ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

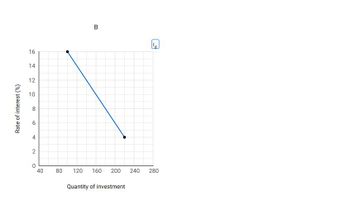

Transcribed Image Text:Rate of interest (%)

16

14

12

10

00

6.

4

2

0

40

80

B

120 160 200

Quantity of investment

144

240 280

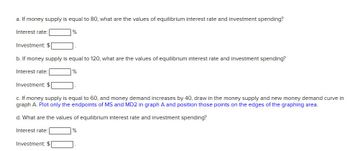

Transcribed Image Text:a. If money supply is equal to 80, what are the values of equilibrium interest rate and investment spending?

Interest rate:

Investment: $

b. If money supply is equal to 120, what are the values of equilibrium interest rate and investment spending?

Interest rate:

Investment: $

%

Investment: $

%

c. If money supply is equal to 60, and money demand increases by 40, draw in the money supply and new money demand curve in

graph A. Plot only the endpoints of MS and MD2 in graph A and position those points on the edges of the graphing area.

d. What are the values of equilibrium interest rate and investment spending?

Interest rate:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Help please, no excel....arrow_forward11- A project requires an initial cost of $15432.00. It results in savings that start at $2000.00 at the end of the 2nd year and the savings increase by $1000.00 every year from then on until the end of 6 years. What is the rate of return on this project? a) 6% b) 7% c) 8% d) 9%arrow_forward14. The time line represents which investment scenario? Today 12 18 24 months months months months months months 30 36 on $2500 $2500 $2500 $2500 $2500 $2500 $2500 $2500 $2500 $2500 $2500 $2500 d or cre $2500.00 follow he qu $2500(1.029) = $2572.50 k as done $2500(1.029)? = $2647.10 $2500(1.029) = $2723.87 $2500(1.029) = $2802.86 $2500(1.029)5 = $2884.14 $2500(1.029) = $2967.78 $2500(1.029) = $3053.85 $2500(1.029)8 = $3142.41 $2500(1.029)° = $3233.54 $2500(1.029)10 = $3327.31 $2500(1.029)11 = $3423.81 answ ge on %3D %3D ou've be abl aments %3D %3D our rou o Renee Sau %3D your ha %! Total = $35 279.17 a. Future Value of $2500 invested monthly for 3 years in a fund that pays 2.9% per year, compounded monthly b. Future Value of $2500 invested monthly for 3 years in a fund that pays 34.3% per year, compounded monthly c. Future Value of $2500 invested quarterly for 3 years in a fund that pays 11.6% per year, compounded quarterly d. Present Value of $2500 invested monthly for 3 years in a…arrow_forward

- 4. Compute the EUAB for these cash flows. The annual interest rate is 12%. Year Cash Flow 0 0 1 <#00 P 4500 3000 1500arrow_forward2. The following cash flows are equivalent in value if the interest rate is i. Which one is more valuable if the interest rate is 2i? (i) 01- -2 (ii) 0-1-2-arrow_forwardCompute the rate of return for the following cash flow. Year 0 1 2 3 4 5 Cash Flow -$6400 0 1000 2000 3000 4000arrow_forward

- 2. Determine the value of EUAW from the cash flow diagram shown below. i=4%. 5000 5000 2 3 4 5 6 1000 6000 2000arrow_forward4-11 The cash flows have a present value of 0. Compute the value of n, assuming a 10% interest rate. A = 2500 4 0-1-2-3-4-5-6————n n = ? F=61,307arrow_forwardQuestion 17 The Applebee's buyer heard through others that Rubio Enterprises, a make of restaurant supplies, recently invested $1.2 million in plant, property, and equipment. The investors for Rubio want an 18% retun on their investment. Appleber's plas to buy 10000 nw electronic menus fen Rubio and received a quatation of $500/anit. In order to make sure Rabio's rntuns 18% to their investors, Rubios beter make sue their overall costs do not exceed O S476A O s300 O $500 O 1216000arrow_forward

- Problem 7 A firm is considering the following three alternatives, as well as a fourth choice: do nothing. Each alternative has a 7-year useful life. The firm's minimum attractive rate of return is 9½ %. A Alternative Initial cost $100,000 Uniform annual net income 24,036 Computed rate of return 15.00% B $130,000 30,198 13.87% с $330,000 69,936 10.96% Using incremental rate of return comparisons, determine which alternative should be selected.arrow_forwardAt 10% interest rate, how much should you invest today to be able to withdraw php 10,000 annualy for 10 years?arrow_forwardYou are the financial manager of the firm LAB.inc which does research in the medical field, your company needs an estimate of a financing plan for a research project. The research project according to the evaluation of the experts will be spread over a period of 4 years. The annual funding required to conduct this research is $100,000 at the beginning of each year. The firm has set a term of 7 years to raise the necessary funds to finance this research, the nominal interest rate is 8% capitalized quarterly. a. How much does the company need to save at the end of each month to fund this research in 7 years? b. Draw the timeline for this financing plan by presenting all the relevant elements. If the firm wants to start financing the research project today t=0, by taking out a bank loan equal to the VA of all the financing needs of the research project (for the 4 years). c. Calculate the amount of monthly payments that the firm must pay to repay this bank loan for a period of 5 years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education