ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

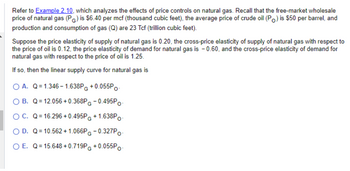

Transcribed Image Text:Refer to Example 2.10, which analyzes the effects of price controls on natural gas. Recall that the free-market wholesale

price of natural gas (PG) is $6.40 per mcf (thousand cubic feet), the average price of crude oil (Po) is $50 per barrel, and

production and consumption of gas (Q) are 23 Tcf (trillion cubic feet).

Suppose the price elasticity of supply of natural gas is 0.20, the cross-price elasticity of supply of natural gas with respect to

the price of oil is 0.12, the price elasticity of demand for natural gas is -0.60, and the cross-price elasticity of demand for

natural gas with respect to the price of oil is 1.25.

If so, then the linear supply curve for natural gas is

OA. Q=1.346-1.638PG +0.055PO

B. Q=12.056+0.368PG -0.495PO-

O C. Q=16.296 +0.495P + 1.638Po

O D. Q=10.562 +1.066PG-0.327Po

O E. Q=15.648+0.719P+0.055Po

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Hand written solutions are strictly prohibitedarrow_forwardSuppose the demand and supply for Xbox-One are: Qd = 500 - 2P, Qs = -100 + 4P . Assume that consumers demand 75 less Xbox units at each price. Also, a new tax has been imposed on foreign microchips, increasing the costs of production, and reducing supply by 35 units at each price Given this information find: a. CS0 = $ b. CS2 = $ c. PS2 = $arrow_forwardConsider a hypothetical market for copper (q), where q is measured in 1000 tons. Suppose the supply of virgin copper is Sv = 10+5q. Suppose that the supply for recycled copper is Sr = 15+2.5q. Demand for copper is P = 65 - 1.5q. Note, buyers don't distinguish between recycled and virgin copper. The equilibrium price and output for copper is (hint: draw a graph) q=8.46, p = $52.31. q=0, p = $65. q=12.50, p = $46.25. O q=4.44, p = $58.33.arrow_forward

- Please provide steps by step answer with proper explanation with final answerarrow_forwardSuppose the demand curve for a product is given by: Q=300-2P+41, where I is average income measured in thousands of dollars. The supply curve is: Q=3P-150. If 1=25, find the market-clearing price and quantity for the product. The market-clearing price is $ and the market-clearing quantity is (Enter your response as an integer.) CILE Price 260- 240- 220- 200 180- 160- 140- 120- 100- 80 60- 40- 20- 0- 0 100 200 300 Quantity O 400 5arrow_forwardI need help working through this problemarrow_forward

- I) The demand for petroleum is given by QD=85 − 0.4? where Q Dis the quantity demanded in thousands of barrels per day and P is the price per barrel in dollars. The supply of petroleum is given by QS=55+0.6?. Calculate the equilibrium price and quantity in this market. II) In the context of the problem in part (i), calculate the demand and supply for petroleum if the market price is $15 per barrel. What problem exists in the economy?arrow_forwardThe short-run demand and supply elasticities for crude oil are -0.076 and 0.088, respectively. The current price per barrel is $30 and the short-run equilibrium quantity is 23.84 million barrels per year. What will be the effects on the market price and quantity if the government decides to purchase (and store away) an additional 2 million barrels of oil? Assume that the additional consumption of oil by the government results in a parallel shift of the supply curve to the left by 2 million barrels per day What could be the economic rationale for buying and storing oil?arrow_forwardThe United Kingdom had a drinking problem. British per capita consumption of alcohol rose 19% between 1980 and 2007, compared with a 13% decline in other developed countries. Worried about excessive drinking among young people, the British government increased the tax on beer by 42% from 2008 to 2012. Under what conditions will this specific tax substantially reduce the equilibrium quantity of alcohol? Answer in terms of the elasticities of the demand and supply curves.arrow_forward

- Consider the market for sweet cherries in the Yakima Valley in Washington. The following are the equations of the supply and demand curves for sweet cherries in the Yakima Valley: Pd=452-Qd or Qd-452-Pd Ps=(1/450) * Qs+1 or Qs=450 * Ps-450=450 * (Ps-1) In these equations, P is the Price/lb of sweet cherries in the Yakima Valley, and Qd and Qs are the quantity demanded and the quantity supplied of cherries in milliion lbs per year. a) complete the table to find the Qd, Qs b) what are the equilibrium P and Q of cherries? c) Suppose that the P of sour cherries, a substitute of the sweet cherries, decreases. As a result the D curve for sweet cherries shifts, and the new D curve is given by the following equation: P=361.8-Qd or Qd-361.8-P Fill the Qd_d column of the table with your answers.arrow_forwardThe research department of the Corn Flakes Corporation (CFC) estimated the demand of the corn flakes it sells:Qx =2.0 -4.0Px +3.0I +1.6Py -6.0Pm +2.0A Where Qx =Sales of CFC cornflakes, in millions of 10-ounce boxes per year; Px= the price of CFC cornflakes, in dollars per 10-once box; I= personal disposable income in millions of dollars per year; Py= price of competitive brand of cornflakes, in dollars per 10-once box; Pm= price of milk in dollars per quart; and A= advertising expenditures in thousands of dollars per year. Given: Px = $4, I=$8, Py= $5.00, Pm= $2, and A= $4 a. Find the Qx of CFC cornflakes at the given values of the determinants of demand for cornflakes. b. What is the price elasticity of demand for cornflakes? Is the demand for cornflakes price elastic, or inelastic? Should management increase, or lower if it desires to increase the operating revenue? c. What is income elasticity of demand for cornflakes? Is the demand for cornflakes income elastic, or inelastic?…arrow_forwardThe following estimates have been obtained for the market demand for cereal In Q= 9.01- 0.68 In P+0.75In A-1.3M, where Q is the quantity of cereal,P is the price of cereal,A is the level of adverstising, and M is income. Based on this information,determine the effect on the consumption of cereal of : a: A 5 percent reduction in the price of cereal. b: A 4 percent increase in income. c: A 20 percent reduction in cereal advertising.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education