College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

1.Please Complete Solution With Details

2.Final Answer Clearly Mentioned

3.Do not give solution in image format

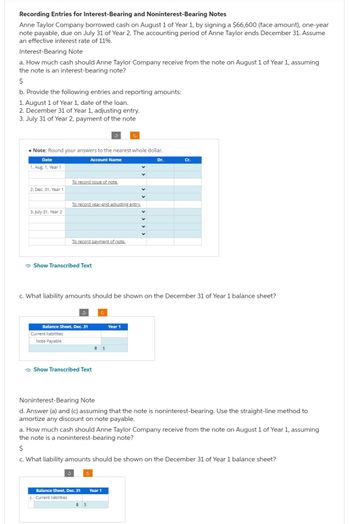

Transcribed Image Text:Recording Entries for Interest-Bearing and Noninterest-Bearing Notes

Anne Taylor Company borrowed cash on August 1 of Year 1, by signing a $66,600 (face amount), one-year

note payable, due on July 31 of Year 2. The accounting period of Anne Taylor ends December 31. Assume

an effective interest rate of 11%.

Interest-Bearing Note

a. How much cash should Anne Taylor Company receive from the note on August 1 of Year 1, assuming

the note is an interest-bearing note?

$

b. Provide the following entries and reporting amounts:

1. August 1 of Year 1, date of the loan.

2. December 31 of Year 1, adjusting entry.

3. July 31 of Year 2, payment of the note

• Note: Round your ans

Date

1. Aug. 1, Year 1

2. Dec. 31, Year 1

3. July 31, Year 2

Current liabilities

Note Payable

To record issue of note.

Show Transcribed Text

to the nearest whole dollar.

Account Name

To record year-end adjusting entry.

Balance Sheet, Dec. 31

To record payment of note.

3

c. What liability amounts should be shown on the December 31 of Year 1 balance sheet?

Show Transcribed Text

c. Current liabilities

→ $

Balance Sheet, Dec. 31 Year 1

÷ $

Dr.

Year 1

Noninterest-Bearing Note

d. Answer (a) and (c) assuming that the note is noninterest-bearing. Use the straight-line method to

amortize any discount on note pay

Cr.

a. How much cash should Anne Taylor Company receive from the note on August 1 of Year 1, assuming

the note is a noninterest-bearing note?

$

c. What liability amounts should be shown on the December 31 of Year 1 balance sheet?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company collects an honored note with a maturity date of 24 months from establishment, a 10% interest rate, and an initial loan amount of $30,000. Which accounts are used to record collection of the honored note at maturity date? A. Interest Revenue, Interest Expense, Cash B. Interest Receivable, Cash, Notes Receivable C. Interest Revenue, Interest Receivable, Cash, Notes Receivable D. Notes Receivable, Interest Revenue, Cash, Interest Expensearrow_forwardNotes Receivable Transactions The following notes receivable transactions occurred for Harris Company during the last three months of the current year. (Assume all notes are dated the day the transaction occurred.) Required: 1. Prepare the journal entries to record the preceding note transactions and the necessary adjusting entries on December 31. (Assume that Harris does not normally sell its notes and uses a 360-day year for the purpose of computing interest. Round all calculations to the nearest penny.) 2. Show how Harris notes receivable would be disclosed on the December 31 balance sheet. (Assume these are the only note transactions encountered by Harris during the year.)arrow_forwardJOURNAL ENTRIES (NOTE ISSUED FOR BANK LOAN) Prepare general journal entries for the following transactions: Sept. 15 Borrowed 7,000 cash from the bank, giving a 60-day non- interest- bearing note. The note is discounted 8 % by the bank. Nov. 14 Paid the 7,000 note, recognizing the discount as interest expense.arrow_forward

- JOURNAL ENTRIES (NOTE ISSUED FOR BANK LOAN) Prepare general journal entries for the following transactions: July15 Borrowed 5,000 cash from the bank, giving a 60-day non- interest-bearing note. The note is discounted 8% by the bank. Sept.13 Paid the 5,000 note, recognizing the discount as interest expense.arrow_forwardNotes Receivable On September 1, 2016, Dougherty Corp. accepted a six-month, 7%, $45,000 interest-bearing note from Rozelle Company in payment of an account receivable. Doughertys year-end is December 31. Rozelle paid the note and interest on the due date. Required Who is the maker and who is the payee of the note? What is the maturity date of the note? Prepare all necessary journal entries that Dougherty needs to make in connection with this note.arrow_forwardEntries for installment note transactions On January 1, 20Y2, Hebron Company issued a 175,000, five-year, 8% installment note to Ventsam Bank. The note requires annual payments of 43,830, beginning on December 31, 20Y2. Journalize the entries to record the following:arrow_forward

- Non-Interest-Bearing Notes Payable On November 16, 2019, Clear Glass Company borrowed 20,000 from First American Bank by issuing a 90-day, non-interest-bearing note. The bank discounted this note at 12% and remitted the difference to Clear Glass. Required: 1. Prepare the journal entries of Clear Glass to record the preceding information, the related calendar year-end adjusting entry, and payment of the note at maturity. 2. Show how the preceding items Would be reported on the December 31, 2019, balance sheet. 3. Next Level What is Clear Glass Companys effective interest rate?arrow_forwardRecording the Sale of Notes Receivable Singer Corporation was involved in the following events in the current year: Required: Prepare the journal entries to record the preceding information on Singers accounting records. Assume that the company does not normally sell its notes. (Assume a 360-day year and round all answers to the nearest penny.)arrow_forwardComprehensive Receivables Problem Blackmon Corporations December 31, 2018, balance sheet disclosed the following information relating to its receivables: The company has a recourse liability of 700 related to a note receivable sold to a bank. During 2019, credit sales (terms, n/EOM) totaled 2,200,000, and collections on accounts receivable (unassigned) amounted to 1,900,000. Uncollectible accounts totaling 18,000 from several customers were written off, and a 1,350 accounts receivable previously written off was collected. Additionally, the following transactions relating to Blackmons receivables occurred during the year: On December 31, 2019, an aging of the accounts receivable balance indicated the following: Required: 1. Prepare the journal entries to record the preceding receivable transactions during 2019 and the necessary adjusting entry on December 31, 2019. Assume a 360-day year for interest calculations and round calculations to the nearest dollar. 2. Prepare the receivables portion of Blackmons December 31, 2019, balance sheet. 3. Next Level Compute Blackmons accounts receivable turnover in days, assuming a 360-day business year. What is your evaluation of its collection policies? 4. If Blackmon uses IFRS, what might be the heading of the section for the receivables reported in Requirement 2?arrow_forward

- On June 1, Phillips Corporation sold, with recourse, a note receivable from a customer to a bank. The note has a face value of 15,000 and a maturity value (principal plus interest) of 15,400. The discount is calculated to be 385, and the accrued interest income is 100. The recourse liability is estimated to be 1,000. Prepare the journal entry of Phillips to record the sale of the note receivable.arrow_forwardRecording Entries for Interest-Bearing and Noninterest-Bearing Notes Anne Taylor Company borrowed cash on August 1, 2020, and signed a $83,250 (face amount), one-year note payable, due on July 31, 2021. The accounting period of Anne Taylor ends December 31. Assume an effective interest rate of 11%. Interest-Bearing Note Noninterest-Bearing Note a. How much cash should Anne Taylor Company receive on the note, assuming the note is an interest-bearing note? Answer b. Provide the following entries: August 1, 2020, date of the loan. December 31, 2020, adjusting entry. July 31, 2021, payment of the note. Note: List multiple debits or credits (when applicable) in alphabetical order.Note: Round your answers to the nearest whole dollar. Date Account Name Dr. Cr. 1. Aug. 1, 2020 Answer Answer Answer Answer Answer Answer 2. Dec. 31, 2020 Answer Answer Answer Answer Answer Answer 3. July 31, 2021 Answer Answer Answer Answer Answer Answer…arrow_forwardEntries for notes payable A business issued a 120-day, 5% note for $100,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360 days in a year. If an amount box does not require an entry, leave it blank. If required, round yours answers to whole dollar. a. Accounts Payable Notes Payable b. Notes Payable Interest Expense Cash 100,000 100,000 100,000 Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage