FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

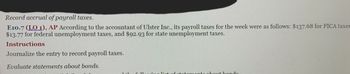

Transcribed Image Text:Record accrual of payroll taxes.

E10.7 (LO 1), AP According to the accountant of Ulster Inc., its payroll taxes for the week were as follows: $137.68 for FICA taxes, $13.77 for federal unemployment taxes, and $92.93 for state unemployment taxes.

Instructions

- Journalize the entry to record payroll taxes.

Evaluate statements about bonds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. a) the amt of interest pd in cash every payment period, 1. b) the amt of amorization to be recorded at each interest payment date.(use the straight -line methodarrow_forwardAssuming a 360-day year, proceeds of $47,444 were received from discounting a $48,147, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was a. 7.59% Ob. 7.08% Oc. 5.84% Od. 3.84%arrow_forwardam. 107.arrow_forward

- Walmart Inc (WMT) has the following excerpts from their financial statements January 31, 2022 January 31, 2021 Net Receivables * (in $ Millions) 8,280 6,516 *Net Receivable = Gross receivable minus Allowance Walmart’s fiscal year “FY22” is defined as the period between February 1, 2021 – January 31, 2022 Gross (Accounts) Receivables, January 31, 2022: $9,265 Million Gross Receivables, January 31, 2021: $7,421 Million Accounts Written-off in FY 22 $221 Million 2% of credit sales is assumed to be uncollectable CALCULATE The ending balance of Allowance for uncollectable accounts as of January 31, 2022 Bad Debt Expense for the fiscal year ending on January 31, 2022. Collections during FY22arrow_forwardAssuming a 360-day year, the interest charged by the bank, at the rate of 6%, on a 90-day, discounted note payable of $106,407 isarrow_forwardAssuming a 360-day year, proceeds of $43,722 were received from discounting a $44,958, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was O a. 12.24% b. 11.00% c. 9% Od. 12.75%arrow_forward

- I need help figuring out the Interest Expense and Discount on Bonds Payable amounts for June 30. Attached are the instructions and results I have so far. I believe the answer to the June 30 will be Interest Expense = $1,494,934 and Discount on Bonds = $94,934 but I'm not sure how to get the figures. Can you please help?arrow_forwardOn June 1, Taci Company lent $86,200 to L. Kaler on a 90-day, 2% note. 12. Journalize for Taci Company the lending of the money on June 1. 13. Journalize the collection of the principal and interest at maturity. Specify the date. Round interest to the nearest dollar. 12. Journalize for Taci Company the lending of the money on June 1. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table. For notes stated in days, use a 365-day year.) Accounts and Explanation Date Jun. 1 Debit Creditarrow_forwardAssuming a 360-day year, proceeds of $45,552 were received from discounting a $46,830, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was а. 12.16% b. 12.67% C. 8.92% Od. 10.92%arrow_forward

- abardeen corporation borrowed 58,000 from the bank on october 1, year 1. The note had a 4 percent annual rate of interest and matured on march 31, year 2. interest and principal were paid in cash on the maturity date. a. what amount of cash did abardeen pay for interest in year 1? b. what amount of interest expense was recognized on the year 1 income statement? c. what amount of total liabilities was reported on december 31, year 1, balance sheet?arrow_forwardMedhurst Corporation issued $89,000 in bonds for $86,000. The bonds had a stated rate of 8% and pay interest quarterly. What is the journal entry to record the first interest payment? If an amount box does not require an entry, leave it blank.arrow_forwardPlease! help me with this questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education