FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

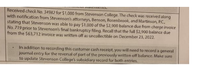

Transcribed Image Text:Received check No. 34982 for $1,000 from Stevenson College. The check was received along

with notification from Stevenson's attorneys, Benson, Rosenbrook, and Martinson, P.C.,

stating that Stevenson was able to pay $1,000 of the $2,900 balance due from charge invoice

No. 719 prior to Stevenson's final bankruptcy filing. Recall that the full $2,900 balance due

from the $63,712 invoice was written off as uncollectible on December 23, 2022.

In addition to recording this customer cash receipt. you will need to record a general

journal entry for the reversal of part of the previously written off balance. Make sure

to update Stevenson College's subsidiary record for both entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Roe's Renovations utilizes the direct write-off method of accounting for uncollectible receivables. On September 15 the company is notified by the attorneys for Jacob Marley that Jacob Marley is bankrupt and no cash is expected in the liquidation. Write off the $3,890 of accounts receivable due from Jacob Marley. If an amount box does not require an entry, leave it blank.arrow_forwardBramble Corp. has the following account balances at December 31, 2021: Notes payable ($47,000 due after 12/31/22) $78,000 Unearned service revenue 55,000 Mortgage Payable ($70,000 due in 2022) 195,000 Salaries payable 25,000 Accounts payable 49,000 In addition, Bramble is involved in a lawsuit. Legal counsel feels it is probable Bramble will pay damages of $20,000 in 2022. Bramble records provisions related to litigations in the account Litigation Liability. Prepare the current liabilities section of Bramble's December 31, 2021, balance sheet. Bramble Corp. (Partial) Balance Sheetarrow_forwardProvided that the entity did not prepare year-end adjustinv jpurnal entry, how much is the 2021 net income overstated?arrow_forward

- Lara Croft has been hired as a new auditor for Jolie Inc. Ms. Croft has suggested thefollowing accounting changes in regards to the company’s financial statements.1. At December 31, 2019, Jolie Inc. had a receivable of $500,000 from Relic Inc. on itsstatement of financial position. Relic had gone bankrupt, and no recovery is expected.Jolie proposes to write off the receivable as a prior period item.2. The client proposes the following changes in depreciation policies. (a) For officefurniture and fixtures, it proposes to change from a 10-year useful life to an 8-yearlife. If this change had been made in prior years, retained earnings at December 31, 2019,would have been $250,000 less. The effect of the change on 2020 income alone is areduction of $60,000.(b) For its equipment in the leasing division, the client proposes to adopt the sum-of-theyears’-digits depreciation method. The client had never used SYD before. The first yearthe client operated a leasing division was 2020. If…arrow_forwardCan you please show your work on how you came up with the balance per bank and the balance per book on the reconciliation statement? Branson Co. received its bank statement for the month ending May 31, 2019, and reconciled the statement balance to the May 31, 2019, balance in the Cash account. The reconciled balance was determined to be $36,400. The reconciliation recognized the following items: A deposit made on May 31 for $22,700 was included in the Cash account balance but not in the bank statement balance. Checks issued but not returned with the bank statement were No. 673 for $4,550 and No. 687 for $9,700. Bank service charges shown as a deduction on the bank statement were $110. Interest credited to Branson Co.'s account but not recorded on the company's books amounted to $88. Returned with the bank statement was a "debit memo" stating that a customer's check for $3,240 that had been deposited on May 23 had been returned because the customer's account was overdrawn. During a…arrow_forwardWrite double entry? On 7 November 2021 there was a fire in the warehouse, in which inventory valued at $12,000 was destroyed. Under the terms of the insurance contract, the insurance company has stated that it will only pay out the first $3,000 of the claim. No entries have yet been made to record this.arrow_forward

- On June 15, we Received notice from the bank that the $5,000 check received from customer Arlene Burnet (10300) on June 14 has not cleared due tolack of funds. The $,5000 balance of this NSF check plus anadditional $80 handling fee will be charged back to Ms. Burnet'saccount (sales invoice number G4016). The $80 handling feecharged by Granite Bay Jet Ski will be entered as MiscellaneousRevenue. At the check number prompt enter BADCK for badcheck. Please enter the following journal entries for the above.arrow_forwardplease give me answer in relatablearrow_forwardMarks Company sold goods to Birch Company totaling $51,830 during 2020. When Birch was unable to meet Marks’normal terms, Marks accepted from Birch a $60,000, 3-year non-interest-bearing note due 1/1/24. (Marks has acceptednotes in the past in settlement of open accounts.)Required:(a) Prepare Marks’ journal entry on 1/1/21 when the note was signed.(b) Prepare a table which shows the amortization of bond discount over the life of the note.(c) What is the 12/31/22 adjusting entry that will be recorded by Marks?(d) What is the purpose of the journal entry at 12/31/22?arrow_forward

- Solstice Company, which uses the direct write-off method, determines on October 1 that it cannot collect $53,000 of its accounts receivable from its customer, P. Moore. On October 30, P. Moore unexpectedly pays his account in full to Solstice Company. Record Solstice’s entries for recovery of this bad debt.arrow_forwardSplish Corporation borrowed $58,500 on November 1, 2020, by signing a $60,000, 3-month, zero-interest-bearing note. Prepare Splish's November 1, 2020, entry; the December 31, 2020, annual adjusting entry; and the February 1, 2021, entry. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record interest) (To pay note)arrow_forwardMr. P's bank statement dated 31.12.2021 showed a balance with his Bank of $924, when checked with his Cash Book the following were noted :(a) During December, the Bank had paid $200 for a yearly contribution of Mr. P made to a local charity, as per his standing order. This amount appeared in the Bank statement but not in the Cash Book.(b) The Bank had credited his account with $28 interest and had collected on his behalf `$230 as dividends. No corresponding entries were made in the Cash Book.(c) A cheque of $65 deposited into the Bank on 28.12.2021 was not cleared by the Bank till after 31.12.2021(d) A cheque of $150 deposited into and cleared by the Bank before 31.12.2021 was not entered in the Cash Book, through an oversight.(e) Cheques drawn by and posted to parties by Mr. White on 31.12.2021 for $73, $119 and $46 were presented for payment to the Bank only on 3.1.2021.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education