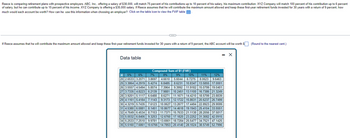

Reece is comparing retirement plans with prospective employers. ABC, Inc., offering a salary of $38000, will match 75 percent of his contributions up to 10 percent of his salary, his maximum contribution. XYZ Company will match 100 percent of his contribution up to 6 percent of salary, but he can contribute up to 15 percent of his income. XYZ Company is offering a $35000 salary. If Reece assumes that he will contribute the maximum amount allowed and keep these first-year retirement funds invested for 30 years with a return of 9 percent, how much would each account be worth? How can he use this information when choosing an employer?

Reece assumes that he will contribute the maximum amount allowed and keep these first-year retirement funds invested for 30 years with a return of 9 percent, the ABC account will be worth $? (Round to the nearest cent.)

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Amy Parker, a 22-year-old and newly hired marine biologist, has opened a 401(k) retirement plan with her employer. Amy's contribution, plus that of her employer, amounts to $2,400 per year starting at age 23. Amy expects this amount to increase by 4% each year until she retires at the age of 57 (there will be 35 EOY payments). What is the compounded future value of Amy's 401(k) plan, in millions of $, if it earns an annual interest rate of 7% per year? (a) The compounded future value of Amy's 401(k) plan is $ million. (Round to three decimal places.) (b) What will be the compounded future value if the plan earns an annual interest rate of 4% per year (instead of 7% per year)? $ million. (Round to three decimal places.)arrow_forwardLastly, Hector wants to invest in a certificate of deposit (CD) to purchase a boat that costs $28,500 when he retires. Leaf Investments offers a CD with 13% compounded semiannually. How much would Hector have to put in the CD today to gain $28,500 in 30 years?arrow_forwardFord Motor Company is considering an early retirement buyout package for some employees. The package involves paying out today's fair value of the employee's final year of salary. Shelby is due to retire in one year. Her salary is at the company maximum of $72,000. If prevailing interest rates are 6.75% compounded monthly, what buyout amount should Ford offer to Shelby todayarrow_forward

- John is trying to decide whether to contribute to a Roth IRA or a traditional IRA. He plans on making a $5,000 contribution to whichever plan he decides to fund. He currently pays tax at a 32 percent marginal income tax rate, but he believes that his marginal tax rate in the future will be 28 percent. He intends to leave the money in the Roth IRA or traditional IRA for 30 years, and he expects to earn a 6 percent before-tax rate of return on the account. (Use Table 1.) Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. Problem 13-78 Part b (Static) b. How much will John accumulate after taxes if he contributes to a traditional IRA (consider only the funds contributed to the traditional IRA)?arrow_forwardYour client, Karna, has asked you for some advice. He would like to know how much he can contribute to his RRSP in the current year without over contributing. Karna has a carry forward amount of $16,000 and a pension adjustment of $6,000 from the previous year. In addition Karna has been divorced for the past three years and pays $2,500 per month in alimony. Given this scenario and based on the financial information below, how much can Karna contribute this year? Base Salary Commission Bonus Investment Portfolio Capital Gains Dividends $5,000 $6,000 Total taxable income $136,000 Select one: Current Year Previous Year $85,000 $80,000 $25,000 $30,000 $15,000 $18,000 a. $29,080 b. $27,100 c. $27,640 d. $29,260 $4,000 $5,000 $137,000arrow_forward"As of today, Americans live on average 20 more years after retiring, which calls for well-designed retirement plans. There are different ways to save for retirement, such as retirement plans offered by the employer, savings and investments, and Social Security among other. " (Norrestad, 2021) Lifetime Savings Accounts, known as LSAS, would allow people to invest after-tax money without being taxed on any gains. If an engineer invests $10,000 now and $10,000 each year for the next 15 years, how much will be in the account immediately after the last deposit if the account grows by 8% per year? All the alternatives resented below were calculated using compound interest factor tables including all decimal places. O $271,521 O $303,243 $427,533 $359,497arrow_forward

- Joy is nearing retirement and is considering buying an annuity product from Wagon Financial. However, she is considering adding a clause that says she will only receive the annual $80,000 payment if she is alive at the time of the payment (up to a maximum of 20 payments). Other than this clause, the specifications for the annuity she is considering are exactly the same as described above. Should Joy expect the price for this product to be cheaper or more expensive by adding this clause?arrow_forwardJoe wants to own a home in the future. He asks you describe an advantages and disadvantage of a FRM versus an ARM. He then asks you to describe the advantages and disadvantages of a 15-year loan versus a 30-year loan. He also wants to know how the portion of the home payment that comprises interest changes over the years assuming he takes out an FRM. Is there anything he can do to reduce the total amount he’ll pay for the home? What else would be added to his monthly mortgage payment? What are three benefits of home ownership? What are three benefits of renting?arrow_forwardRobin Hood is 23 years old and has accumulated $4,000 in her self-directed defined contribution pension plan. Each year she contributes $2,000 to the plan, and her employer contributes an equal amount. Robin thinks she will retire at age 67 and figures she will live to age 81. The plan allows for two types of investments. One offers a 3.5% risk-free real rate of return. The other offers an expected return of 10% and has a standard deviation of 23%. Robin now has 5% of her money in the risk-free investment and 95% in the risky investment. She plans to continue saving at the same rate and keep the same proportions invested in each of the investments. Her salary will grow at the same rate as inflation. What is the expected value of Robin's risky assets at retirement?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education