FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

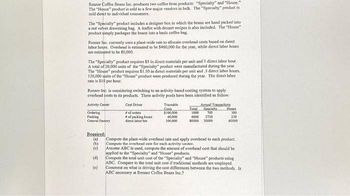

Transcribed Image Text:Renner Coffee Beans Inc. produces two coffee bean products: "Specialty" and "House."

The "House" product is sold to a few major vendors in bulk. The "Specialty product is

sold direct to individual consumers.

The "Specialty" product includes a designer box in which the beans are hand packed into

a red velvet drawstring bag, A leaflet with dessert recipes is also included. The "House"

product simply packages the beans into a basic coffee bag.

Renner lec, currently uses a plant-wide rate to allocate overhead costs based on direct

labor hours, Overhead is estimated to be $460,000 for the year, while direct labor hours

are estimated to be 80,000,

The Specialty" product requires $5 in direct materials per unit and I direct labor hour.

A total of 20,000 units of the "Specialty" product were manufactured during the year.

The "House" product requires $1.50 in direct materials per unit and .5 direct labor hours.

120,000 units of the "House" product were produced during the year. The direct labor

rate is $10 per hour.

Renner Inc. is considering switching to an activity-based costing system to apply

overhead costs to its products. Three activity pools have been identified as follow.

Activity Center

Cost Driver

of orders

of packing hours

direct labores

Ordering

Packing

General Factory

Required:

(a)

(b)

(c)

(d)

(c)

Traceable

Conta

$100,000

60,000

300,000

Total

1000

4000

80000

Annual Tramoactions

Specialty

700

3750

20000

Home

300

250

60000

Compute the plant-wide overhead rate and apply overhead to each product.

Compute the overhead rate for each activity center.

Assume ABC is used, compute the amount of overhead cost that should be

applied to the "Specialty" and "House" products.

Compute the total unit cost of the "Specialty" and "House" products using

ABC. Compare to the total unit cost if traditional methods are employed.

Comment on what is driving the cost differences between the two methods. la

ABC necessary at Renner Coffee Beans Inc.?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cheyenne Appliance Co. manufactures low-price, no-frills appliances that are in great demand for rental units. Pricing and cost information on Cheyenne's main products are as follows. Standalone Item Selling Price (Cost) Refrigerator $510 ($260 ) Range 570 (280 ) Stackable washer/dryer unit 710 (390 ) Customers can contract to purchase either individually at the stated prices or a three-item bundle with a price of $1,830. The bundle price includes delivery and installation. Cheyenne also provides installation (not a separate performance obligation). Respond to the requirements related to the following independent revenue arrangements for Cheyenne Appliance Co.arrow_forwardPopper! is a specialty popcorn store. It offers two varieties of popcorn: plain and flavored. The flavors range from Caramel Popcorn to Dark Chocolate Drizzled Popcorn to White Cheddar Popcorn. The plain popcorn sells for ss attachedarrow_forwardHardevarrow_forward

- Lamothe Kitchen and Bath makes products for the home, which it sells through major retailers and remodeling (do-it-yourself, or DIY) outlets. One product that has had varying success is a ceiling fan for the kitchen. The fan comes in three sizes (36-Inch, 44-Inch, and 54-Inch), which are designed for various kitchen sizes and cooling requirements. The chief financial officer (CFO) at Lamothe has been looking at the segmented income statement for the fan and is concerned about the results for the 36-inch model. Revenues Variable costs Fixed costs allocated to products Operating profit (loss) 36 Inch $ 372,200 231,600 147,230 $ (6,630) If the 36-Inch model is dropped, the revenue associated with it would be lost and the related variable costs saved. In addition, the company's total fixed costs would be reduced by 25 percent. Required A Required B Required: a. Prepare a differential cost schedule to support your recommendation. b. Should Lamothe Kitchen and Bath should drop the 36-Inch…arrow_forwardHow to do this. Please explain. Thank you.arrow_forwardAny help with explaining the process to get to these figures would be extremely appreciated! please answer all requirements or skip /leave please remember answer all or better to leave for other experts upvote if complete and correctarrow_forward

- please help me to solve this questionarrow_forwardMukharrow_forwardLance Inc., processes sugar cane that it purchases from farmers. Sugar cane is processed in batches. A batch of sugar cane costs P60 to buy from farmers and P13 to crush in the company's plant. Two intermediate products, cane fiber and cane juice, emerge from the crushing process. The cane fiber can be sold as is for P29 or processed further for P13 to make the end product industrial fiber that is sold for P61. The cane juice can be sold as is for P40 or processed further for P20 to make the end product molasses that is sold for P67.1. How much profit (loss) does the company make by processing the intermediate product cane juice into molasses rather than selling it as is?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education