FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

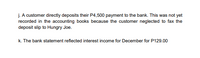

Transcribed Image Text:j. A customer directly deposits their P4,500 payment to the bank. This was not yet

recorded in the accounting books because the customer neglected to fax the

deposit slip to Hungry Joe.

k. The bank statement reflected interest income for December for P129.00

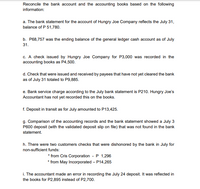

Transcribed Image Text:Reconcile the bank account and the accounting books based on the following

information:

a. The bank statement for the account of Hungry Joe Company reflects the July 31,

balance of P 51,780.

b. P68,757 was the ending balance of the general ledger cash account as of July

31.

c. A check issued by Hungry Joe Company for P3,000 was recorded in the

accounting books as P4,500.

d. Check that were issued and received by payees that have not yet cleared the bank

as of July 31 totaled to P9,885.

e. Bank service charge according to the July bank statement is P210. Hungry Joe's

Accountant has not yet recorded this on the books.

f. Deposit in transit as for July amounted to P13,425.

g. Comparison of the accounting records and the bank statement showed a July 3

P600 deposit (with the validated deposit slip on file) that was not found in the bank

statement.

h. There were two customers checks that were dishonored by the bank in July for

non-sufficient funds:

* from Cris Corporation - P 1,296

* from May Incorporated – P14,265

i. The accountant made an error in recording the July 24 deposit. It was reflected in

the books for P2,895 instead of P2,700.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the following information: The bank statement balance is $3,093. The cash account balance is $3,305. Outstanding checks amounted to $767. Deposits in transit are $815. The bank service charge is $155. A check for $40 for supplies was recorded as $31 in the ledger. Prepare a bank reconciliation for Miller Co. for August 31. Miller Co.Bank ReconciliationAugust 31 Cash balance according to bank statement $fill in the blank 1 Adjustments: $- Select - - Select - Total adjustments fill in the blank 6 Adjusted balance $fill in the blank 7 Cash balance according to company's records $fill in the blank 8 Adjustments: $- Select - - Select - Total adjustments fill in the blank 13 Adjusted balance $fill in the blank 14arrow_forwardhelp with working for eacharrow_forwardThe following data were accumulated for use in reconciling the bank account of Kaycee Sisters Inc. for August 20Y9: Cash balance according to the company's records at August 31, $16,840. Cash balance according to the bank statement at August 31, $17,570. Checks outstanding, $3,420. Deposit in transit, not recorded by bank, $2,740. A check for $340 in payment of an account was erroneously recorded by Kaycee Sisters Inc. as $430. Bank debit memo for service charges, $40. Prepare a bank reconciliation, using the format shown in Exhibit 12.arrow_forward

- Entries for Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Nakajima Co. for July: Cash balance according to the company's records at July 31, $25,010. Cash balance according to the bank statement at July 31, $26,060. Checks outstanding, $5,080. Deposit in transit, not recorded by bank, $4,080. A check for $340 issued in payment of an account was erroneously recorded in the check register as $430. Bank debit memo for service charges, $40. Journalize the entries that should be made by the company, part (a) Error and part (b) Service Charge. If an amount box does not require an entry, leave it blank. a. July 31 fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 b. July 31 fill in the blank 8 fill in the blank 9 fill in the blank 11 fill in the blank 12arrow_forwardEntries for Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Mathers Co. for July: Cash balance according to the company's records at July 31, $22,240. Cash balance according to the bank statement at July 31, $23,450. Checks outstanding, $4,510. Deposit in transit, not recorded by bank, $3,630. A check for $590 in payment of an account was erroneously recorded in the check register as $950. Bank debit memo for service charges, $30. Journalize the entries that should be made by the company, part (A) Error and part (B) Service Charge. a. July 31 b. July 31arrow_forwardThe following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $25,127 debit balance, but its July bank statement shows a $27,260 cash balance. b. Check Number 3031 for $1,420, Check Number 3065 for $486, and Check Number 3069 for $2,188 are outstanding checks as of July 31. c. Check Number 3056 for July rent expense was correctly written and drawn for $1,290 but was erroneously entered in the accounting records as $1,280. d. The July bank statement shows the bank collected $9,000 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $14 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification…arrow_forward

- The following data were accumulated for use in reconciling the bank account of Nakajima Co. for July: Cash balance according to the company's records at July 31, $49,910. Cash balance according to the bank statement at July 31, $48,250. Checks outstanding, $4,460. Deposit in transit, not recorded by bank, $6,450. A check for $590 issued in payment of an account was erroneously recorded in the check register as $950. Bank debit memo for service charges, $30. Question Content Area a. Prepare a bank reconciliation, using the format shown in Exhibit 12. Nakajima Co.Bank ReconciliationJuly 31 Cash balance according to bank statement $fill in the blank 8740c9ff3f91023_1 - Select - - Select - Adjusted balance $fill in the blank 8740c9ff3f91023_6 Cash balance according to company's records $fill in the blank 8740c9ff3f91023_7 - Select - - Select - Adjusted balance $fill in the blank 8740c9ff3f91023_12 Question Content Area b. If the…arrow_forwardanswer in text form please (without image)arrow_forwardThe following information has been extracted from the accounting records of the Simplicity Corporation: a. Cash on hand ( undeposited collections) P1,020 b. Certificates of deposit 25,000 c. Customer’s notes receivable 1,000 d. Reconciled balance in Uno Bank checking account (350) e. Reconciled balance in Trese Bank payroll account 9,350 f. Balance in Rural bank savings account 8,560 g. Customer’s postdated checks 1,350 h. Employee travel advances 1,600 i. Cash in bond sinking fund 1,200 j. Bond sinking fund investments 8,090 k. Postage stamps 430 Required:a. What is the adjusted cash balance?b. Discuss the treatment of the items not included as cash.arrow_forward

- Refer to the information given below: a. The August 31 balance shown on the bank statement is $9,050. b. There is a deposit in transit of $1,300 at August 31. c. Outstanding checks at August 31 totaled $1,620. d. Interest credited to the account during August but not recorded on the company's books amounted to $68. e. A bank charge of $44 for checks was made to the account during August. Although the company was expecting a charge, the amount was not known until the bank statement arrived. f. In the process of reviewing the canceled checks, it was determined that a check issued to a supplier in payment of accounts payable of $142 had been recorded as a disbursement of $412. g. The August 31 balance in the general ledger Cash account, before reconciliation, is $8,436. Required: a-1. Show the reconciling items in a horizontal model that should be prepared to reflect the reconciling items as on August 31. (Use amounts with + for increases and amounts with for decreases.) Cash Assets…arrow_forwardEntries for Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Mathers Co. for July: 1. Cash balance according to the company's records at July 31, $17,410. 2. Cash balance according to the bank statement at July 31, $18,430. 3. Checks outstanding, $3,530. 4. Deposit in transit, not recorded by bank, $2,840. 5. A check for $590 in payment of an account was erroneously recorded in the check register as $950. 6. Bank debit memo for service charges, $30. Journalize the entries that should be made by the company, part (A) Error and part (B) Service Charge. a. July 31 Cash |X Accounts Payable b. July 31 Miscellaneous Expense Feedback Cash Check My Work Keep in mind that the company needs to journalize any adjusting items in the company section of the bank reconciliation, decrease Cash. If the company made an error that understates cash in the company section, the journal adjustment woularrow_forwardUsing the following information: a. The bank statement balance is $4,265. b. The cash account balance is $4,448. c. Outstanding checks amount to $835. d. Deposits in transit are $954. e. The bank service charge is $55. f. A check for $37 for supplies was recorded as $28 in the ledger. Prepare a bank reconciliation for Candace Co. for May 31. Candace Co. Bank Reconciliation Line Item Description May 31 Amount Amount Cash balance according to bank statement Adjusted balance Cash balance according to company's records Total deductions Adjusted balancearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education