thank you. Please calculate the Current Ratio (for two years) and the Quick Ratio (for two years), comment on the trend.arrow_forwardProvide answer this questionarrow_forwardThe balance sheet of Pacific Ocean Resort reports total assets of $660,000 and $810,000 at the beginning and end of the year, respectively. The return on assets for the year is 16%. Calculate Pacific Ocean's net income for the year.arrow_forward

- Answer provide Answer with calculationarrow_forwardThe year-end financial statements of Calloway Company contained the following elements and corresponding amounts: Assets = $34,000; Liabilities = ?; Common Stock = $6,400; Revenue = $13,800; Dividends = $1,450; Beginning Retained Earnings = $4,450; Ending Retained Earnings = $8,400.The amount of liabilities reported on the end-of-period balance sheet was:arrow_forwardThe year-end financial statements of Greenway Company contained the following elements and corresponding amounts: Assets = $23,000; Liabilities = ?; Common Stock = $5,300; Revenue = $11,600; Dividends = $900; Beginning Retained Earnings = $3,900; Ending Retained Earnings = $7,300. The amount of liabilities reported on the end-of-period balance sheet was A. $11,200. B. $10,400. C. $13,800. D. $9,200.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education