ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

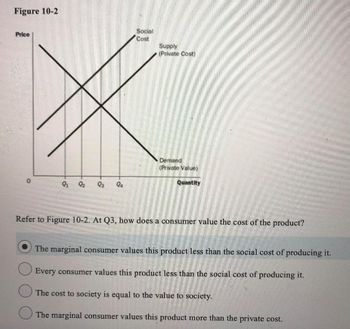

Transcribed Image Text:Figure 10-2

Price

0

Q & Q3 94

Social

Cost

Supply

(Private Cost)

Demand

(Private Value)

Quantity

Refer to Figure 10-2. At Q3, how does a consumer value the cost of the product?

The marginal consumer values this product less than the social cost of producing it.

Every consumer values this product less than the social cost of producing it.

The cost to society is equal to the value to society.

The marginal consumer values this product more than the private cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose a new social service is introduced by a government at a fixed cost of $3,000 (note: there is no marginal cost to provide this service). This service has not been provided before and there is no available substitute for this service. Economists have estimated the marginal benefit of the new service is given by: MB = 100 – Q where Q is the quantity (in hours) of the service that is used. Please note the MB gives both the marginal private benefit (MPB) and marginal social benefit (MSB) (i.e., MB = MPB = MSB). Compare the two mechanisms (administrative and price) for rationing the service. How do they compare in terms of efficiency (the size of the pie) and in terms of distributional impacts (the way the pie is divided up between the service users and taxpayers)?arrow_forwardMarkets and Common Resources. This problem is also called “the tragedy of the commons.” There are seven families in the village. Each family has $70 to spend on either a steer or a bond. A steer today costs $70 per steer; a bond costs $70. In one year, a family can sell their steer that uses the common grazing land (the common resource) for the village. The revenue and price received for selling a steer depend upon how many other families are selling their steers. See the demand for steers in the graph below. A family can buy one steer or buy one bond. Therefore, the number of steers is the number of families that decided to buy a steer. If a family holds the $70 in cash, the family will earn nothing. Each family has $70. If a family buys a bond today for $70, they will receive $90 in one year. A family can only earn income from raising & selling steers or from buying and holding bonds. Hint: complete the table first. How many families will want to buy a…arrow_forwardScenario 10-1 The demand curve for gasoline slopes downward and the supply curve for gasoline slopes upward. The production of the 1,000th gallon of gasoline entails the following: a private cost of $3.10 • a social cost of $3-55 a value to consumers of $3.70 Refer to Scenario 10-1. Suppose the equilibrium quantity of gasoline is 1,150 gallons; that is, QMARKET = 1,150. Then the equilibrium price of a gallon could be a. $3.30. b. $3.80. c. $3.00. d. $2.80.arrow_forward

- One of the problems of allowing goods and services to be distributed solely by the market is that income is unequally distributed, especially here in the US. Why would the market produce an inadequate level of some goods and services, which society might view as critical for peoples’ well being, while at the same time, use a significant quantity of resources to produce goods and services that contributed little to society’s overall well being? Your answer should contain at least two examples of goods and services that are critical and inadequately produced and two examples of goods and services that are largely wasteful and overproduced (4 examples in total). Remember your answer should revolve around the distribution of income, and should be focused only on the United States.arrow_forwardSuppose there are only two consumers in the market for a public good. The figure to the right shows marginal benefit lines for a public good for the two individuals, Andrew (A) and Brenda (B). Use the line drawing tool to draw and label the social marginal benefit line. Make sure that the line extends from quantity level 0 to 10 as the private marginal benefit lines do. Carefully follow the instructions above, and only draw the required object. Marginal Benefit, Marginal Cost ($) 20- 18- 16- 14- có + 2- 0- -O 0 1 MC 2 3 4 5 6 7 8 9 Quantity of a Public Good MBA MBB 10 11 12 Qarrow_forwardonly typed solutionarrow_forward

- Consider the market illustrated in the figure to the right. Supply curve S₁ represents the private cost of production and demand curve D₁ represents the private benefit from consumption. Suppose consumption of this good creates a positive externality. Show how the externality affects the market. 1.) Use the line drawing tool to draw either a new supply (S₂) or demand (D₂) curve incorporating the positive externality in consumption. Properly label this line. 2.) Use the point drawing tool to indicate the market equilibrium price and quantity. Label this point 'Market equilibrium'. 3.) Use the point drawing tool to indicate the efficient equilibrium price and quantity. Label this point 'Efficient equilibrium'. Carefully follow the instructions above, and only draw the required objects. Price Quantity S₁ D₁ Narrow_forwardThere are two consumers of mosquito abatement (a public good), Dave and Lilly. Dave’s benefit from mosquito abatement is given by ??? = 100 − ?, where Q is the quantity of mosquito abatement. Lilly’s benefit is given by ??? = 60 − ?.a. Calculate the total marginal benefit, ???.b. Suppose that mosquito abatement can be provided at a marginal cost of ?? = 2?. Find the socially optimal level of abatement. c. If mosquito abatement is privately supplied, what quantity will be supplied by Dave, and what quantity will be supplied by Lilly? Briefly explain.arrow_forwardSuppose a new social service is introduced by a government at a fixed cost of $3,000 (note: there is no marginal cost to provide this service). This service has not been provided before and there is no available substitute for this service. Economists have estimated the marginal benefit of the new service is given by: MB = 100 – Q where Q is the quantity (in hours) of the service that is used. Please note the MB gives both the marginal private benefit (MPB) and marginal social benefit (MSB) (i.e., MB = MPB = MSB). The government imposes a price to ration use of the service to recover part of its costs. What price should be introduced to ration the use of the service to 50 hours? What is the net social benefit when the service charge is used? How does charging a price compare to providing it for free and/or rationing? Be Hint(s): similarly, think about measuring the area of consumer surplus and compare it to the governments cost. You may want to complete Q5 as you complete this…arrow_forward

- There are three individuals in society, named A, B and C. The individuals' inverse demand curves for a public good are PA = 20 - 3Q, PB = 35 - 5Q and PC = 45 - Q, and the social marginal cost curve for the public good is given by SMC = Q. What is the optimal amount of the public good? a) 1 b) 9 c) answer 10 d) 100 , show me the method.arrow_forward1. During the winter break, Sam decides to go for a skiing vacation in Aspen instead of taking piano lessons. The opportunity cost of the skiing vacation is the:cost of accommodation and food in Aspen.value of piano lessons.cost of buying a piano.amount paid to the skiing instructor. 2. Which of the following is an example of a negative externality?Smith reducing the consumption of imported wine following an increase in the price of imported winePhoebe refusing to contribute to the building of a children’s park in her neighborhoodChristina accepting a payment in cash rather than in check for her laundry servicesTom playing music loudly in his room, disturbing his roommate who has an exam the next day3. A perfectly competitive firm sells 10 units of Good X at a price of $2 per unit. It incurs a fixed cost of $5 and a variable cost of $40 to produce the good. Which of the following is true?The firm should operate in the short run but shut down in the long run.The marginal cost…arrow_forwardAssume D1 reflects private benefits from consumption and assume S1 reflects private costs of production. If we begin with demand curve D1 and supply curve S1 in the figure above and external costs are incorporated into this market, then Group of answer choices government should subsidize its production and shift supply from S1 to S2. the vertical distance between S1 and S2 equals external costs. price will increase from P1 to P4. underproduction equals Q3 minus Q1. price will rise from P1 to P3.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education