FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

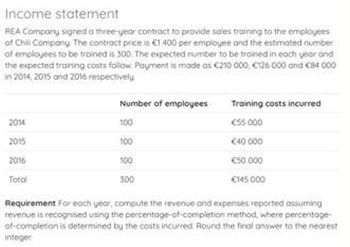

Transcribed Image Text:Income statement

REA Company signed a three-year contract to provide sales training to the employees

of Chili Company. The contract price is €1 400 per employee and the estimated number

of employees to be trained is 300. The expected number to be trained in each year and

the expected training costs follow. Payment is made as €210 000, €126 000 and €84 000

in 2014, 2015 and 2016 respectively

2014

2015

2016

Total

Number of employees

100

100

100

300

Training costs incurred

€55.000

€40 000

€50.000

€145.000

Requirement For each year, compute the revenue and expenses reported assuming

revenue is recognised using the percentage-of-completion method, where percentage-

of-completion is determined by the costs incurred Round the final answer to the nearest

integer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question Seema Company purchased a machine on April 01, 2017 at a list price of Rs 1,000,000 with a trade discount at 10%. The credit terms were 2/10, 1/20, n/30. The payment was made on 19 April. The company incurred the following additional expenditures. | 1- 5% Sales tax on the cash price of Machine 2- Custome Duty Rs 5% of cash price 3- Installation & Testing cost Rs 200,000 | 4- The machine was insured against theft and fire and premium paid Rs 50,000 5- Insurance in transit Rs 100,000 6- Freight in Rs 50,000 7- Some parts damaged during installation and get repaired for 25,000arrow_forwardDecision on Accepting Additional Business Brightstone Tire and Rubber Company has capacity to produce 153,000 tires. Brightstone presently produces and sells 117,000 tires for the North American market at a price of $94 per tire. Brightstone is evaluating a special order from a European automobile company, Euro Motors. Euro is offering to buy 18,000 tires for $78.5 per tire. Brightstone's accounting system indicates that the total cost per tire is as follows: Direct materials $36 Direct labor 13 Factory overhead (60% variable) 22 Selling and administrative expenses (40% variable) 19 Total $90 Brightstone pays a selling commission equal to 5% of the selling price on North American orders, which is included in the variable portion of the selling and administrative expenses. However, this special order would not have a sales commission. If the order was accepted, the tires would be shipped overseas for an additional shipping cost of $5 per tire. In addition, Euro has made…arrow_forwardPricing: meteor model retails for 840€, Moonlight Model retails 1485€ The company incurs overheads which total €1200.000. Α total of 15000€ direct labour hours are worked. Department cost center Buliding rent 50.000 utilities 50.000 machining 600.000 Procurement 150.000 Sales 150.000 General Management 200.000 Total 1.200.000 Cost center Machining Finishing Administration Floor Area 1.500 sq.m 1.500 sq.m 2.000 sq.m Machine Hours 25.000 hours 5.000 hours Direct Labour Hours 5000 hours 10.000 hours Each unit of Meteor was machined for 10 hours in Machining and 1 hour in Finishing. Each unit of the Moonlight was machined for 2 hours in Machining and 1 hour in Finishing. Calculate the full cost for each bicycle model (e.g. Meteor and Moonlight) based on: a. Plant-wide (single or blanket) overhead rates b. Department cost centre rates (where overhead absorption rates are based on an overhead analysis sheet) c. Activity-based costing (ABC)arrow_forward

- Midterm 1- What is the deal?" is a company in West Windsor, NJ operated by Pam Smith. The company has two activities. Here are the facts: A. Subscriptions: The company provides maintenance of the equipment including back-ups and charges $50 weekly. B. Technical repairs: These repair services are priced $100 per hour plus materials. The materials are charged 20% over the purchase price and the employees are paid $30 per hour. The overhead for 2024 was estimated to be $20,000, and the estimated hours of labor 2,000. The company allocates the costs based on the number of hours of labor. Durante the first week of January they sold 10 subscriptions and received four computers to be repaired. The maintenance required 1 each. The information about orders is attached: Materials Labor cost Order 01 $120 $60 Order 02 $200 $120 Order 03 $100 $60 1. Determine the total cost of serving each client. 2. Calculate the profitability of each order and the profitability of the subscriptions. Order 04 $50…arrow_forward1.3 REQUIRED Calculate the earnings of Amanda for the day using the straight piecework incentive scheme. INFORMATION The standard time to produce a product is 10 minutes. Amanda is paid R120 per hour and the normal working day is 8 hours. If Amanda produces more than her quota, she receives 1.5 times the hourly rate on the additional output. Amanda produced 54 units for the day.arrow_forwardDecision on Accepting Additional Business Brightstone Tire and Rubber Company has capacity to produce 247,000 tires. Brightstone presently produces and sells 189,000 tires for the North American market at a price of $93 per tire. Brightstone is evaluating a special order from a European automobile company, Euro Motors. Euro is offering to buy 29,000 tires for $78.15 per tire. Brightstone's accounting system indicates that the total cost per tire is as follows: Direct materials $35 Direct labor 13 Factory overhead (70% variable) 21 Selling and administrative expenses (40% variable) 19 Total $88 Brightstone pays a selling commission equal to 5% of the selling price on North American orders, which is included in the variable portion of the selling and administrative expenses. However, this special order would not have a sales commission. If the order was accepted, the tires would be shipped overseas for an additional shipping cost of $5 per tire. In addition, Euro has made…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education