Principles Of Marketing

17th Edition

ISBN: 9780134492513

Author: Kotler, Philip, Armstrong, Gary (gary M.)

Publisher: Pearson Higher Education,

expand_more

expand_more

format_list_bulleted

Question

Read the passage that attached and answer the following questions. I am the SELLER in this situation.

- What do you think that the most important issues are for your counterparty in the negotiation?

- What do you think is your counterparty’s BATNA? Reservation price? Target?

- What parts of the scenario work in your counterparty’s favor?

Transcribed Image Text:You are the CEO and co-owner of Solaris Ltd. ("Solaris"). In a few minutes you will meet the CEO of the Energy

Sector of Suremen AG (“Suremen”), to negotiate the potential acquisition of Solaris by Suremen. You have been

authorized by the other co owners to negotiate the sale of Solaris.

Suremen is among the oldest and largest industrial companies in the world. From its founding in 19th century

Germany, Suremen has grown into a self described "global powerhouse" in electronics and electrical

engineering. The company prides itself for its technical achievements, quality and global reach. Today,

Suremen has more than 400,000 employees and in the last fiscal year Suremen earned a net income of €5.9

billion from revenues of €77.3 billion.

Your counterpart is the CEO of Suremen's Energy Sector. The Energy Sector offers products and services for

the generation, transmission, and distribution of power and for the extraction, conversion, and transport of oil

and gas. In the last fiscal year the Energy Sector (workforce 80,000) had revenues of approximately €22.6 billion

and posted a profit of €1.4 billion. The Energy Sector's mission is to expand its "green" profile, especially in the

field of concentrated solar power plants.

Concentrated Solar Power ("CSP") and the_DESERTEC Project

CSP plants use sunlight to generate electricity. Large_parabolic mirrors track the movement of the sun, catch the

sunlight, and concentrate it on a tube, called a "receiver". Receivers are assembled in multiple rows that make

up the "solar field”. Receivers contain a special oil that is heated from the concentrated sunlight and subsequently

is used to generate steam. The steam powers a turbine that produces the electricity.

Areas that receive a great deal of direct sunlight which is not diffused by clouds, fumes or dust are suitable for

CSP plants. Hence, these plants are typically located in steppes, bush, savannas, semi

deserts or deserts, which ideally are within 40 degrees north or south of the equator. Areas that meet these criteria

have an enormous potential for the generation of electricity. It is possible to generate up to 130 gigawatt hours

(GWh) of solar electricity a year, enough to provide power for thousands of households and equal to the power

that is produced by a 50 MW conventional coal or gas-fired power plant from solar energy collected from a 1

km² (or 0.28 m²) field. Greenpeace estimates that with ongoing improvements in solar technology, CSP power

plants could meet up to 7% of the world's power needs by 2030 and fully one quarter by 2050. By 2020 this

should reduce CO₂ emissions by 148 million tons annually, and 2.1 billion tons annually by 2050. To put these

numbers into perspective, the CO₂ generated by Australia in the year 2009 was 394 million tons.

Since the capacity of the typical CSP site by far exceeds local demand for electricity, the sunlight "harvested"

in the regions most suitable for CSP must be exported to more power-hungry parts of the world. One ambitious

example of this is the “DESERTEC” project. DESERTEC aims to build a net of CSP and photovoltaic power

plants, as well as wind parks, throughout the desert regions of Northern Africa. The electricity would be

transmitted to European and African countries by a "super grid" of high-voltage direct current cables.

DESERTEC would meet most local demand for electricity as well as provide about 15% of the energy needs

of continental Europe.

The DESERTEC idea, originally developed by the Club of Rome, has gained considerable traction in recent

years. Some of Europe's biggest companies (such as Munich Re, ABB, Deutsche Bank, and E.ON) have

established a consortium to make DESERTEC a reality. The economics of the project are staggering - the

consortium estimates that it will require investments reaching €400 billion by 2050. Suremen, as one of the

founders of the DESERTEC consortium, hopes to gain a fair share of the DESERTEC business building solar

energy plants and transmission lines and facilities.

Suremen's existing product portfolio

Suremen is the market leader in producing steam turbines for CSP power plants. It has already supplied the

turbines for more than 50 CSP power plants worldwide. The company also designs and manufactures the other

components needed for building a CSP plant (such as transformers, boilers and heat exchangers). However,

Suremen does not produce receivers. Only two companies in the world have the technology to manufacture

receivers: Scholl GmbH of Switzerland (which is also a member of the DESERTEC consortium) and Solaris

Ltd. of Israel.

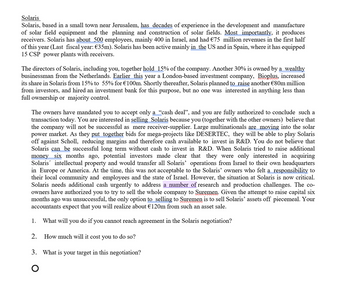

Transcribed Image Text:Solaris

Solaris, based in a small town near Jerusalem, has decades of experience in the development and manufacture

of solar field equipment and the planning and construction of solar fields. Most importantly, it produces

receivers. Solaris has about 500 employees, mainly 400 in Israel, and had €75 million revenues in the first half

of this year (Last fiscal year: €35m). Solaris has been active mainly in the US and in Spain, where it has equipped

15 CSP power plants with receivers.

The directors of Solaris, including you, together hold 15% of the company. Another 30% is owned by a wealthy

businessman from the Netherlands. Earlier this year a London-based investment company, Bioplus, increased

its share in Solaris from 15% to 55% for €100m. Shortly thereafter, Solaris planned to raise another €80m million

from investors, and hired an investment bank for this purpose, but no one was interested in anything less than

full ownership or majority control.

The owners have mandated you to accept only a "cash deal", and you are fully authorized to conclude such a

transaction today. You are interested in selling Solaris because you (together with the other owners) believe that

the company will not be successful as mere receiver-supplier. Large multinationals are moving into the solar

power market. As they put together bids for mega-projects like DESERTEC, they will be able to play Solaris

off against Scholl, reducing margins and therefore cash available to invest in R&D. You do not believe that

Solaris can be successful long term without cash to invest in R&D. When Solaris tried to raise additional

money six months ago, potential investors made clear that they were only interested in acquiring

Solaris intellectual property and would transfer all Solaris' operations from Israel to their own headquarters

in Europe or America. At the time, this was not acceptable to the Solaris' owners who felt a responsibility to

their local community and employees and the state of Israel. However, the situation at Solaris is now critical.

Solaris needs additional cash urgently to address a number of research and production challenges. The co-

owners have authorized you to try to sell the whole company to Suremen. Given the attempt to raise capital six

months ago was unsuccessful, the only option to selling to Suremen is to sell Solaris' assets off piecemeal. Your

accountants expect that you will realize about €120m from such an asset sale.

1. What will you do if

2.

you cannot reach agreement in the Solaris negotiation?

How much will it cost you to do so?

3. What is your target in this negotiation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- What are the six standard export documents? For each standard export document, who prepares it, who receives it, and what purpose does it serve? What common information do many standard export documents share? Besides the six standard export documents, identify five other export documents. Under what circumstances might these other export documents be required? For each other export document, who prepares it and what purpose does it serve?arrow_forwardComment on the limitations encountered along the supply chain of natural gas and liquified natural gas (LNG) and their effect on the prices, and the present and future trading trends for these commodities.arrow_forwardHi, please read the attachment and answer the questions below. I am the buyer in this negotiation. What strategies will you be using in the negotiation? Do you want to make the opening offer? Why or why not? What strategies do you expect to see from your counterparty? How will you prepare to meet those strategies? Given your scenario, what other information is important for you to keep in mind while negotiating?arrow_forward

- what is zone of possible agreement (ZOPA)arrow_forwardHi, please read the attachment and answer the questions below. I am the buyer in this negotiation. What do you think that the most important issues are for your counterparty in the negotiation? What do you think is your counterparty’s BATNA? Reservation price? Target? What parts of the scenario work in your counterparty’s favor?arrow_forwardDo problem 2 letter garrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles Of MarketingMarketingISBN:9780134492513Author:Kotler, Philip, Armstrong, Gary (gary M.)Publisher:Pearson Higher Education,

Principles Of MarketingMarketingISBN:9780134492513Author:Kotler, Philip, Armstrong, Gary (gary M.)Publisher:Pearson Higher Education, MarketingMarketingISBN:9781259924040Author:Roger A. Kerin, Steven W. HartleyPublisher:McGraw-Hill Education

MarketingMarketingISBN:9781259924040Author:Roger A. Kerin, Steven W. HartleyPublisher:McGraw-Hill Education Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning

Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning Marketing: An Introduction (13th Edition)MarketingISBN:9780134149530Author:Gary Armstrong, Philip KotlerPublisher:PEARSON

Marketing: An Introduction (13th Edition)MarketingISBN:9780134149530Author:Gary Armstrong, Philip KotlerPublisher:PEARSON

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Principles Of Marketing

Marketing

ISBN:9780134492513

Author:Kotler, Philip, Armstrong, Gary (gary M.)

Publisher:Pearson Higher Education,

Marketing

Marketing

ISBN:9781259924040

Author:Roger A. Kerin, Steven W. Hartley

Publisher:McGraw-Hill Education

Foundations of Business (MindTap Course List)

Marketing

ISBN:9781337386920

Author:William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:Cengage Learning

Marketing: An Introduction (13th Edition)

Marketing

ISBN:9780134149530

Author:Gary Armstrong, Philip Kotler

Publisher:PEARSON

Contemporary Marketing

Marketing

ISBN:9780357033777

Author:Louis E. Boone, David L. Kurtz

Publisher:Cengage Learning