FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Q.Calculate the budgeted cost per service of X-rays, ultrasounds, CT scans, and MRI if RRC allocated

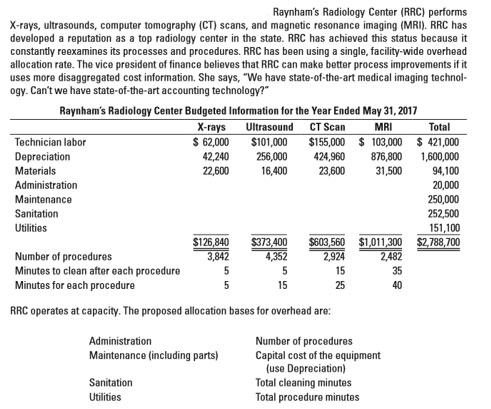

Transcribed Image Text:Raynham's Radiology Center (RRC) performs

X-rays, ultrasounds, computer tomography (CT) scans, and magnetic resonance imaging (MRI). RRC has

developed a reputation as a top radiology center in the state. RRC has achieved this status because it

constantly reexamines its processes and procedures. RRC has been using a single, facility-wide overhead

allocation rate. The vice president of finance believes that RRC can make better process improvements if it

uses more disaggregated cost information. She says, "We have state-of-the-art medical imaging technol-

ogy. Can't we have state-of-the-art accounting technology?"

Raynham's Radiology Center Budgeted Information for the Year Ended May 31, 2017

X-rays Ultrasound CT Scan

$101,000

MRI

Total

Technician labor

Depreciation

$155,000 $ 103,000 $ 421,000

$ 62,000

42,240

22,600

256,000

424,960

23,600

876,800

31,500

1,600,000

94,100

20,000

250,000

252,500

151,100

$2,788,700

Materials

16,400

Administration

Maintenance

Sanitation

Utilities

$126,840

3,842

$373,400

4,352

$603,560 $1,011,300

2,924

15

Number of procedures

Minutes to clean after each procedure

Minutes for each procedure

2,482

35

15

25

40

RRC operates at capacity. The proposed allocation bases for overhead are:

Number of procedures

Administration

Maintenance (including parts)

Capital cost of the equipment

(use Depreciation)

Total cleaning minutes

Total procedure minutes

Sanitation

Utilities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 11 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Classify the following costs as typically direct (D) or indirect (I): Project staff Audit and legal Utilities Rent Raw materials Training on equipment Project supplies Labor Administrative staff Miscellaneous office supplies Quality assurance IT department Scheduled maintenance Shared software packagesarrow_forwardWhich best describes the flow of overhead costs in an activity-based costing system? Group of answer choices Overhead costs –> direct labor cost or hours –> products Overhead costs –> products Overhead costs –> activity cost pools –> cost drivers –> products Overhead costs –> machine hours –> productsarrow_forwardProcess costing is an effective method to identify resource and logistics costs. Please respond to the following: Discuss the specific steps you would take to design a process costing system that effectively identifies resource and logistics costs of a manufactured product.arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Question Content Area Activity rates and product costs using activity-based costing Idris Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows: Activity BudgetedActivity Cost Activity Base Casting $640,000 Machine hours Assembly 125,000 Direct labor hours Inspecting 30,000 Number of inspections Setup 28,000 Number of setups Materials handling 20,000 Number of loads Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activity-base usage quantities and units produced follow: Activity Base Entry Dining Total Machine hours 7,500 12,500 20,000…arrow_forwardPrepare a direct materials budget for silicon and solution, and a direct labor budget.arrow_forwardWhich one of the following options can be used when allocating cafeteria costs? Select one: a. Number of square feet b. Appraised value of square footage c. Number of direct labor hours d. Number of employeesarrow_forward

- Which of the following cost and cost allocation base have a stronger cause and effect relationship? A) administration costs and cubic feet B) setup costs and square feet C) quality control costs and the number of inspections D) machine maintenance and setup hoursarrow_forwardActivity-based costing (ABC) is a costing technique that uses a two-stage allocation process. Which of the following statements best describes these two stages? Multiple Choice Direct costs are allocated to the production departments based on a predetermined overhead rate. The costs are assigned to departments, and then to the products based upon their use of activity resources. The costs are assigned to activities, and then to the products based upon their use of the activities. Indirect costs are assigned to activities, and then to the products based upon the direct cost resources used by the activities.arrow_forwardA direct material standard cost is: Group of answer choices The cost of direct materials that should be incurred to produce one unit of output or product. The amount of direct materials that should be used to produce one unit of output or product. The cost of all materials and supplies used to produce one unit of output or product. The price that should be spent to purchase each unit of direct material for production.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education