FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Record each transaction in a journal entry . Explanations are not required.

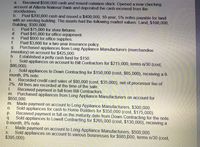

Transcribed Image Text:**Transaction Analysis for Educational Purposes**

Here's a detailed analysis of a series of financial transactions:

a. **Capital Infusion:**

- Received $500,000 in cash and issued common stock.

- Opened a new checking account at Atlanta National Bank and deposited the cash received from stockholders.

b. **Asset Acquisition:**

- Paid $200,000 in cash and issued a $400,000, 10-year, 5% notes payable to acquire land with an existing building.

- Asset market values: Land: $100,000; Building: $500,000.

c. **Store Fixtures Purchase:**

- Paid $75,000 for new store fixtures.

d. **Office Equipment Purchase:**

- Paid $45,000 for office equipment.

e. **Office Supplies Purchase:**

- Paid $600 for office supplies.

f. **Insurance Policy:**

- Paid $3,600 for a two-year insurance policy.

g. **Inventory Purchase:**

- Purchased $425,000 worth of appliances from Long Appliance Manufacturers on account.

h. **Petty Cash Fund:**

- Established a petty cash fund of $150.

i. **Credit Sale:**

- Sold $215,000 worth of appliances to Bill Contractors, with terms n/30 (cost: $86,000).

j. **Promissory Note:**

- Sold $150,000 worth of appliances to Down Contracting (cost: $65,000), receiving a 6-month, 8% note.

k. **Credit Card Sales:**

- Recorded $80,000 in credit card sales (cost: $35,000), net of a 2% processor fee.

l. **Accounts Receivable Collection:**

- Received full payment from Bill Contractors.

m. **Additional Inventory Purchase:**

- Purchased $650,000 worth of appliances from Long Appliance Manufacturers on account.

n. **Account Payment:**

- Made a $300,000 payment on account to Long Appliance Manufacturers.

o. **Cash Sale:**

- Sold appliances to Home Builders for $350,000 in cash (cost: $175,000).

p. **Note Receivable Collection:**

- Received full payment on the maturity date from Down Contracting for the note.

q. **Additional Sales via Promissory Note:**

- Sold $265,000 worth of appliances

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Is it possible to explain the procedures that must be followed in order to close out entries?arrow_forwardWhat is the purpose of posting J.F numbers that are entered in the journal at the time entries are posted to the accounts.arrow_forwardFill in the Blank Question A posting reference in a (journal/ledger) includes the page number of the account debited or credited in the (journal/ledger) and serves as a link to cross-reference the transaction from one record to another.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education