Recently, the owner of KFC Franchise decided to change how she compensated her top manager. Last year, the manager received a fixed salary of GHC50,000 and KFC made GHC110,000 in profits (excluding the manager’s compensation). She feared that her store’s performance was connected to the top manager shirking on the job and expected that changes to her top manager’s compensation structure would improve sales. Therefore, this year she decided to offer him a fixed salary of $40,000 plus 5 percent of the store’s profit. Since the change, the store is performing much better, and she forecasts profits this year to be $300,000 (again, excluding the manager’s compensation). Assuming the change of compensation is the reason for owner make (net of payment to her top manager) because of this change? Does the manager make more money under the new payment scheme?

Recently, the owner of KFC Franchise decided to change how she compensated her

top manager. Last year, the manager received a fixed salary of GHC50,000 and KFC

made GHC110,000 in profits (excluding the manager’s compensation). She feared

that her store’s performance was connected to the top manager shirking on the job

and expected that changes to her top manager’s compensation structure would

improve sales. Therefore, this year she decided to offer him a fixed salary of $40,000

plus 5 percent of the store’s profit. Since the change, the store is performing much

better, and she

manager’s compensation). Assuming the change of compensation is the reason for owner make (net of payment to her top manager) because of this change?

Does the manager make more money under the new payment scheme?

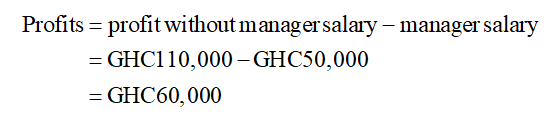

The total profit of the owner is calculated by deducting all the amounts of expenses, wages, and manager salary from the total profit of the store.

Previous year:

Profits of owner without manager salary: GHC110,000

Fixed salary of manager: GHC50,000

Profits of the owner is calculated as follows:

Step by step

Solved in 4 steps with 3 images