FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

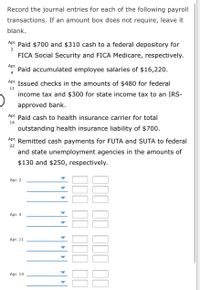

Transcribed Image Text:Record the journal entries for each of the following payroll

transactions. If an amount box does not require, leave it

blank.

Apr. Paid $700 and $310 cash to a federal depository for

2

FICA Social Security and FICA Medicare, respectively.

Apr.

Paid accumulated employee salaries of $16,220.

4

Apr. Issued checks in the amounts of $480 for federal

11

income tax and $300 for state income tax to an IRS-

approved bank.

Apr. Paid cash to health insurance carrier for total

14

outstanding health insurance liability of $700.

Apr.

Remitted cash payments for FUTA and SUTA to federal

22

and state unemployment agencies in the amounts of

$130 and $250, respectively.

Apr. 2

Apr. 4

Apr. 11

Apr. 14

III II 1II I1

1II II III II

Transcribed Image Text:Apr. 2

Apr. 4

Apr. 11

Apr. 14

Apr. 22

III II 1II I1 II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mr. P's bank statement dated 31.12.2021 showed a balance with his Bank of $924, when checked with his Cash Book the following were noted :(a) During December, the Bank had paid $200 for a yearly contribution of Mr. P made to a local charity, as per his standing order. This amount appeared in the Bank statement but not in the Cash Book.(b) The Bank had credited his account with $28 interest and had collected on his behalf `$230 as dividends. No corresponding entries were made in the Cash Book.(c) A cheque of $65 deposited into the Bank on 28.12.2021 was not cleared by the Bank till after 31.12.2021(d) A cheque of $150 deposited into and cleared by the Bank before 31.12.2021 was not entered in the Cash Book, through an oversight.(e) Cheques drawn by and posted to parties by Mr. White on 31.12.2021 for $73, $119 and $46 were presented for payment to the Bank only on 3.1.2021.arrow_forwardOn July 31, 2022, Carla Vista Co. had a cash balance per books of $6,335.00. The statement from Dakota State Bank on that date showed a balance of $7,885.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank service charge for July was $19.00. 2. The bank collected $1,715.00 from a customer for Carla Vista Co. through electronic funds transfer. 3. The July 31 receipts of $1,394.30 were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31. 4. Company check No. 2480 issued to L. Taylor, a creditor, for $374.00 that cleared the bank in July was incorrectly entered in the cash payments journal on July 10 for $347.00. 5. Checks outstanding on July 31 totaled $2,046.10. 6. On July 31, the bank statement showed an NSF charge of $770.00 for a check received by the company from W. Krueger, a customer, on account.…arrow_forwardThe LLYOD bank statement for the month of June shows that there is $13,300 difference with the cash balance per book. The difference occurs on the 12 of June as one of the customers’ outstanding check has been returned because of not sufficient fund. Record the required entries at the end of June.arrow_forward

- Assume that the employees are paid from the company's regular bank account check numbers 981 and 982 prepare the entry to record and pay the payroll in general journal from September 30th if required round amounts to the nearest cent if an amount does not require an entry leave it blank. College accounting 13th editionarrow_forwardKameron Gibson's bank statement showed a balance of $612.85. Kameron's checkbook had a balance of $215.20. Check Number 104 for $139.80 and check Number 105 for $19.55 were outstanding. A $799.30 deposit was not on the statement. He has his payroll check electronically deposited to his checking account-the payroll check was for $1,069.10. There was also a $10.80 teller fee and an $20.70 service charge. Prepare Kameron Gibson's bank reconciliation. Note: Input all amounts as positive values. Round your answers to 2 decimal places. Kameron's checkbook balance Add: Subtotal Deduct Subtotal Reconciled balance BANK RECONCILIATION Bank balance Add: Subtotal Deduct: + Reconciled balancearrow_forwardKameron Gibson's bank statement showed a balance of $1,020.35. Kameron's checkbook had a balance of $282.10. Check Number 104 for $150.70 and check Number 105 for $16.35 were outstanding. A $666.60 deposit was not on the statement. He has his payroll check electronically deposited to his checking account-the payroll check was for $1,260.90. There was also a $10.70 teller fee and an $12.40 service charge. Prepare Kameron Gibson's bank reconciliation. Note: Input all amounts as positive values. Round your answers to 2 decimal places. Kameron's checkbook balance Add: Subtotal Deduct: Subtotal Reconciled balance BANK RECONCILIATION Bank balance Add: Subtotal Deduct: Reconciled balancearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education