FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

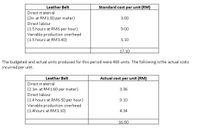

Razi Company is a manufacturer of the leather belt based in Kelang, Selangor. The company estimated a total of 400 units of production for the most recent period. The

(see the picture)

Required

From the foregoing information, compute the following variances and indicate whether they are favorable (F) or unfavorable (U). State why each of the variances occurred.

Material price variance

Material usage variance

Direct labour rate variance

Direct labour efficiency variance

Variable

Variable overhead efficiency variance

Transcribed Image Text:Leather Belt

Standard cost per unit (RM)

Direct material

(2m at RM1.50 per meter)

3.00

Direct labour

(1.5 hours at RM6 per hour)

Variable production overhead

(1.5 hours at RM3.40)

9.00

5.10

17.10

The budgeted and actual units produced for this period were 400 units. The following isthe actual costs

incurred per unit.

Leather Belt

Actual cost per unit (RM)

Direct material

(2.1m at RM1.60 per meter)

3.36

Direct labour

(1.4 hours at RM6.50 per hour)

Variable production overhead

(1.4hours at RM3.10)

9.10

4.34

16.80

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you show me how this is done? How do I know if it is favorable or unfavorable? Warren Company manufactures pans. Below is the information related to its direct material costs: Standard amount of material used per pan 1.9 lb. Standard cost per lb $5.2 Actual amount of material used per pan 1.2 lb Actual cost per lb $4.5 Actual number of pans produced and sold 2,360 Warren’s direct material spending variance is $__________ Indicate the amount and whether it is Favorable or Unfavorable by placing F or U by amount, do not skip a space and do not use $ in your answer. For example, if your answer is $1,000 favorable, answer 1000F Selected Answer: 4,335 Correct Answer: 10,573 ± 2 (F)arrow_forwardThe following data relate to the direct materials cost for the production of 1,800 automobile tires: Actual: 60,900 lb. at $1.70 Standard: 59,100 lb. at $1.75 a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Price variance $fill in the blank 1 Quantity variance $fill in the blank 3 Total direct materials cost variance $fill in the blank 5arrow_forwardPerez Company established a predetermined fixed overhead cost rate of $37 per unit of product. The company planned to make 6,100 units of product but actually produced only 5,300 units. Actual fixed overhead costs were $233,200. Required a. Determine the fixed cost spending variance and indicate whether it is favorable (F) or unfavorable (U). b. Determine the fixed cost volume variance and indicate whether it is favorable (F) or unfavorable (U). Note: For all requirements, Select "None" if there is no effect (i.e., zero variance). a. Total spending variance b. Total volume variancearrow_forward

- I. Krueger Corporation in Washington, D.C., U.S., recently implemented a standard cost system. The company's cost accountant has gathered the following information needed to perform a variance analysis at the end of the month: Standard Cost Information Direct materials.... Quantity allowed per unit . Direct labor rate..... Hours allowed per unit .. Fixed overhead budgeted . Normal level of production .. Variable overhead application rate . Fixed overhead application rate ($12,000 _ 1,200 units)... 10.00 per unit Total overhead application rate.. $5 per pound .100 pounds per unit $20.00 per hour 2 hours per unit $12,000 per month . 1,200 units $ 2.00 per unit $12.00 per unit Actual Cost Information Cost of materials purchased and used ... Pounds of materials purchased and used . Cost of direct labor .... $468,000 .104,000 pounds $46,480 2,240 hours Hours of direct labor.. arre$2,352 .$12,850 Cost of variable overhead . Cost of fixed overhead . Volume of production ..1,000 units…arrow_forward2. Acme Inc. has the following information available: Actual price paid for material Standard price for material Actual quantity purchased and used in production Standard quantity for units produced Actual labor rate per hour Standard labor rate per hour Actual hours Standard hours for units produced A. Compute the material price and quantity, and the labor rate and B. C. D. E. unfavorable variances. $1.00 $0.90 100 90 15 $ $ 16 200 220 efficiency variances. Describe the possible causes for this combination of favorable andarrow_forwardAPPLY THE CONCEPTS: Conduct the direct labor cost variance analysis Illustrated Example: Calculating Direct Labor Cost Variance Complete the following graphic to compute the direct labor rate variance, the direct labor time variance, and the total direct labor cost variance for your shoe-making business. When required, enter the rates as dollars and cents. If required, use the minus sign to indicate a negative value.arrow_forward

- please answer all with working please answer in text . answer all please please please 1. What is the materials price variance for March? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for none effect.) 2. What is the materials quantity variance for March? 3. If Preble had purchases 182,000kg of materials at $7.40 per kg and used 160,000kg in productions, what would be the materials price variance efficiency for March? 4. If Preble had purchases 182,000kg of materials at $7.40 per kg and used 160,000kg in productions, what would be the materials quantity variance efficiency for March? 5. What is the labour rate variance for March? 6. What is the labour efficiency for March?arrow_forward1. Compute for Spending Variance 2. Compute for Variable Overhead Efficiency Variance 3. Compute for Controllable Variancearrow_forwardThe management of Cleancut Lawnmowers has calculated the following variances: Direct materials cost variance Direct materials efficiency variance Direct labor cost variance Direct labor efficiency variance Variable overhead cost variance Variable overhead efficiency variance Fixed overhead cost variance $10,000 U 37,000 F 15,000 F 14,000 U 3,000 F 6,500 F 3,000 F When determining the total product cost flexible budget variance, what is the total manufacturing overhead variance of the company? OA. $3,000 F OB. $12,500 F OC. $6,500 F OD. $9,500 Farrow_forward

- 4.arrow_forwardBest, Inc. uses a standard cost system and provides the following information. (Click the icon to view the information.) variable overhead, $3,800; actual fixed overhead, $3, 500; actual direct labor hours, 1,400. Read the requirements. Data table Requirement 1. Compute the variable overhead cost and efficiency variances and fixed overhead cost and volume variances. Begin with the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standardco \table [[,, Formula,Variance], [VOH cost variance, = , 1 = , ], [VOH efficiency variance, =,1 =, 0arrow_forwardFor the month of April, compute the variances, indicating whether it is favorable (F) or unfavorable (U) Q.Production-volume variance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education