EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Financial accounting question

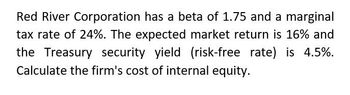

Transcribed Image Text:Red River Corporation has a beta of 1.75 and a marginal

tax rate of 24%. The expected market return is 16% and

the Treasury security yield (risk-free rate) is 4.5%.

Calculate the firm's cost of internal equity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The current risk-free rate of return is 4.67%, while the market risk premium is 6.63%. The D'Amico Company has a beta of 0.78. Using the Capital Asset Pricing Model (CAPM) approach, D'Amico's cost of equity is: a. 8.86%. b. 10.82%. C. 10.33%. d. 9.84%.arrow_forwardThe current risk-free rate of return is 4.2%. The market risk premium is 6.6%. Allen Co. has a beta of 0.87. Using the Capital Asset Pricing Model (CAPM) approach, Allen's cost of equity isarrow_forwardThe risk free rate currently have a return of 2.5% and the market risk premium is 4.22%. If a firm has a beta of 1.42, what is its cost of equity?arrow_forward

- Assume that the Collins Company has a beta of 1.8 and that the risk-free rate of return is 2.5 percent. If the equity-risk premium is six percent, calculate the cost of equity for the Collins Company using the capital asset pricing model.arrow_forwardThe estimated beta (β) of a firm is 1.7. The market return (rm) is 14 %, and the risk-free rate (rf) is 7%. Estimate the cost of equity (ie).arrow_forwardVargo, Inc., has a beta estimated by Value Line of 1.3. The current risk-free rate (long-term) is 3.5 percent and the market risk premium is 6.4 percent. What is the cost of common equity for Vargo?arrow_forward

- The current risk-free rate of return is 4.6%. The market risk premium is 6.6%. D'Amico Co. has a beta of 1.56. Using the Capital Asset Pricing Model (CAPM) approach, D'Amico's cost of equity is ... .··. ··· .... .··. .··...arrow_forwardYour estimate of the market risk premium is 6%. The risk-free rate of return is 4% and General Motors has a beta of 1.4. What is General Motors' cost of equity capital? A. 13.0% B. 12.4% C. 11.8% D. 11.2%arrow_forwardThe cost of equity using the CAPM approach The current risk-free rate of return (rRF) is 3.86%, while the market risk premium is 6.63%. the Monroe Company has a beta of 0.92. Using the Capital Asset Pricing Model (CAPM) approach, Monroe's cost of equity isarrow_forward

- The company has a beta of 0.85. If the risk- free rate is 3.4% and the market premium is 8.5%, what is the company's cost of equity?arrow_forwardYour estimate of the market risk premium is 8%. The risk−free rate of return is 3.1% and General Motors has a beta of 1.5. According to the Capital Asset Pricing Model (CAPM), what is its expected return?arrow_forwardDraftKings Inc (DKNG) has a capital structure of 29% debt and 71% equity. The expected return on the market is 7.65%, and the risk-free rate is 2.41%. What discount rate should an analyst use to calculate the NPV of a project with an equity beta of 1.22 if the firm’s after-tax cost of debt is 4.26%? A. 3.15% B. 5.18% C. 7.49% D. 9.01%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT