Calculus: Early Transcendentals

8th Edition

ISBN: 9781285741550

Author: James Stewart

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Give the formulas for finding the growth rate (r) and the carrying capacity (N).

• r = ?

• N = ?

Transcribed Image Text:WK Topic 13

CO

LA things

calstatela instructure.com/courses/78782/assignments/1268237

Important My Personal things

Question 3

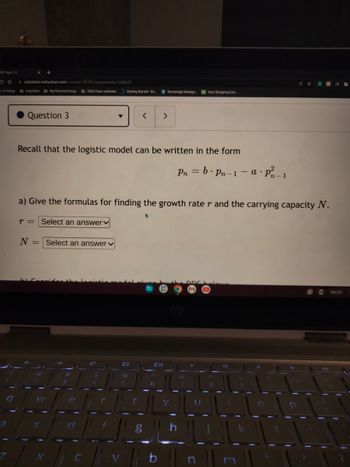

N = Select an answer

W

2022 Class websites Getting Started - Da...

S

Recall that the logistic model can be written in the form

#

e

a) Give the formulas for finding the growth rater and the carrying capacity N.

r = Select an answer

C

$

r

%

<

5

t

8 Stoneridge Manage...

>

g

Pn = b.Pn-1-a. P²-1

Your Shopping Cart...

h

1

u

10

I

O

11

1

GR 36

1

- Oct 27

11

1₁

Expert Solution

arrow_forward

Step 1

We have to find carrying capacity and growth rate, by comparing the logistics model formula to the given formula as shown below.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- A certificate of deposit is worth P (1+r)t dollars after t years, where r is the annual interest rate expressed as a decimal, and P is the amount initially deposited. Which investment will be worth more? Investment A, in which P =$7300, r=4%, and t=5 years. Or investment B, in which P= $6300, r=6%, and t= 7years. Round to two decimal places. The value of certificate A will be what? And the value for investment B will be what? And which is worth more, A or B?arrow_forwardPlease explain how to solve, thank you!arrow_forwardThe formula for interest compounded continuously is A=Pert where P is the principal, i.e. the amount invested, r is the annual rate expressed as a decimal, and A is the amount at the end of t years. Use this information to do the next problem. 20. If you invest, $8950 at the annual rate of 6.75% compounded continuously, how much money will be in the account at the end of 15.75 years?arrow_forward

- A = P (1+)* nt Use the correct formula: A = Pert %3D You are considering two investments. One earns interest at 0.9% compounded bi-annually, and the other earns interest that is compounded continuously at 0.895%. You have $100,000 to invest, and plan to leave it there for 10 years. Barring changes in the interest rate, in which should you invest? What is the difference at the end of 10 years?arrow_forwardA bank features a savings account that has an annual percentage rate of r = 2.9% with interest compounded quarterly. Emma deposits $5,000 into the account. r\ kt The account balance can be modeled by the exponential formula A(t) = al1 -+ where A is account value after t years , a is the principal (starting amount), r is the annual percentage rate, k is the number of times each year that the interest is compounded. (A) What values should be used for a, r, and k? a = r = k (B) How much money will Emma have in the account in 9 years? Amount $ %3D Round answer to the nearest penny. (C) What is the annual percentage yield (APY) for the savings account? (The APY is the actual or effective annual percentage rate which includes all compounding in the year). APY % Round answer to 3 decimal places.arrow_forwardThe value of the account will be $ enter your response here. (Round to the nearest dollar as needed.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON

Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON

Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning

Calculus: Early Transcendentals

Calculus

ISBN:9781285741550

Author:James Stewart

Publisher:Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:9780134438986

Author:Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:9780134763644

Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:9781319050740

Author:Jon Rogawski, Colin Adams, Robert Franzosa

Publisher:W. H. Freeman

Calculus: Early Transcendental Functions

Calculus

ISBN:9781337552516

Author:Ron Larson, Bruce H. Edwards

Publisher:Cengage Learning