FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

ASSETS

110 Cash

121 Accounts Receivable -Empire Co.

122 Accounts Receivable-Equinox Co.

123 Accounts Receivable-Targhee Co.

124 Accounts Receivable-Vista Co.

125 Notes Receivable

130 Merchandise Inventory

131 Estimated Returns Inventory

140 Office Supplies

141 Store Supplies

142 Prepaid Insurance

180 Land

192 Store Equipment

193 Accumulated Depreciation -Store Equipment

194 Office Equipment

REVENUE

410 Sales

610 Interest Revenue

EXPENSES

510 Cost of Merchandise Sold

521 Delivery Expense

522 Advertising Expense

524 Depreciation Expense-Store Equipment

525 Depreciation Expense-Office Equipment

526 Salaries Expense

531 Rent Expense

533 Insurance Expense

534 Store Supplies Expense

535 Office Supplies Expense

536 Credit Card Expense

195 Accumulated Depreciation-Office Equipment

539 Miscellaneous Expense

710 Interest Expense

LIABILITIES

210 Accounts Payable

216 Salaries Payable

218 Sales Tax Payable

219 Customer Refunds Payable

221 Notes Payable

EQUITY

310 Owner, Capital

311 Owner, Drawing

Transcribed Image Text:**Instructions:**

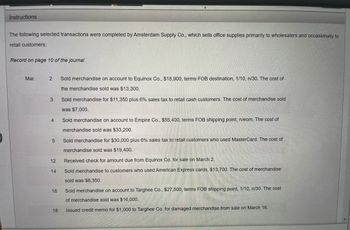

The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to wholesalers and occasionally to retail customers:

**Record on page 10 of the journal**

**March Transactions**

1. **March 2**: Sold merchandise on account to Equinox Co., $18,900, terms FOB destination, 1/10, n/30. The cost of the merchandise sold was $13,300.

2. **March 3**: Sold merchandise for $11,350 plus 6% sales tax to retail cash customers. The cost of merchandise sold was $7,000.

3. **March 4**: Sold merchandise on account to Empire Co., $55,400, terms FOB shipping point, n/eom. The cost of merchandise sold was $33,200.

4. **March 5**: Sold merchandise for $30,000 plus 6% sales tax to retail customers who used MasterCard. The cost of merchandise sold was $19,400.

5. **March 12**: Received check for amount due from Equinox Co. for sale on March 2.

6. **March 14**: Sold merchandise to customers who used American Express cards, $13,700. The cost of merchandise sold was $8,350.

7. **March 16**: Sold merchandise on account to Targhee Co., $27,500, terms FOB shipping point, 1/10, n/30. The cost of merchandise sold was $16,000.

8. **March 18**: Issued credit memo for $1,000 to Targhee Co. for damaged merchandise from sale on March 16.

This information will help you understand the recording of sales transactions for a company that deals in both wholesale and retail sales. Note the varying terms and conditions associated with each transaction, such as payment terms and shipping terms, which can significantly affect the accounting records and cash flow.

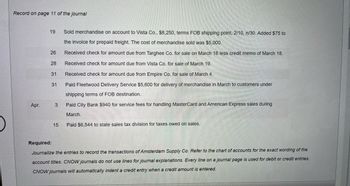

Transcribed Image Text:### Journal Entries for Amsterdam Supply Co. (Page 11 of the Journal)

#### March 19

- **Transaction**: Sold merchandise on account to Vista Co.

- **Details**: $8,250; terms FOB shipping point, 2/10, n/30. Added $75 to the invoice for prepaid freight.

- **Cost of Merchandise Sold**: $5,000.

#### March 26

- **Transaction**: Received check for the amount due from Targhee Co. for sale on March 16.

- **Details**: Less credit memo of March 18.

#### March 28

- **Transaction**: Received check for the amount due from Vista Co. for sale on March 19.

#### March 31

- **Transaction**: Received check for the amount due from Empire Co. for sale on March 4.

#### March 31

- **Transaction**: Paid Fleetwood Delivery Service for the delivery of merchandise in March to customers under shipping terms of FOB destination.

- **Details**: $5,600.

#### April 3

- **Transaction**: Paid City Bank for service fees for handling MasterCard and American Express sales during March.

- **Details**: $940.

#### April 15

- **Transaction**: Paid state sales tax division for taxes owed on sales.

- **Details**: $6,544.

### Required

- **Task**: Journalize the entries to record the transactions of Amsterdam Supply Co. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.

---

#### Explanation of Terms:

- **FOB Shipping Point**: The buyer takes responsibility for the goods once they are shipped.

- **2/10, n/30**: A common credit term that means a 2% discount is available if payment is made within 10 days; otherwise, the net amount is due within 30 days.

Journal entries should correctly reflect these transactions based on whether they are credit or debit entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- No. Accounts Title & Explanation Debit Credit 1 Prepaid Insurance 5,400 Cash 5,400 2 Uniform Inventory 146,000 Accounts Payable 146,000 3e Account Receivable 193,800 Sales Revenue 193,800 (To record the sale of goods) 3b Cost of Good Sold 100,000 Inventory 100,000 (To record the cost) 4 Cash 134,625 Accounts Receivable 403,875 Service Revenue 538,500 5 Accounts Payable 137,100 Cash 137,100 6 Cash 246,000 Accounts Receivable 246,000 7 Advertising Expense 13,700 Cash 13,700 8 Interest expense 10,500 Bank Loan Payable 30,000 Cash 40,500 9 Cash 3,000 Dividend Revenue 3,000 10 Utility Expense 16,600 Cash 16,600 11 Dividends Declared 14,400 Cash 14,400 12s Wages Expense 94,000 Wage Payable 8,000 Cash 102,000 (To record accrued wages) 12b Wages Expense 2000 Wage Payable 2000 13 Depreciation Expense 30,000 Accumulated Depreciation Equipment 30,000 14 Insurance expense 1,800 Prepaid Insurance 1,800 Enter the beginninin belances from 2023, post the 2024 journal entries and determine the ending…arrow_forwardDon't upload imagearrow_forwardAccounts payable 919 Accounts receivable 631 Accumulated depreciation 1,813 Cash 729 Common stock 1,387 Cost of goods sold 7,578 Current portion of long-term debt 24 Depreciation expense 108 Dividends 13 Goodwill and other long-term assets 2,627 Income tax expense 24 Income taxes payable 12 Interest expense 54 Interest revenue 11 Inventories 930 Long-term liabilities 1,585 Prepaid expenses and other current assets 65 Property and equipment 2,389 Retained earnings 825 Sales 9,710 Selling, general, and administrative expenses 2,276 Unearned revenue 990 Wages payable 148 Prepare the balance sheet.arrow_forward

- Ergonomics Supply Inc., a wholesaler of office products, was organized on July 1 of the current year, with an authorization of 27,000 shares of preferred 2% stock, $100 par, and 600,000 shares of $10 par common stock. The following selected transactions were completed during the first year of operations: July 1. Issued 213,000 shares of common stock at par for cash. 1. Issued 400 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. Aug. Issued 69,400 shares of common stock in exchange for land, buildings, and equipment with fair market 7. prices of $149,100, S505,120 and $164,700 respectively. Sept. 20. Issued 17,600 shares of preferred stock at $105 for cash. Required: Journalize the transactions. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a…arrow_forwardCHART OF ACCOUNTS 101 Cash 401 Service Revenue 211 Notes Payable 212 Accounts Payable 451 Rent Revenue 111 Notes Receivable 214 Interest Payable 491 Interest Revenue 112 Accounts Receivable 114 Interest Receivable 216 Wages Payable 511 Depreciation Expense 125 Supplies 261 Unearned Revenue 513 Insurance Expense 130 Prepaid Insurance 311 Common Stock 515 Rent Expense 320 Retained Earnings 517 Wages Expense 519 Supplies Expense 132 Prepaid Rent 161 Equipment 162 Accumulated Depreciation 591 Interest Expense Corporation purchased equipment on July 1 and gave an 18-month, 10% interest-bearing note with a face value of $45,000. Depreciation will be for 10 years using the straight-line method. The December 31 depreciation adjusting entry would be: Date Enter Account Number Debit Credit XX/XX/XX Would this adjusting entry be reversed? (Y for Yes or N for No)arrow_forwardCHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 114 Interest Receivable 115 Notes Receivable 116 Merchandise Inventory 117 Supplies 119 Prepaid Insurance 120 Land 123 Delivery Truck 124 Accumulated Depreciation-Delivery Truck 125 Equipment 126 Accumulated Depreciation-Equipment 130 Mineral Rights 131 Accumulated Depletion 132 Goodwill 133 Patents LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends REVENUE 410 Sales 610 Interest Revenue 620 Gain on Sale of Delivery Truck 621 Gain on Sale of Equipment EXPENSES 510 Cost of Merchandise Sold 520 Salaries Expense 521 Advertising Expense 522 Depreciation Expense-Delivery Truck 523 Delivery Expense 524 Repairs and Maintenance Expense 529 Selling…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education