FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

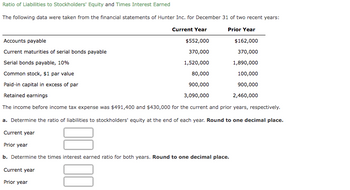

Transcribed Image Text:Ratio of Liabilities to Stockholders' Equity and Times Interest Earned

The following data were taken from the financial statements of Hunter Inc. for December 31 of two recent years:

Current Year

Prior Year

Accounts payable

$552,000

$162,000

Current maturities of serial bonds payable

370,000

370,000

Serial bonds payable, 10%

1,520,000

1,890,000

Common stock, $1 par value

80,000

100,000

Paid-in capital in excess of par

900,000

900,000

Retained earnings

3,090,000

2,460,000

The income before income tax expense was $491,400 and $430,000 for the current and prior years, respectively.

a. Determine the ratio of liabilities to stockholders' equity at the end of each year. Round to one decimal place.

Current year

Prior year

b. Determine the times interest earned ratio for both years. Round to one decimal place.

Current year

Prior year

Transcribed Image Text:c. The ratio of liabilities to stockholders' equity have

from the previous year. These results are the combined result of a

and the times interest earned ratio has

income before income taxes and

interest expense in the current year compared to the previous year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Statement of Stockholders' Equity The stockholders’ equity T accounts of I-Cards Inc. for the fiscal year ended December 31, 20Y9, are as follows. COMMON STOCK Jan. 1 Balance 1,200,000 Apr. 14 Issued 18,600 shares 558,000 Dec. 31 Balance 1,758,000 PAID-IN CAPITAL IN EXCESS OF PAR Jan. 1 Balance 192,000 Apr. 14 Issued 18,600 shares 130,200 Dec. 31 Balance 322,200 TREASURY STOCK Aug. 7 Purchased 3,100 shares 86,800 RETAINED EARNINGS Mar. 31 Dividend 31,000 Jan. 1 Balance 2,090,000 June. 30 Dividend 31,000 Dec. 31 Closing Sept. 30 Dividend 31,000 (Net income) 314,000 Dec. 31 Dividend 31,000 Dec. 31 Balance 2,280,000 Prepare a statement of stockholders’ equity for the year ended December 31, 20Y9. If an amount box does not require an entry, leave it blank. Also, if an amount reduces Stockholders' Equity, then add "minus" sign. I-Cards Inc.Statement of Stockholders' EquityFor the Year Ended…arrow_forwardThe following information was drawn from the year-end balance sheets of Munoz River, Incorporated. Year 2 $675,000 213,000 Account Title Bonds payable Common stock Treasury stock Retained earnings Additional information regarding transactions occurring during Year 2: 1. Munoz River, Incorporated issued $49,800 of bonds during Year 2. The bonds were issued at face value. All bonds retired were retired at face value. 35,000 89,600 2. Common stock did not have a par value. 3. Munoz River, Incorporated uses the cost method to account for treasury stock. 4. The amount of net income shown on the Year 2 income statement was $35,100. Required a. Determine the amount of cash flow for the retirement of bonds that should appear on the Year 2 statement of cash flows. b. Determine the amount of cash flow from the issue of common stock that should appear on the Year 2 statement of cash flows. c. Determine the amount of cash flow for the purchase of treasury stock that should appear on the Year 2…arrow_forwardThe following selected data were taken from the financial statements of the Winter Group for the three most recent years of operations: Dec. 31, Year 3 Dec. 31, Year 2 Dec. 31, Year 1 Total assets $3,000,000 $2,700,000 $2,400,000 Notes payable (10% interest) 1,000,000 1,000,000 1,000,000 Common stock 400,000 400,000 400,000 Preferred $6 stock, $100 par 200,000 200,000 200,000 Retained earnings 1,126,000 896,000 600,000 The Year 3 net income was $242,000 and the Year 2 net income was $308,000. No dividends on common stock were declared during the 3 years. a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity for Years 2 and 3. If required, round your answers to one decimal place. i cant figure out the stockholders equity or common stockholders equityarrow_forward

- Please do not give solution in image formatarrow_forwardThe following selected data were taken from the financial statements of Vidahill Inc. for December 31, 20Y7, 20Y6, and 20Y5: December 31 20Y7 20Y6 20Y5 Total assets $174,000 $157,000 $140,000 Notes payable (8% interest) 60,000 60,000 60,000 Common stock 24,000 24,000 24,000 Preferred 6% stock, $100 par 12,000 12,000 12,000 (no change during year) Retained earnings 70,170 47,100 36,000 The 20Y7 net income was $23,790, and the 20Y6 net income was $11,820. No dividends on common stock were declared between 20Y5 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7. a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders’ equity for the years 20Y6 and 20Y7. When required, round to one decimal place. 20Y7 20Y6 Return on total assets fill in the blank 1 % fill in the blank 2 % Return on stockholders’ equity fill in the blank 3 % fill…arrow_forwardStatement of Stockholders' Equity Potter Financial Services, Inc. For the Year Ended December 31, 20Y1 Common Retained Stock Earnings 210,000 Total Balances, January 1, 20Y1 Issued Common Stock 40,000 250,000 60,000 128,600 10,000 448,600 60,000 128,600 10,000 348,600 Net Income for the Year Dividends Balances, December 31, 20Y1 100,000arrow_forward

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 20Y8, were as follows: Record on journal page 10: Jan. 3 Issued 15,000 shares of $20 par common stock at $30, receiving cash. Feb. 15 Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash. May 1 Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. 16 Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. 26 Paid the cash dividends declared on May 16. Jun. 8 Purchased 8,000 shares of treasury common stock at $33 per share. 30 Declared a $1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. Jul. 11 Paid the cash dividends to the preferred…arrow_forwardBalance sheet and income statement data indicate the following: Bonds payable, 8% (due in 15 years) $1,082,526 Preferred 8% stock, $100 par (no change during the year) 200,000 Common stock, $50 par (no change during the year) 1,000,000 Income before income tax for year 414,083 Income tax for year 124,225 Common dividends paid 60,000 Preferred dividends paid 16,000 Based on the data presented, what is the times interest earned ratio (round to two decimal places)? Oa. 2.35 Оb. 3.35 Oc. 4.78 Od. 5.78arrow_forwardSubject: accountingarrow_forward

- Hahaharrow_forwardThe balance sheet of QUIGGE and get the end of the current fiscal year indicated the following bonds payable 8% $1 million preferred $10 stock $100 par 117,000 common stock $13 par 1,026,675 income before and come tax expense was $200,000 in income taxes for $30,350 for the current year cash dividends paid common stock during the current. Your total is $do 47,285 common stock with selling for $20 per share at the end of the year determine each of the following round answers to one decimal place, except for dollar amounts, which should be rounded to the nearest whole cent a. Times interest earned ratio. b. Earnings per share in common stock. c. Price earnings ratio. d. Dividends per share of common stock. e. Dividend yield.arrow_forwardBalance sheet and income statement data indicate the following: Bonds payable, 7% (due in 15 years) $850,550 Preferred 8% stock, $100 par (no change during the year) 200,000 Common stock, $50 par (no change during the year) 1,000,000 Income before income tax for year 379,777 Income tax for year 113,933 Common dividends paid 60,000 Preferred dividends paid 16,000 Based on the data presented, what is the times interest earned ratio (round to two decimal places)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education