FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

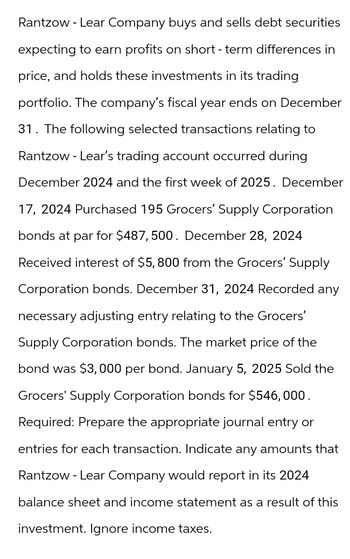

Transcribed Image Text:Rantzow - Lear Company buys and sells debt securities

expecting to earn profits on short-term differences in

price, and holds these investments in its trading

portfolio. The company's fiscal year ends on December

31. The following selected transactions relating to

Rantzow - Lear's trading account occurred during

December 2024 and the first week of 2025. December

17, 2024 Purchased 195 Grocers' Supply Corporation

bonds at par for $487,500. December 28, 2024

Received interest of $5,800 from the Grocers' Supply

Corporation bonds. December 31, 2024 Recorded any

necessary adjusting entry relating to the Grocers'

Supply Corporation bonds. The market price of the

bond was $3,000 per bond. January 5, 2025 Sold the

Grocers' Supply Corporation bonds for $546,000.

Required: Prepare the appropriate journal entry or

entries for each transaction. Indicate any amounts that

Rantzow - Lear Company would report in its 2024

balance sheet and income statement as a result of this

investment. Ignore income taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Gorman Group issued $930,000 of 11% bonds on June 30, 2021, for $1,009,794. The bonds were dated on June 30 and mature on June 30, 2041 (20 years). The market yield for bonds of similar risk and maturity is 10%. Interest is paid semiannually on December 31 and June 30. Required: 1.to3. Prepare the journal entries to record their issuance by The Gorman Group on Jun 30, 2021, interest on December 31, 2021, and interest on June 30, 2022 (at the effective rate). Record the issuance of the bond on June 30, 2021. Record the interest on December 31, 2021 (at the effective rate). Record the interest on June 30, 2022 (at the effective rate).arrow_forwardOn January 1, 2016, Instaform, Inc., issued 10% bonds with a face amount of $50 million, dated January 1. The bonds mature in 2035 (20 years). The market yield for bonds of similar risk and maturity is 12%. Interest is paid semiannually. Required: 1. Determine the price of the bonds at January 1, 2016, and prepare the journal entry to record their issuance by Instaform. 2. Assume the market rate was 9%. Determine the price of the bonds at January 1, 2016, and prepare the journal entry to record their issuance by Instaform. 3. Assume Broadcourt Electronics purchased the entire issue in a private placement of the bonds. Using the data in requirement 2, prepare the journal entry to record the purchase by Broadcourt.arrow_forwardRantzow-Lear Company buys and sells debt securities expecting to earn profits on short-term differences in price, and holds these investments in its trading portfolio. The company’s fiscal year ends on December 31. The following selected transactions relating to Rantzow-Lear’s trading account occurred during December 2024 and the first week of 2025. December 17, 2024 Purchased 195 Grocers’ Supply Corporation bonds at par for $487,500. December 28, 2024 Received interest of $5,800 from the Grocers’ Supply Corporation bonds. December 31, 2024 Recorded any necessary adjusting entry relating to the Grocers’ Supply Corporation bonds. The market price of the bond was $3,000 per bond. January 5, 2025 Sold the Grocers' Supply Corporation bonds for $546,000. Prepare the appropriate journal entry or entries for each transaction. Indicate any amounts that Rantzow-Lear Company would report in its 2024 balance sheet and income statement as a result of this investment. Ignore income…arrow_forward

- Flint Company invests $10,000,000 in 6% fixed rate corporate bonds on January 1, 2020. All the bonds are classified as available-for-sale and are purchased at par. At year-end, market interest rates have declined, and the fair value of the bonds is now $10,710,000. Interest is paid on January 1.Prepare journal entries for Flint Company to (a) record the transactions related to these bonds in 2020, assuming Flint does not elect the fair option; and (b) record the transactions related to these bonds in 2020, assuming that Flint Company elects the fair value option to account for these bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Date Account Titles and Explanation Debit Credit (a)…arrow_forwardBrussels Enterprises issues bonds at par dated January 1, 2021, that have a $2,000,000 par value, mature in four years, and pay 9% interest semiannually on June 30 and December 31. 1. Record the entry for the issuance of bonds for cash on January 1. 2. Record the entry for the first semiannual interest payment and the second semiannual interest payment. 3. Record the entry for the maturity of the bonds on December 31, 2024 (assume semiannual interest is already recorded). View transaction list Journal entry worksheet < 1 2 3 4 Record the issuance of bonds for cash on January 1. Date January 01 Note: Enter debits before credits. General Journal Debit Creditarrow_forwardDaan Corporation wholesales repair products to equipment manufacturers. On April 1, 2016, Daan Corporation issued $3,400,000 of 4-year, 12% bonds at a market (effective) interest rate of 11%, receiving cash of $3,507,686. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 2016. For a compound transaction, if an amount box does not require an entry, leave it blank. fill in the blank 96de01ff9f9efb1_2 fill in the blank 96de01ff9f9efb1_3 fill in the blank 96de01ff9f9efb1_5 fill in the blank 96de01ff9f9efb1_6 fill in the blank 96de01ff9f9efb1_8 fill in the blank 96de01ff9f9efb1_9 b. Journalize the entry to record the first interest payment on October 1, 2016, and amortization of bond premium for six months, using the straight-line method. The bond premium amortization is combined with the semiannual interest payment. (Round to the nearest dollar.) For a compound transaction,…arrow_forward

- Pretzelmania, Inc., issues 7%, 15-year bonds with a face amount of $70,000 for $63,948 on January 1, 2021. The market interest rate for bonds of similar risk and maturity is 8%. Interest is paid semiannually on June 30 and December 31. Required: 1. & 2. Record the bond issue and first interest payment on June 30, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Round your intermediate computations and final answers to the nearest whole dollar amount.)arrow_forwardOn December 31, 2018, Marsh Company held Xenon Company bonds in its portfolio of available-for-sale securities. The bonds have a par value of $14,000, carry a 10% annual interest rate, mature in 2025, and had originally been purchased at par. The market value of the bonds at December 31, 2018 was $12,000. The December 31, 2018, balance sheet showed the following: Marsh Company Partial Balance Sheet December 31, 2018 1 Assets 2 Investment in Available-for-Sale Securities $14,000.00 3 Less: Allowance for Change in Fair Value of Investment (2,000.00) 4 $12,000.00 5 Shareholders’ Equity: 6 Unrealized Holding Gain/Loss $(2,000.00) On January 1, 2019, Marsh acquired bonds of Yellow Company with a par value of $16,000 for $16,200. The Yellow Company bonds carry an annual interest rate of 12% and mature on December 31, 2023. Additionally, Marsh acquired Zebra Company bonds with a face value of 19,000 for…arrow_forwardMarigold Corporation issued $660,000 of 6% bonds on May 1,2025 . The bonds were dated January 1,2025 , and mature January 1 , 2028 , with interest payable July 1 and January 1 . The bonds were issued at face value plus accrued interest. Prepare Marigold's journal entries for (a) the May 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education