Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

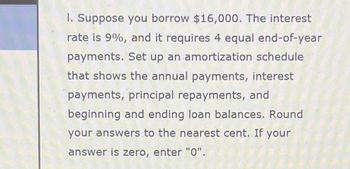

Transcribed Image Text:1. Suppose you borrow $16,000. The interest

rate is 9%, and it requires 4 equal end-of-year

payments. Set up an amortization schedule

that shows the annual payments, interest

payments, principal repayments, and

beginning and ending loan balances. Round

your answers to the nearest cent. If your

answer is zero, enter "0".

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- write down an answer, without showing any work, you will receive only half credit for that problem if you are correct (anc rong). The point is that I want to see that you know how to set up each problem. Question 1 Calculate the effective interest rate for each nominal annual interest rate and compounding frequency shown. Round your answer to 2 decimal places. a. 12% Quarterly compounding b. 7% Semiannual compounding C. 14% Continuous compounding Upload Choose a File Question 2 You are looking at buying a new sorting machine for recycling plastics that sod 6 11-15odarrow_forwardFor each case, provide the missing information. Assume payments occur at the end of each period. (Use the present value and future value tables, the formula method, financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places X.XXXXX. Round all final answers to the nearest cent, $X.XX, and round the loan maturity date to the nearest whole year.) (Click the icon to view the cases.) Future Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table Cases Amount borrowed Interest rate Number of periodic payments per year Maturity (in years) Periodic payment (1) (a) 4% 4 10 $ 10,354.90 (2) $ 675,000 $ 4% 2 10 (b) S CO (3) 456,000 6 % 1 (c) 81.685.59 (4) $ 750.000 12 % T (d) I Xarrow_forwardUse the amortization table to determine how much interest is paid in the first 4 months of the loan. Click the icon to view the amortization table. $ (Type an integer or a decimal.) Amortization Table Payment Number 0 1 2 3 4 5 6 7 8 9 10 11 12 Amortization Table Amount of Payment $215.17 $215.17 $215.17 $215.17 $215.17 $215.17 $215.17 $215.17 $215.17 $215.17 $215.17 $215.13 Print Interest for Period $12.50 $11.49 $10.47 $9.44 $8.42 $7.38 $6.34 $5.30 $4.25 $3.20 $2.14 $1.07 Portion to Principal $202.67 $203.68 $204.70 $205.73 $206.75 $207.79 $208.83 $209.87 $210.92 $211.97 $213.03 $214.06 Done Principal at End of Period $2500.00 $2297.33 $2093.65 $1888.95 $1683.22 $1476.47 $1268.68 $1059.85 $849.98 $639.06 $427.09 $214.06 $0.00arrow_forward

- A finance company uses the discount method of calculating interest. The loan principal is $5,000, the interest rate is 10%, and repayment is expected in two years. You will receivearrow_forwardTo borrow $3,400, you are offered an add-on interest loan at 9.6 percent with 12 monthly payments. Compute the 12 equal payments. Use the amount you borrowed and the monthly payments you computed to calculate the APR of the loan. Then, use that APR to compute the EAR of the loan. Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Equal payment Effective annual ratearrow_forwardA $178,000 mortgage loan is offered at an APR of 4%. Follow the instructions below the table. The loan payment formula was used to calculate the monthly payments for the loans and results are reported in the table below. You do NOT have to verify the given payment entries (you already used the formula for calculating payments in the first part Loan term in years Monthly Payment on $178,000 loan (in $) Total amount paid back over the full loan term (in $) Interest over the full loan term (in $) Difference in monthly payment from option above (in $) t = 15 years Pmt = $ 1316.64 F = I = No entry here t = 30 years Pmt = $ 849.80 F = I = Difference in MONTHLY payment t = 40 years Pmt = $ 743.93 F = I = Difference in MONTHLY payment t = 50 years Pmt = $ 686.56 F = I = Difference in MONTHLY payment For each loan term option, calculate the total amount paid back over the…arrow_forward

- A loan has quarterly payments. The APR is 16%, and interest is compounded 12 time(s) per year. The effective interest rate that would be needed to find the payment amount for the loan is _%. Margin of error for correct responses: +/-.02 (%) Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your *final* response to 2 decimal places (example: if your answer is 12.3456, 12.3456%, or $12.3456, you should enter 12.35).arrow_forwardYou have taken a loan of $78,000.00 for 20 years at 4.9% compounded quarterly. Fill in the table below, rounding all values to the nearest cent. Note that the principal column is listed before the interest column even though the interest calculation is done first. Many lending institutions use this order in the amortization schedules they provide to their customers. Payment number Payment amount Principal Amount Interest 0) 1) 2) 3) $ S $ $ s Balance $78,000.00 $arrow_forwardPrepare an amortization schedule for a three-year loan of $57,000. The interest rate is 8 percent per year, and the loan agreement calls for a principal reduction of $19,000 every year. How much total interest is paid over the life of the loan? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. Leave no cells blank. You must enter '0' for the answer to grade correctly.) Year Beginning Balance Total Payment Interest Payment Principal Payment Ending Balance 1 $57,000 $4,560 2 3 0 Total Interestarrow_forward

- Find the amount (in $) of interest and the maturity value of the loans. Use the formula MV = P + I to find the maturity value. (Round your answers to two decimal places.) Principal Rate (%) Maturity Value $145,000 15-/1/2 Time 8 months $ Interest $arrow_forwardYou plan to borrow $32,200 at an 8.2% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments. How much interest would you be paying in Year 2? Oa. $5,755.17 Ob. $2,346.29 $2,384.99 Od. $2,640.40 O$6,227.10arrow_forwardNeed hood explanation, don’t use excel please. Tsinoor takes out a loan of $6800. He will repay the loan over 5-years with semi-annual payments of $816 (first payment due in 6-months). Using linear interpolation, what rate of interest, j2 is being charged on the loan?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education